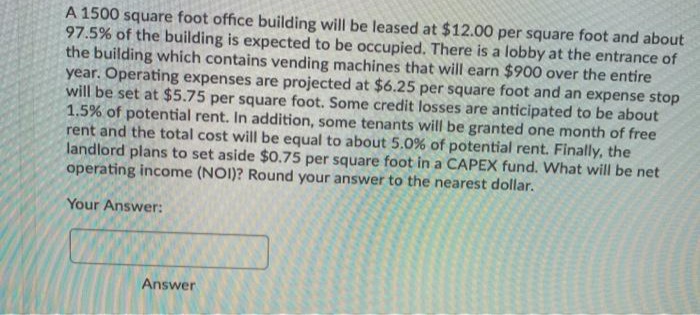

A 1500 square foot office building will be leased at $12.00 per square foot and about 97.5% of the building is expected to be occupied. There is a lobby at the entrance of the building which contains vending machines that will earn $900 over the entire year. Operating expenses are projected at $6.25 per square foot and an expense stop will be set at $5.75 per square foot. Some credit losses are anticipated to be about 1.5% of potential rent. In addition, some tenants will be granted one month of free rent and the total cost will be equal to about 5.0% of potential rent. Finally, the landlord plans to set aside $0.75 per square foot in a CAPEX fund. What will be net operating income (NOI)? Round your answer to the nearest dollar. Your Answer: Answer

A 1500 square foot office building will be leased at $12.00 per square foot and about 97.5% of the building is expected to be occupied. There is a lobby at the entrance of the building which contains vending machines that will earn $900 over the entire year. Operating expenses are projected at $6.25 per square foot and an expense stop will be set at $5.75 per square foot. Some credit losses are anticipated to be about 1.5% of potential rent. In addition, some tenants will be granted one month of free rent and the total cost will be equal to about 5.0% of potential rent. Finally, the landlord plans to set aside $0.75 per square foot in a CAPEX fund. What will be net operating income (NOI)? Round your answer to the nearest dollar. Your Answer: Answer

Chapter9: Capital Budgeting And Cash Flow Analysis

Section: Chapter Questions

Problem 12P

Related questions

Question

Transcribed Image Text:A 1500 square foot office building will be leased at $12.00 per square foot and about

97.5% of the building is expected to be occupied. There is a lobby at the entrance of

the building whích contains vending machines that will earn $900 over the entire

year. Operating expenses are projected at $6.25 per square foot and an expense stop

will be set at $5.75 per square foot. Some credit losses are anticipated to be about

1.5% of potential rent. In addition, some tenants will be granted one month of free

rent and the total cost will be equal to about 5.0% of potential rent. Finally, the

landlord plans to set aside $0.75 per square foot in a CAPEX fund. What will be net

operating income (NOI)? Round your answer to the nearest dollar.

Your Answer:

Answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning