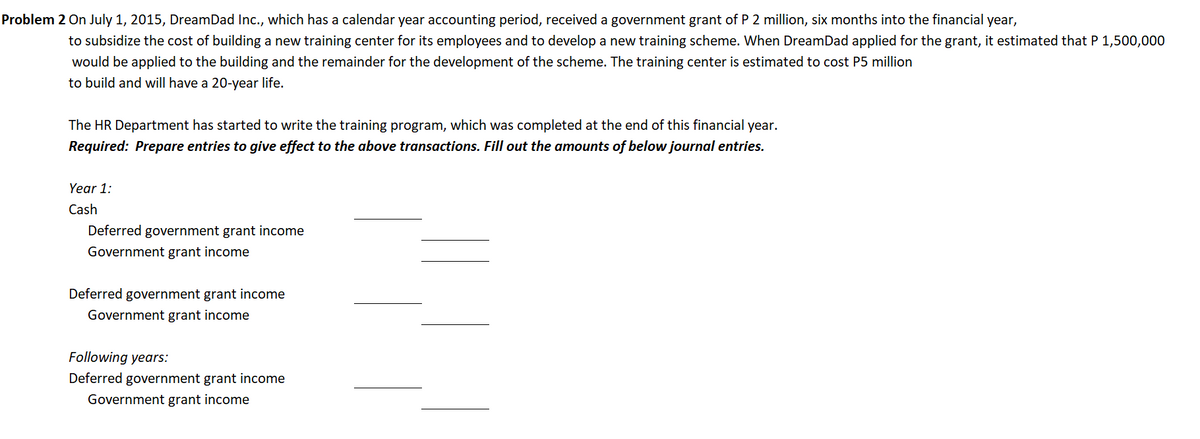

Problem 2 On July 1, 2015, DreamDad Inc., which has a calendar year accounting period, received a government grant of P 2 million, six months into the financial year, to subsidize the cost of building a new training center for its employees and to develop a new training scheme. When DreamDad applied for the grant, it estimated that P 1,500,000 would be applied to the building and the remainder for the development of the scheme. The training center is estimated to cost P5 million to build and will have a 20-year life. The HR Department has started to write the training program, which was completed at the end of this financial year. Required: Prepare entries to give effect to the above transactions. Fill out the amounts of below journal entries. Year 1: Cash Deferred government grant income Government grant income Deferred government grant income Government grant income Following years: Deferred government grant income Government grant income

Problem 2 On July 1, 2015, DreamDad Inc., which has a calendar year accounting period, received a government grant of P 2 million, six months into the financial year, to subsidize the cost of building a new training center for its employees and to develop a new training scheme. When DreamDad applied for the grant, it estimated that P 1,500,000 would be applied to the building and the remainder for the development of the scheme. The training center is estimated to cost P5 million to build and will have a 20-year life. The HR Department has started to write the training program, which was completed at the end of this financial year. Required: Prepare entries to give effect to the above transactions. Fill out the amounts of below journal entries. Year 1: Cash Deferred government grant income Government grant income Deferred government grant income Government grant income Following years: Deferred government grant income Government grant income

Chapter3: Corporations: Introduction And Operating Rules

Section: Chapter Questions

Problem 51P

Related questions

Question

Transcribed Image Text:Problem 2 On July 1, 2015, DreamDad Inc., which has a calendar year accounting period, received a government grant of P 2 million, six months into the financial year,

to subsidize the cost of building a new training center for its employees and to develop a new training scheme. When DreamDad applied for the grant, it estimated that P 1,500,000

would be applied to the building and the remainder for the development of the scheme. The training center is estimated to cost P5 million

to build and will have a 20-year life.

The HR Department has started to write the training program, which was completed at the end of this financial year.

Required: Prepare entries to give effect to the above transactions. Fill out the amounts of below journal entries.

Year 1:

Cash

Deferred government grant income

Government grant income

Deferred government grant income

Government grant income

Following years:

Deferred government grant income

Government grant income

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you