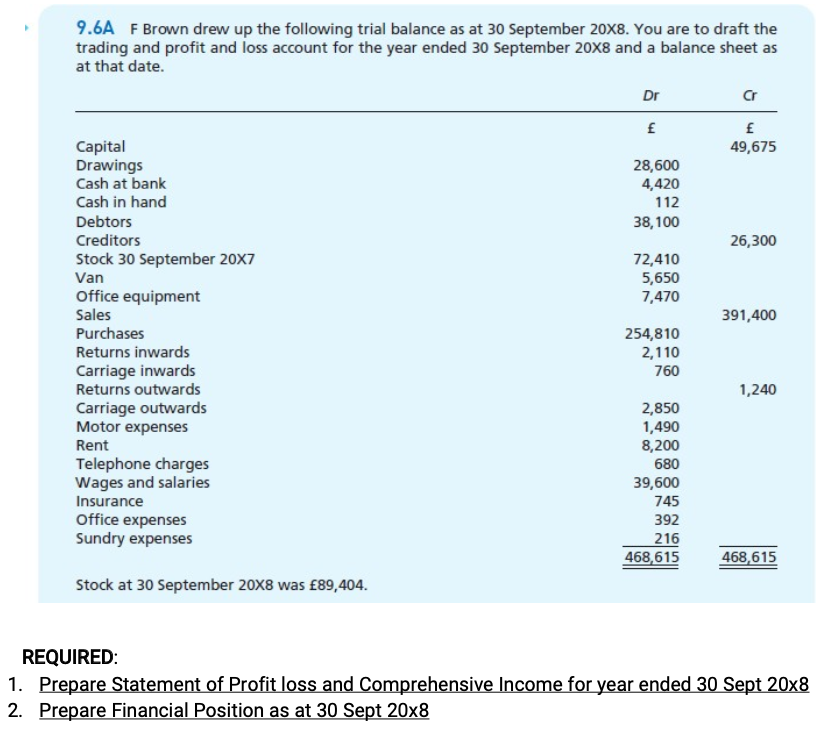

9.6A F Brown drew up the following trial balance as at 30 September 20X8. You are to draft the trading and profit and loss account for the year ended 30 September 20X8 and a balance sheet as at that date. Dr Cr Capital Drawings Cash at bank 49,675 28,600 4,420 Cash in hand 112 Debtors 38,100 Creditors 26,300 Stock 30 September 20X7 Van 72,410 5,650

Q: Dibiasky Corporation is a trading company based in Laguna. The auditor in charge for 2020 audit is e...

A: Accounts Payable Balance ad on Dec. 31, 2020 600000 C) Goods shipped FOB shipping point and ar...

Q: The following are facts about a company's activities: Cash flows from operating activities was $33,0...

A:

Q: ed on giving them a significant cash bonus in the following month. The chief financial officer (CFO)...

A: The following are resons for the having high profit with insufficient cash 1) Credit sales: If credi...

Q: A bond promises to pay you $7,000.00 in earn 6 percent on securities of equal risks, what would be t...

A: The present value of the bond shall be equal to the face value of the bond discounted at the require...

Q: According to a summary of the payroll of Sinclair Company, $505,000 was subject to the 6.0% social s...

A: Your journal entries may not be seen if you use accounting software or outsource your accounting, bu...

Q: Quark acquired 70% of the 1m issued £1 ordinary shares of Whey on 1 January 20X1 when Whey's retaine...

A: A minority interest seems to be another term for a non-controlling interest. This is a situation whe...

Q: (LG 7.3) Which of the following is a capital cost? a. Anew printer. b. Paper for a new printer. c. C...

A: Capital costs seem to be funds used by an organization to acquire, enhance, or maintain long-term as...

Q: The chief financial officer (CFO) of New Age Fashion Ltd. has just received a request from a project...

A: Marginal cost-benefit analysis refers to examination of related costs and potential benefits of any ...

Q: On October 1, Year 3, Eure Retailers signed a 4-month, 16% note payable to finance the purchase of h...

A: The correct answer for the above mentioned question is given in the following steps for your referen...

Q: produces and sells lumber that can be sold to outside customers or within the company to the Constru...

A: Internal transfer means where one independent department is transferring the goods to another indepe...

Q: Your company declared $13,800 cash dividen dividends payable at the beginning of the year and $2,800...

A: Beginning dividends payable = $6,400 Cash dividends declared = $13,800 Ending dividends payable = $2...

Q: The following transactions of Atty. Linag Law Firm were completed during the month of November 2018,...

A: Worksheet - Worksheet is a statement where all the ledgers are posted horizontally in the form of Ac...

Q: Some of the responses by governments to slow down the pandemic have had a negative impact on the tax...

A: Tax revenue is the revenue to the government, the government of any country gets the revenue by way ...

Q: Silver Company makes a product that is very popular as a Mother’s Day gift. Thus, peak sales occur i...

A: Budget means the expected value of future. Budget is not affected by the actual value as it is prepa...

Q: Which of the following qualifications is NOT a prerequisite for becoming a licensed agent? a. being ...

A: A town clerk, government agency or corporate executive, government entity, firm, or organization tha...

Q: Accrual income versus cash flow for a period The Motor Corporation sold vehicles for $500,000 to one...

A: Accrual basis of accounting depicts recording of transactions as and when they occur, irrespective o...

Q: Inventory items that belong in the A category include National has 10 different items in its invento...

A: Inventory Item No. of Units Average Unit Cost Total Cost 1 5000 P0.05 P0.05 x 5000 = P250 2...

Q: (LG 7.3) Freeport Brothers have recently purchased a process management system. Cabling installed in...

A: According to the given question: Data Collection nodes : =(4,500×3)+6,000+648+188+5,950+1950+200+150...

Q: On 1 July, after reimbursement for June expenditures, the petty cash fund of Rocky Road had a balanc...

A: The book which is used to record all the transactions, including the expenses, reimbursement of pett...

Q: The simple interest rate charged on a $8,600 loan is two-thirds of 1% per month. If the principal an...

A: Simple Interest Rate = 1% x 12 x 2 / 3 = 8% Interest = Principal x Interest Rate x No. of Years Here...

Q: Assume that Helene E, who pays 35 percent in income taxes, plans to contribute $2,625,000 to not-for...

A: Not-for-Profit Organisations seem to be enterprises that are established for the benefit of society ...

Q: Accrual income versus cash flow for a period. Thomas Book Sales, Ic., supplies textbooks to college ...

A: Under Accrual Basis , Net Income = Sales revenue - Cost of goods sold Under Cash basis , Net cash fl...

Q: Hemingway Corporation is considering expanding its operations to boost its income, but before making...

A: Since you have posted question with multiple sub-parts , we will do the first three sub-parts for yo...

Q: CCT 328, HW 2 Due no later than Mar 13, 2022 11:55 PM:

A: RRSP means Registered Retirement Saving Plan. A taxpay...

Q: Abba Company accounted for noncurrent assets using the revaluation model. On June 30, 2021, the enti...

A: Given information, •On June 30,2021: Fair value =P3,300,000 Cost of disposal=P200,000 •On decemb...

Q: Last month dexter company had $32010 loss on sale of 164000 fixed costs are 86130 a month. By how mu...

A: Cost volume profit analysis is the technique used by the management for decision-making. The methods...

Q: Fred is considering three job offers in advertising. A full-time position as a coordinator that pay...

A: Gross is the income ,which a person get without deduction of tax,social security tax, medicare tax ...

Q: elp 1) know the difference between a service business and a manufacturing business. 2) What does j...

A: Note: As per our guidelines, we will solve the first three subparts. 1) Service business: These ar...

Q: Accounts Receivable and Inventory Turnover Use the following information to respond to the questions...

A: Ratio analysis helps to analyze the financial statements of the company. The management can take dec...

Q: What is the annual carrying cost per unit? * Format: 1.11 The following data refer to various annual...

A: Calculation: Amount (P) Storage per unit 0.12 Add: Insurance per unit ...

Q: Journalize the following merchandise transactions, using the net method under a perpetual inventory ...

A: Merchandise Inventory: Products that a firm acquires with the intention of reselling to clients at a...

Q: If JoBlo Inc., has a retained earnings opening balance of $50,000 at the beginning of the year, and ...

A: Formula: Ending retained earnings balance = Beginning retained earnings balance + Net income - Divid...

Q: to the nearest integer.) More info Corporate Tax Rate Schedule Taxable income brackets Base tax $o t...

A: Marginal tax rate refers to the extra tax paid for every extra dollar gained by an entity.

Q: Use the data in Exhibit 14.5 On October 7, Schmidt Machinery Company purchased 720 pounds of PVC at ...

A: journal entry under cost accounting integrated set where both financial and cost systems are recorde...

Q: Blake Green's weekly gross earnings for the week ending December 7 were $2,500, and her federal inco...

A: An employee's net pay is his or her salary after all deductions have been made. Obligatory deduction...

Q: Clara Company purchased equipment for P5,000,000 on January 1, 2021 with a useful lite of 10 years a...

A: Recognized gain/loss = P3,800,000 - P200,000 = P3,600,000

Q: Arun and Margot want to admit Tammy as a third partner for their partnership. Their capital balances...

A: Partnership The partnership is referred to as that form of business that is run by two or more perso...

Q: Question 6, P1-1 (book/static) Part 1 of 3 Liability comparisons John Bailey invested $50,000 in The...

A: Sole proprietors have unlimited personal liability. Means creditors of business can claim against bu...

Q: TABLE 13-2 Present value of an annuity of $1 Period 2% 3% 5% 6% 7% 8% 9% 10% 11% 12% 13% 1. 0.9804 0...

A: Value of different alternate offers is examined on basis of concept of time value of money and annui...

Q: Vlad died on October 20, 2018. During his lifetime, upon knowing that he had Stage 4 cancer, sold hi...

A: Introduction:- A good or service's economic value is a measure of the advantage it provides to an ec...

Q: Vaughn Boards sells a snowboard, Xpert, that is popular with snowboard enthusiasts. Information rela...

A: Definitions:- FIFO Method of inventory valuation :- In FIFO method of inventory valuation, invent...

Q: Parent own 100% of Sub. On the open market parent bought all bonds of the Sub for Sa0o,000 on Jamuar...

A: In this question ,we ae given with Interest Expense = 40,000Interest Revenue = 37,000Explanation:Int...

Q: 1. Seattle's 2017 operating income using absorption costing is (a) $870,000, (b) $600,000, (c) $1,03...

A: Variable costing means that inventory is valued at variable manufacturing cost and fixed cost is ign...

Q: New attempt is in progress. Some of the new entries may impact the last attempt grading. Your answer...

A: Meaning: The direct method is one of two accounting treatments used to generate a cash flow statemen...

Q: The partnership of Chase and Chloe shares profits and losses in a 70:30 ratio respectively after Chl...

A: Remaining income allocation = Total income - Salaries

Q: December Norway Company reported that the year-end is ! receivable of P400,000 from a customer that ...

A:

Q: Interest versus dividend income Depot Logistics Inc. has declared pretax income from its operations ...

A: “Since you have posted a question with multiple sub-parts, we will solve first three subparts for yo...

Q: The following trial balance was extracted from the books of Movies To The Max Ltd at December 31, th...

A: The closing entries are made to close the temporary accounts and transfer the balance into Income Su...

Q: The production manager of Rordan Corporation has submitted the following quarterly production foreca...

A: Total direct labor hours needed = Units to be produced ×Direct labor time per unit

Q: 7. Joshua Owen commenced business on 1 September, and had several special transactions during the mo...

A: The journal entries are prepared to keep the record of day to day transactions of the business.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

- Write the third closing entry to transfer the net income or net loss to the P. Hernandez, Capital account, assuming the following: a. A net income of 3,842 during the first quarter (Jan.Mar.) b. A net loss of 1,781 during the second quarter (Apr.Jun.)Question 1The following information was extracted from the financial statement of Barryfor the year ended 31 December 2020. RMSales 437,500Opening inventories 17,500Closing inventories 26,250Cost of sales 262,500Other income 3,750Expenses 61,250Current liabilities 47,250Trade receivables 39,375Bank 8,750Cash 31,500Required:(a) Show the formulae and compute the value of the following for Barry:(i) Purchases(ii) Gross profit(iii)Net ProfitUse the trial balance, adjustments and additional information to prepare the Statement ofComprehensive Income for the year ended 28 February 2022.Liat TradersPRE-ADJUSTMENT TRIAL BALANCE AS AT 28 FEBRUARY 2022Balance sheet accounts section Debit CreditR RCapital 550 854Drawings 75 150Land and buildings 477 164Vehicles at cost 91 000Equipment at cost 67 000Accumulated depreciation on vehicles 31000Accumulated depreciation onequipment 23800Trading inventory 68 800Debtors control 45 850Provision for bad debts 1900Bank 15 560Cash float 1 250Petty cash 250Creditors control 38 860Loan: MUFG Bank (15%) 21600Nominal accounts sectionSales 498 000Cost of sales 244 000Sales returns 8 000Wages 42 500Bank charges 2 300Rent income 26000Packing materials 12 000Advertising 8 500Rates 3 000Bad debts 900Discount allowed 750Discount received 980Stationery 8 500Interest on loan 2 970Water and electricity 5 550Insurance 5 000Telephone 7 0001 192 994 1 192 994Adjustments and additional information1. A…

- 2. The following is extracted trial balance of Brahim Labi Sdn Bhd, after his first year’s trading, Brahim Labi Sdn BhdTrial Balance as at 30 June 2020Particulars Debit (RM) Credit (RM)Sales 265,900Purchases 154,870Rent 4,200Lighting and heating expenses 530Salaries and wages 51,400Insurance 2,100Buildings 85,000Fixtures 1,100Account receivable 31,300Sundry expenses 412Account payable 15,910Cash at bank 14,590Drawings 30,000Vans 16,400Motor running expenses 4,110Capital 114,202TOTAL 396,012 396,012Inventory at 30 June 2020 was RM16,280.Required: i. Statement of Profit and Loss and Others Comprehensive Income for the year ended 30 June 2020.ii. Statement of Financial Position as at 30 June 2020.The comparative balance sheet of Whitman Co. at December 31, 20Y2 and 20Y1, is as follows:Dec. 31, 20Y2 Dec. 31, 20Y1AssetsCash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 918,000 $ 964,800Accounts receivable (net) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 828,900 761,940Inventories . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,268,460 1,162,980Prepaid expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 29,340 35,100Land . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 315,900 479,700Buildings . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,462,500 900,900Accumulated depreciation—buildings . . . . . . . . . . . . . . . . . . . . . . . . . . .…The following pre‐adjustment trial balance appeared in the books of Central Perk Furniture Storeat the end of their financial year. IGNORE VAT.Pre‐adjustment trial balance of Central Perk Furniture Store for the year ended 31 March 2020.Fol. Debit (R) Credit (R)Statement of financial position sectionCapital B1 500 000.00Drawings B2 25 000.00Land and buildings B3 865 000.00Vehicles B4 220 987.00Equipment B5 156 760.00Accumulated depreciation: Equipment(1 April 2019)B6 54 320.00Accumulated Depreciation: Vehicles(1 April 2019)B7 22 580.00Bank B8 22 430.00Debtors Control B9 35 600.00Allowance for Credit Losses‐ 1 April 2019 B10 1 780.25Petty Cash B11 1 378.98Trading inventory (1 April 2019) B12 27 865.43Mortgage Loan B13 287 650.00Creditors Control B14 31 420.00SARS(UIF/SDL/PAYE) B15 23 290.6520 2020© The Independent Institute of Education (Pty) Ltd 2020Page 6 of 7Fol. Debit (R) Credit (R)Nominal accounts sectionSales N1 1 167 371.07Sales Returns N2 25 340.87Purchases N3 520…

- Marked out of 20.00P Flag questionusing the income summary account for the month ofSiren MarketingAdjusted Trial BalanceMay 31, 2022Account TitleCashDebitCredit$8, 600Accounts Receivable$2, 500Prepaid Insurance$2,700 Accounts PayableUnearned RevenueKirk, Capital$1, 200$1, 800$5, 880Kirk, Withdrawals$1,600Service Revenue$8, 620Advertising Expenselnsurance ExpenseRent Expense Total$790$450$860$17,500 $17,500No comma or dollar sign should be included in the imput icklPrepare the closing entries in the proper order. For transactions that have more than 1 debit or more than 1 deditDebitAccount Title and Explanation Date May 31Question The following pre‐adjustment trial balance appeared in the books of Central Perk Furniture Storeat the end of their financial year. IGNORE VAT.Pre‐adjustment trial balance of Central Perk Furniture Store for the year ended 31 March 2020.Fol. Debit (R) Credit (R)Statement of financial position sectionCapital B1 500 000.00Drawings B2 25 000.00Land and buildings B3 865 000.00Vehicles B4 220 987.00Equipment B5 156 760.00Accumulated depreciation: Equipment(1 April 2019)B6 54 320.00Accumulated Depreciation: Vehicles(1 April 2019)B7 22 580.00Bank B8 22 430.00Debtors Control B9 35 600.00Allowance for Credit Losses‐ 1 April 2019 B10 1 780.25Petty Cash B11 1 378.98Trading inventory (1 April 2019) B12 27 865.43Mortgage Loan B13 287 650.00Creditors Control B14 31 420.00SARS(UIF/SDL/PAYE) B15 23 290.6520 2020Page 6 of 7Fol. Debit (R) Credit (R)Nominal accounts sectionSales N1 1 167 371.07Sales Returns N2 25 340.87Purchases N3 520 389.76Purchases returns N4 76 540.32Service Income N5 10…9.1 From the transaction(in image) you are required to : After completing the Unadjusted trial balance use the below information to prepare the Adjusted Trial Balance. a.Unearned revenue OMR 1000 at the end of the month. b. Rent expense for the month OMR 200 c. The Equipment has useful life 3 years and residual value OMR 500

- DATA PROVIDEDThe pre-adjustment trial balance of Wing-It (Pty) Ltd as at 31 August 2022 is presented:AccountDebitCreditProfessional fees765 000Goods sold435 000Cost of sales215 000Interest received19 500Interest on loan6 300Bank charges3 200Cleaning1 500Staff welfare650Salaries and wages35 850Municipal services6 850Printing and stationery16 715Telephone18 600Fuel and oil56 000Repairs and maintenance: Building5 200Repairs and maintenance: Vehicles6 850Capital: Blue520 000Capital: Green630 000Drawings: Blue35 000Drawings: Green27 000Current account: Blue2 500Current account: Green6 400Retained income265 000Land500 000Buildings1 500 000Accumulated depreciation on buildings21 000Vehicles380 000Accumulated depreciation on vehicles65 000Equipment and electronics79 500Accumulated depreciation on equipment and electronics1 5008% Long-term loan325 000Bank: FNB168 000Bank: ABSA32 000Debtors control account85 000Allowance for credit losses6 400Creditors control account78 600Petty cash2…*see attached In its income statement for the year ended June 30, 20x1, what amount should Oren report as rent expense?a. P 10,000b. P 10,500c. P 40,000d. P 50,000Financial statementsThe assets and liabilities of Global Travel Agency on December 31, 20Y5.and its revenue and expenses for the year are as follows: Accounts payableAccounts receivableCashCommon stockFees earnedLandMiscellaneous expense Rent expenseSuppliesSupplies expenseUtilities expenseWages expense $ 108,000539,000200,000575,000940,0001,500,000$ 19,50056,0006,00012,70034,80415,000 Common stock was $525,000 and retained earnings was $1,250,000 as ofJanuary 1. 20Y5. During the year, additional common stock of $50,000was issued for cash, and dividends of $90,000 were paid. Instructions1. Prepare an income statement for the year ended December 31.20Y5.2. Prepare a statement of stockholders' equity for the year ended December 31. 2015.3. Prepare a balance sheet as of December 31, 20Y5.4. What items appears on both the statement of stockholders'equity and the balance sheet?