Concept explainers

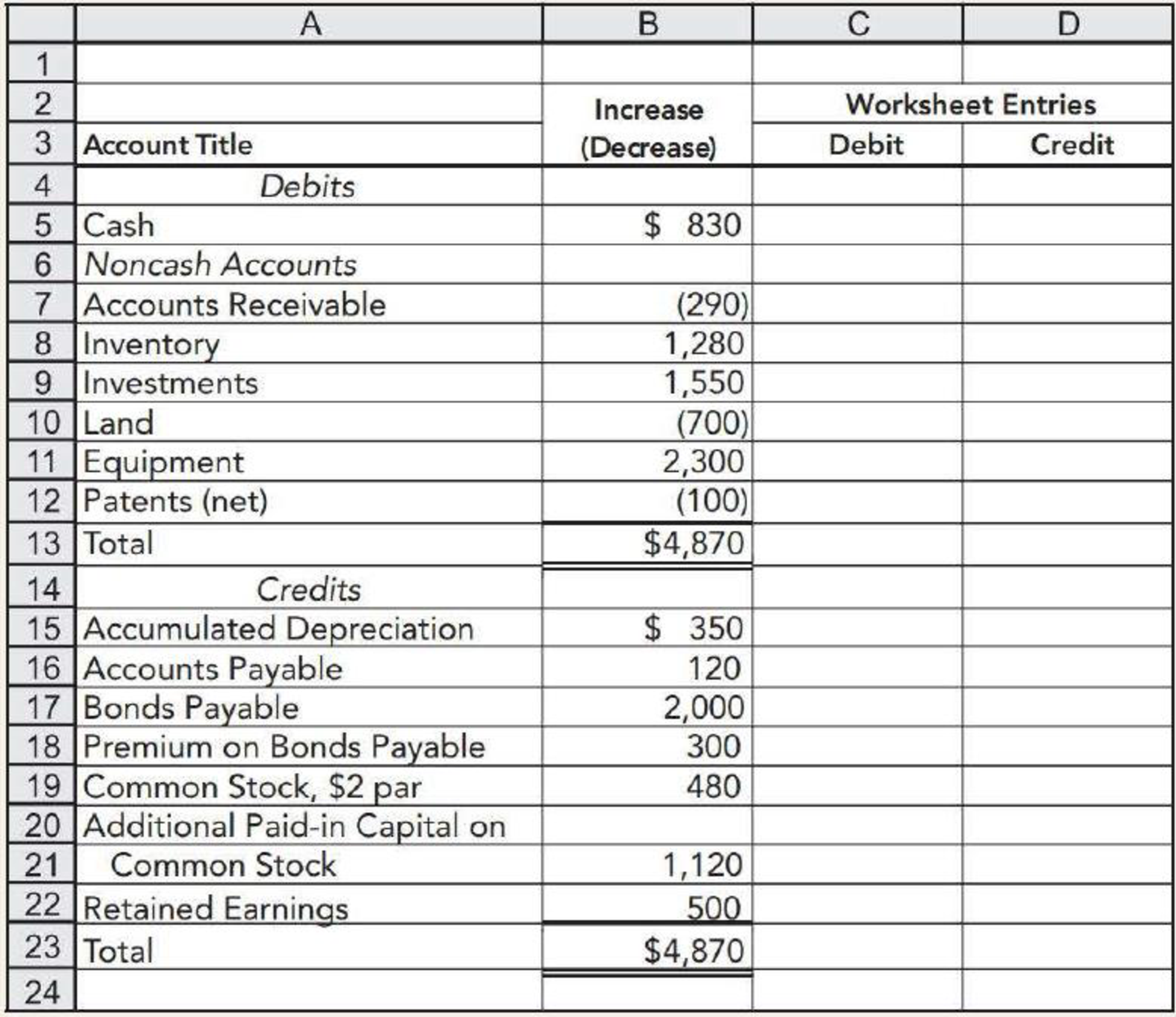

Partially Completed Spreadsheet Hanks Company has prepared the following changes in account balances for the spreadsheet to support its 2019 statement of

Additional information: The net income was $1,300.

Required:

On the basis of the preceding information, complete the spreadsheet.

Trending nowThis is a popular solution!

Chapter 21 Solutions

Intermediate Accounting: Reporting And Analysis

- Determining Cash Flows from Investing Activities Burns Companys 2019 and 2018 balance sheets presented the following data for equipment: During 2019, equipment costing $41,000 with accumulated depreciation of $36,700 was sold for cash, producing a $3,200 gain. Required: 1. Calculate the amount of depreciation expense for 2019. 2. Calculate the amount of cash spent for equipment during 2019. 3. Calculate the amount that should be included as a cash inflow from the disposal of equipment.arrow_forwardSpreadsheet and Statement The following 2019 information is available for Stewart Company: Partial additional information: The equipment that was sold for cash had cost 400 and had a book value of 300. Land that was sold brought a cash price of 530. Fifty shares of stock were issued at par. Required: Making whatever additional assumptions that are necessary, 1. Prepare a spreadsheet to support a 2019 statement of cash flows for Stewart. 2. Prepare the statement of cash flows.arrow_forwardSpreadsheet and Statement The following 2019 information is available for Stewart Company: Partial additional information: The equipment that was sold for cash had cost 400 and had a book value of 300. Land that was sold brought a cash price of 530. Fifty shares of stock were issued at par. (Appendix 21.1) Operating Cash Flows Spreadsheet Method Refer to the information for Stewart Company in E21-11. Required: Raised only on the information presented and using the direct method, prepare the cash flows from operating activities section of the 2019 statement of cash flows for Stewart using the spreadsheet method.arrow_forward

- Selected information from Brook Corporations accounting records and financial statements for 2019 follows: On the statement of cash flows for the year ended December 31, 2019, Brook should disclose a net increase in cash in the amount of: a. 1,700,000 b. 2,400,000 c. 3,700,000 d. 4,200,000arrow_forwardDetermining Cash Flows 1from Investing Activities Airco owns several aircraft and its balance sheet indicated the following amounts for its aircraft accounts at the end of 2019 and 2018: Required: 1. Assume that Airco did not sell any aircraft during 2019. Determine the amount of depreciation expense for 2019 and the cash spent for aircraft purchases in 2019. 2. If Airco sold for cash aircraft that cost $4,100,000 with accumulated depreciation of $3,825,000 producing a gain of $193,000, determine (a) the amount of depreciation expense, (b) the cash paid for aircraft purchases in 2019, and (c) the cash inflow from the disposal of aircraft.arrow_forwardInvesting Activities and Depreciable Assets Verlando Company had the following account balances and information available for 2019: During 2019, Verlando recorded the following transactions affecting these accounts: a. Land with a carrying value of 35,000 was sold at a loss of 6,000. b. Land and equipment were purchased with cash during the period. c. Equipment with an original cost of 20,000 that had a book value of 4,000 was written off as obsolete. d. A building with an original cost of 60,000 and accumulated depreciation of 25,000 was sold at a 23,000 gain. e. Depreciation expense and amortization expense were recorded. f. Net income for the year was 60,000. g. A patent was acquired during the year in exchange for 1,200 shares of common stock with a par value of 1 per share and a market value of 26 per share. h. Additional marketable securities wefe purchased during the year. i. Verlando Company has no notes payable in the liabilities section of its balance sheet. Required: 1. Next Level Assuming that Verlando uses the indirect method to determine operating cash flows, what is the amount of depreciation expense and amortization expense that would be added back to net income: 2. Prepare the investing activities section of the statement of cash flows for the year ended December 31, 2019. 3. Prepare the disclosure for significant noncash transactions for the statement of cash flows for the year ended December 31, 2019.arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,