92,500 Premium on common stocks 16,300 esh ommon stocks, $10 par eferred taxes payable iscount on bonds payable ividends payable inished goods 7,200 Premium on preferred stocks 7,000 44,100 Prepaid insurance 2,500 2,800 Raw materials 10,100 2,500 Retained earnings 28,100 5,600 Unearned rent 5,000 23,800 Unrealized increase in value of available-for-sale stock 2,000 ncome taxes payable 2,700 Wages payable Work in process 8,900 14,700 Lequired: Prepare a properly cassified balance sheet for the Green Manufacturing Company on December 31, 2020.

92,500 Premium on common stocks 16,300 esh ommon stocks, $10 par eferred taxes payable iscount on bonds payable ividends payable inished goods 7,200 Premium on preferred stocks 7,000 44,100 Prepaid insurance 2,500 2,800 Raw materials 10,100 2,500 Retained earnings 28,100 5,600 Unearned rent 5,000 23,800 Unrealized increase in value of available-for-sale stock 2,000 ncome taxes payable 2,700 Wages payable Work in process 8,900 14,700 Lequired: Prepare a properly cassified balance sheet for the Green Manufacturing Company on December 31, 2020.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter7: Operating Assets

Section: Chapter Questions

Problem 24CE

Related questions

Question

Solution with the proper order and each category please

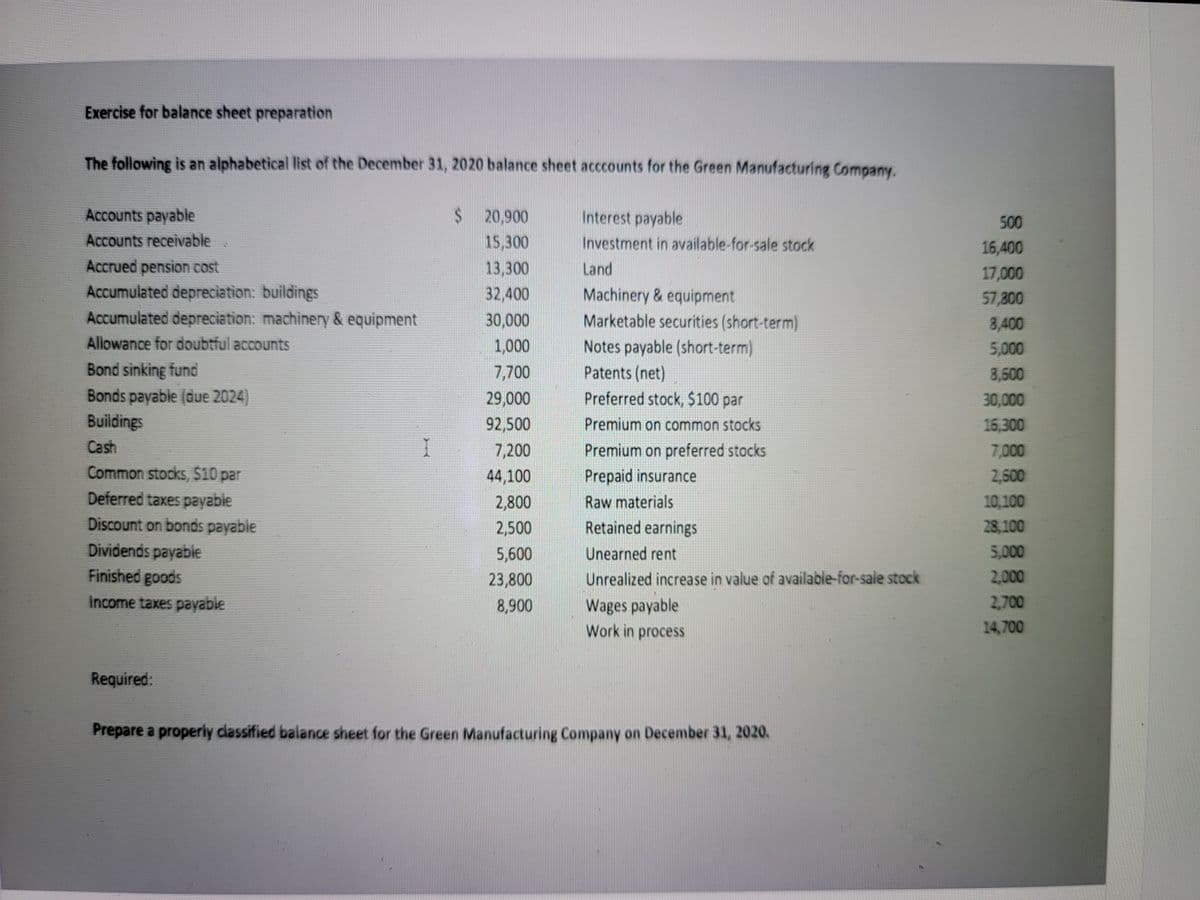

Transcribed Image Text:Exercise for balance sheet preparation

The following is an alphabetical list of the December 31, 2020 balance sheet acccounts for the Green Manufacturing Company.

Accounts payable

$ 20,900

Interest payable

500

Accounts receivable

15,300

Investment in available-for-sale stock

16,400

Accrued pension cost

Accumulated depreciation: buildings

Accumulated depreciation: machinery & equipment

13,300

Land

17,000

Machinery & equipment

Marketable securities (short-term)

32,400

57,800

30,000

8,400

Allowance for doubtful accounts

1,000

Notes payable (short-term)

5,000

Bond sinking fund

7,700

29,000

92,500

Patents (net)

Preferred stock, $100 par

8,600

Bonds payable (due 2024)

Buildings

30,000

Premium on common stocks

16,300

Cash

I

7,200

Premium on preferred stocks

7,000

Common stocks, $10 par

44,100

Prepaid insurance

2,600

Deferred taxes payabie

2,800

Raw materials

10,100

Discount on bonds payable

2,500

Retained earnings

28,100

Dividends payable

5,600

Unearned rent

5,000

Finished goods

23,800

Unrealized increase in value of available-for-sale stock

2,000

Income taxes payable

2,700

Wages payable

Work in process

8,900

14,700

Required:

Prepare a properly classified balance sheet for the Green Manufacturing Company on December 31, 2020.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning