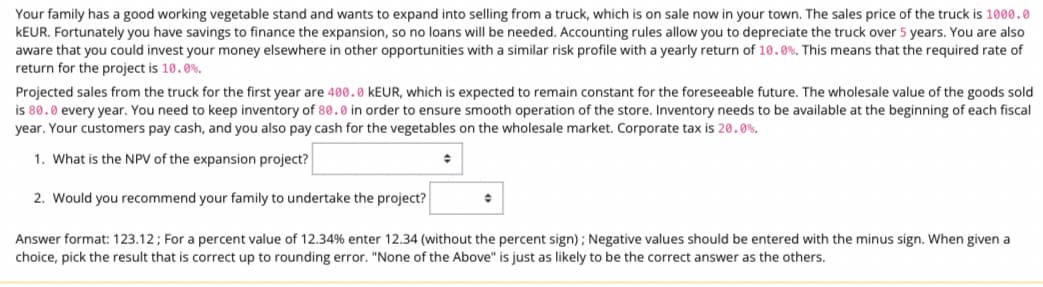

Your family has a good working vegetable stand and wants to expand into selling from a truck, which is on sale now in your town. The sales price of the truck is 1000.0 kEUR. Fortunately you have savings to finance the expansion, so no loans will be needed. Accounting rules allow you to depreciate the truck over 5 years. You are also aware that you could invest your money elsewhere in other opportunities with a similar risk profile with a yearly return of 10.0%. This means that the required rate of return for the project is 10.0%. Projected sales from the truck for the first year are 400. 0 kEUR, which is expected to remain constant for the foreseeable future. The wholesale value of the goods sold is 80.0 every year. You need to keep inventory of 80.0 in order to ensure smooth operation of the store. Inventory needs to be available at the beginning of each fiscal year. Your customers pay cash, and you also pay cash for the vegetables on the wholesale market. Corporate tax is 20.0%, 1. What is the NPV of the expansion project? 2. Would you recommend your family to undertake the project?

Your family has a good working vegetable stand and wants to expand into selling from a truck, which is on sale now in your town. The sales price of the truck is 1000.0 kEUR. Fortunately you have savings to finance the expansion, so no loans will be needed. Accounting rules allow you to depreciate the truck over 5 years. You are also aware that you could invest your money elsewhere in other opportunities with a similar risk profile with a yearly return of 10.0%. This means that the required rate of return for the project is 10.0%. Projected sales from the truck for the first year are 400. 0 kEUR, which is expected to remain constant for the foreseeable future. The wholesale value of the goods sold is 80.0 every year. You need to keep inventory of 80.0 in order to ensure smooth operation of the store. Inventory needs to be available at the beginning of each fiscal year. Your customers pay cash, and you also pay cash for the vegetables on the wholesale market. Corporate tax is 20.0%, 1. What is the NPV of the expansion project? 2. Would you recommend your family to undertake the project?

Pfin (with Mindtap, 1 Term Printed Access Card) (mindtap Course List)

7th Edition

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Chapter2: Using Financial Statements And Budgets

Section: Chapter Questions

Problem 6FPE

Related questions

Question

Your family has a good working vegetable stand and wants to expand into selling from a truck, which is on sale now in your town. The sales price of the truck is 1000.0

kEUR. Fortunately you have savings to finance the expansion, so no loans will be needed. Accounting rules allow you to depreciate the truck over 5 years. You are also

aware that you could invest your money elsewhere in other opportunities with a similar risk profile with a yearly return of 10.0%. This means that the required rate of

return for the project is 10.0%.

Projected sales from the truck for the first year are 400. 0 kEUR, which is expected to remain constant for the foreseeable future. The wholesale value of the goods sold

is 80.0 every year. You need to keep inventory of 80.0 in order to ensure smooth operation of the store. Inventory needs to be available at the beginning of each fiscal

year. Your customers pay cash, and you also pay cash for the vegetables on the wholesale market. Corporate tax is 20.0%,

1. What is the NPV of the expansion project?

2. Would you recommend your family to undertake the project?

Transcribed Image Text:Your family has a good working vegetable stand and wants to expand into selling from a truck, which is on sale now in your town. The sales price of the truck is 1000.0

KEUR. Fortunately you have savings to finance the expansion, so no loans will be needed. Accounting rules allow you to depreciate the truck over 5 years. You are also

aware that you could invest your money elsewhere in other opportunities with a similar risk profile with a yearly return of 10.0%. This means that the required rate of

return for the project is 10.0%.

Projected sales from the truck for the first year are 400.0 KEUR, which is expected to remain constant for the foreseeable future. The wholesale value of the goods sold

is 80.0 every year. You need to keep inventory of 80.0 in order to ensure smooth operation of the store. Inventory needs to be available at the beginning of each fiscal

year. Your customers pay cash, and you also pay cash for the vegetables on the wholesale market. Corporate tax is 20.0%.

1. What is the NPV of the expansion project?

2. Would you recommend your family to undertake the project?

+

Answer format: 123.12; For a percent value of 12.34% enter 12.34 (without the percent sign); Negative values should be entered with the minus sign. When given a

choice, pick the result that is correct up to rounding error. "None of the Above" is just as likely to be the correct answer as the others.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College