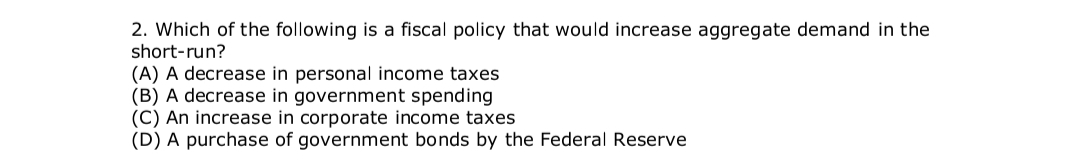

(A) A decrease in personal income taxes (B) A decrease in government spending (C) An increase in corporate income taxes (D) A purchase of government bonds by the Federal Reserve

Q: ) Reported annual total returns (%) of Vanguard FTSE Emerging Markets Index Fund ETF Shares for the…

A: To Find: Average growth rate which takes effect of compounding is 1.59%

Q: Based on the information provided above, apply Gordon’s growth model to compute the dividend growth…

A: Gordon Growth Model: Such a model carries an assumption that the company exists forever and the…

Q: Your family has a good working vegetable stand and wants to expand into selling from a truck, which…

A: To maintain the smooth operations of the company has to maintain a minimum inventory level. This…

Q: Calculate the effective rate (APY) of interest for 1 year. (Do not nearest hundredth percent.)

A: Effective Rate (Annual Percentage Yield): It is the effective rate of return to the investor on…

Q: As a helpful amenity for customers making electronic payments, certain credit card issuers provide…

A: Virtual credit cards or credit card numbers that can be used only once are increasingly becoming…

Q: I Current ratio li. Times interest earned jli. Inventory turnover

A: Current Ratio: It is a measure of a firm's liquidity and shows the firm's ability to repay its…

Q: 17) What is the total risk (measured by standard deviation) of a two-asset portfolio made up of:…

A: Solution:- Total risk is measured by standard deviation of a portfolio. It means that how much will…

Q: differences in bond interest rates reflect differences in default risk True or False . Expl

A: Each bond have different rate of return depending on nature of bond and period of bond and maturity…

Q: Problem 1 An adjustable interest loan was taken by David Walker for a sum of $20,000 for 10 years.…

A: An adjustable interest rate loan is a loan where based on the financial index, the interest rate of…

Q: What are the supposed benefits of targeting owners' wealth? 2. How can managers target owners'…

A: In a capitalist society where individuals own goods and services privately, earning per share is the…

Q: Each Tuesday, Ryan Airlines reduces its one-way ticket from Fort Wayne to Chicago from $136 to $25.…

A: Airlines companies often offer attractive discounts on their ticket fares, when they try actively to…

Q: An engineering graduate received a job offer with a promise of a 4.75 percent annual raise in her…

A: This is the case of growing annuity in which periodic amounts are deposited at the end of each year.…

Q: ompany clinches a contract to supply cleaning services to a nursing home for the next 5 years. Under…

A: WACC is weighted average cost of capital is weighted cost of equity, weighted cost of loan and…

Q: An insurance company must make payments to a customer of £10 million in one year and £4 million in…

A: Bonds are the long-term financing measures to create debt. Interest (coupon) is paid periodically on…

Q: act of statement of Income and Expenditure for the Financial Years Ended 31 August 2020 2020…

A: The net asset value (NAV) is the market value per unit of all securities owned by a mutual fund…

Q: Show your work for the following A firm's equity beta is 1.2 and its debt is risk free. Given a…

A: Equity beta = 1.2 Debt/equity ratio = 0.7 Asset beta = ? Asset beta is systematic risk over…

Q: Better plc is comparing two mutually exclusive projects, whose details are given below. The…

A: Given, Two projects A and B with cashflows The cost of capital is 12%

Q: After learning the course, you divide your portfolio into three equal parts (i.e., equal market…

A: Here, Beta of Market Index is always 1 Beta of Treasury Bills is always 0 Beta of Mutual Fund is 0.8…

Q: Give four examples, What would be one of several ways you could protect your hard earnings that are…

A: While investing in portfolio, it is essential to analyze the risk factor associated with the…

Q: b. Percentage Change is calculated with the formula (30th June 2021 Value/30th June 2020 Value) - 1…

A: Solution:- Percentage change means the rate of change in values. Now, as per given information,…

Q: 1 A i). What is leasing? ii). Discuss five important benefits of leasing. iii). Discuss five…

A: Leasing is a process according in which a business or firm can obtain the use of fixed assets in…

Q: Anderson Manufacturing Co., a small fabricator of plastics, needs to purchase an extrusion molding…

A: As per the information provided: Principal (P) = $140,000 n = 5 g = 9% or 0.09 i = 13% or 0.13

Q: “Give me $5000 today and I’ll return $20,000 to you in five years,” offers the investment broker. To…

A: To calculate the interest rate we will use the below formula as follows: Interest rate =…

Q: Reed River Apiary is considering which of two mutually exclusive project it should undertake to…

A: Before investing in new projects or assets, profitability of the firm is evaluated by using various…

Q: A)A US corporate bond has a coupon rate of 4% and a face value of $1000 and will mature in 4 years.…

A: Bonds are generally long-term financial debt instruments raised by the company. Company periodically…

Q: Employees in 2020 pay 6.2% of their gross wages towards social security (FICA tax), while employers…

A: Federal Insurance Contributions Act tax is a payroll tax that covers both the salaried and…

Q: a. What price would you be willing to pay for a share of Acap stock today, if you planned to hold…

A: Share Price: It represents the current value to the buyer and sellers in the marketplace and is…

Q: The standardized approach for calculating operational risk capital requirements uses beta factors…

A: Beta factor indicates that amount of risk involved and how much the change in market will impact on…

Q: The Grant Corporation is considering permanently adding $500 million of debt to its capital…

A: Adjusted present value is the net present value (NPV) of a project or business if funded solely in…

Q: Projects A and B are mutually exclusive. If project A, the larger project, has an approximate ERR of…

A: The economic rate of return (ERR) is a rate of return being used in capital budgeting to monitor and…

Q: MM Proposition II states that: I) the expected return on equity is positively related to leverage;…

A: MM has given two basic proposition one is related to value of firm and second is about the cost of…

Q: Question 2 The management of a power generation company in Zambia is planning to invest K100m for…

A: Investment means engaging your funds to generate more income for the future. Basically, investors…

Q: Fifteen years ago, Jackson Supply set aside $130,000 in case of a financial emergency. Today, that…

A: To calculate the interest rate we will use the below formula Interest rate = (FV/PV)1/N-1 Where FV…

Q: A firm earns $3550 million in profits and pays $2480 million in dividends for the year. The firm…

A: The dividend is part of the profits given by the company to its shareholders. Preferred…

Q: Based on the following data for the current year, what is the number of days' sales in inventory?…

A: Days sales inventory It is an estimation of the typical number of days or time expected for a…

Q: 6) Banco Bradesco S.A., announced yesterday that its 1th quarter earnings will be 2.9% higher than…

A: Abnormal returns are the returns when usually a company has large profits or losses generated from…

Q: Return on asset is a term often used to express income earned on capital invested in a business…

A: The financial ratio of a company's profitability to total assets is known as return on assets (ROA).…

Q: Stock ABC has a beta of 1.25 and stock XYZ has a beta of 0.55. Which stock would you buy if you knew…

A: Beta is a statistical factor which shows the systematic risk involved in particular assets. It…

Q: Assuming that 163,000 will be distributed as a dividend in the current year, how much will the…

A: Preferred Stock Holders: These are holders of preferred stock and have priority of the firm's…

Q: dust Telecommunications, Inc has the following target capital structure, which it considers to be…

A: Weighted average cost of capital is the weighted cost of equity, preferred stock and debt to be used…

Q: Which of the following is NOT a capital component when calculating the weighted average cost of…

A: WACC (discount rate) refers to the joint cost of company's capital from all the sources of the…

Q: You borrow $11,331 and repay the loan with 5 equal annual payments. The first payment is supposed to…

A: The loans are paid by the equal periodic payment and these payments carry the payment of principal…

Q: The table below contains the covariance matrix of stock returns and the market. Assume that the…

A: Risk is the possibility of loss for an organization and risk management is one of the most important…

