A-7

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter2: Basic Managerial Accounting Concepts

Section: Chapter Questions

Problem 58P: Cost of Goods Manufactured, Income Statement W. W. Phillips Company produced 4,000 leather recliners...

Related questions

Question

A-7

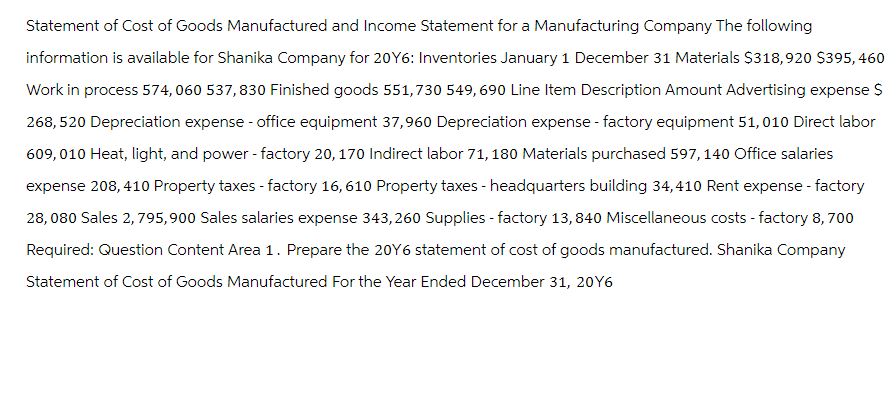

Transcribed Image Text:Statement of Cost of Goods Manufactured and Income Statement for a Manufacturing Company The following

information is available for Shanika Company for 20Y6: Inventories January 1 December 31 Materials $318,920 $395,460

Work in process 574,060 537,830 Finished goods 551,730 549, 690 Line Item Description Amount Advertising expense $

268,520 Depreciation expense - office equipment 37,960 Depreciation expense - factory equipment 51, 010 Direct labor

609, 010 Heat, light, and power - factory 20, 170 Indirect labor 71,180 Materials purchased 597, 140 Office salaries

expense 208, 410 Property taxes - factory 16, 610 Property taxes - headquarters building 34,410 Rent expense - factory

28,080 Sales 2, 795,900 Sales salaries expense 343,260 Supplies - factory 13,840 Miscellaneous costs - factory 8, 700

Required: Question Content Area 1. Prepare the 20Y6 statement of cost of goods manufactured. Shanika Company

Statement of Cost of Goods Manufactured For the Year Ended December 31, 20Y6

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College