Q: steps that you would take to mitigate the risk of interest rate risk

A: The important steps in mitigating interest rate risks are as follows: Diversification: One of the…

Q: o buy equipment ; current price of it is ( $ 50,000 ) . So , he requested the help of a bank , the…

A: A bank costs a borrower an interest rate that is a percent of the principle, or the amount…

Q: Find the present value of this cash flow stream. 2. Find the future…

A: Time value of money (TVM) refers to the method used to measure the amount of money at different…

Q: In 2003 your parents put 16 million HUF aside for you to help you buy your first apartment. They…

A: First investment in fund = 16,000,000 Return = 10% yearly N = 2003 to 2022 = 19 years

Q: Since only one sign change occurs in the net cash flow series, the project is a simple investment,…

A: Initial Investment = 2,500,000 Periodic Payment = 7,725,000 Lumpsum Payment at 15 Years = 80,000…

Q: A stock model has the parameters u = 1.6, d = 0.4, So = 18. A European call option, expiring at t =…

A: All calculations are done in excel, So, there is no intermediate rounding. Workings: If upward…

Q: What is portfolio A's CAPM beta based on your analysis? Round off your answer to three digits after…

A: The Beta: In the CAPM, the beta is a measure of the sensitivity of the stock's returns to that of…

Step by step

Solved in 2 steps

- How can a federal budget deficit increase market equilibrium interest rates and reduce private investment and future economic growth?Briefly explain whether each of the following statements is true or false. 1. An increase in government expenditure financed by borrowing (running a larger budget deficit) necessarily leads GDP to rise by more than the increase in gov- ernment expenditure according to the IS-LM model.Assuming that taxes are to be raised, which tax increase would be least detrimental to long term economic growth, a GST/HST increase or an increase in income tax? Assume that either of the increases would be revenue neutral, i.e., the federal government would take in the same amount of revenue with either tax that is raised.

- If Congress wants to stimulate the economy, explainhow it might alter each of the following: (a) personaland corporate tax rates, (b) depreciation expenseschedules, and (c) the differential between the taxrate on personal income and long-term capitalgains. How would these changes affect corporateprofitability and free cash flow? How would theyaffect investors’ choices regarding which securities to hold in their portfolios? Might any of theseactions affect the general level of interest rates?When a government lowers taxes it is employing ________. A) fiscal policy B) monetary policy C) domestic policy D) the law of one priceInterest payments on federal government bonds which are owned by the central bank 1, are recorded as central bank profits and then paid to the government as dividends. 2, are recorded as central bank profits and paid out to the private investors who own the central bank. 3, necessitate an increase in taxation so that they can be funded. 4, lead to a decrease in the money suppy.

- Suppose expenses for Medicare and Medicaid are rising rapidly. Which strategy could the federal government use to solve this situation? Make cuts to defense and education spending, and then increase income and payroll tax rates to reduce the effect of increasing expenses in the federal government. Delay payments for the interest on the national debt and increase tax rates for payroll and corporate income taxes to raise funds for Medicare and Medicaid. Increase corporate and individual income tax rates to raise revenue, and then eliminate payments to state and local governments to cut other costs in the federal government. Increase payouts for entitlements and decrease income and payroll taxes so that consumers are provided with more money to pay for increased medical costs.The government announces a cut in the income tax rate. Explain the multiplier effect by analysing how a typical consumer would react to this tax cut and which other decisions this reaction would trigger in the economy.The government has to go into debt to meet the needs of the budget deficit or shortfall. Identify whether this statement is true or false. Select one:TrueFalse

- What effect would each of the following events likely have on the level of nominalinterest rates?1. Households dramatically increase their savings rate.2. Corporations increase their demand for funds following an increase in investmentopportunities.3. The government runs a larger-than-expected budget deficit.4. There is an increase in expected inflation.Through utilizing fiscal policy, i.e. varying ________ and/or ___________, governments achieve goals for output and employment growth as well as price stability.a. interest rates, financial liberalizationb. inflation, tax elasticityc. tax rates, government spendingd. interest rates, tax ratesOf the following, the most likely effect of an increase in income tax rates would be to: A) Decrease the savings rate B) Decrease the supply of loanable funds C) Increase interest rates a. All statements are correct. b. Only one statement is correct. c. Only one statement is incorrect.