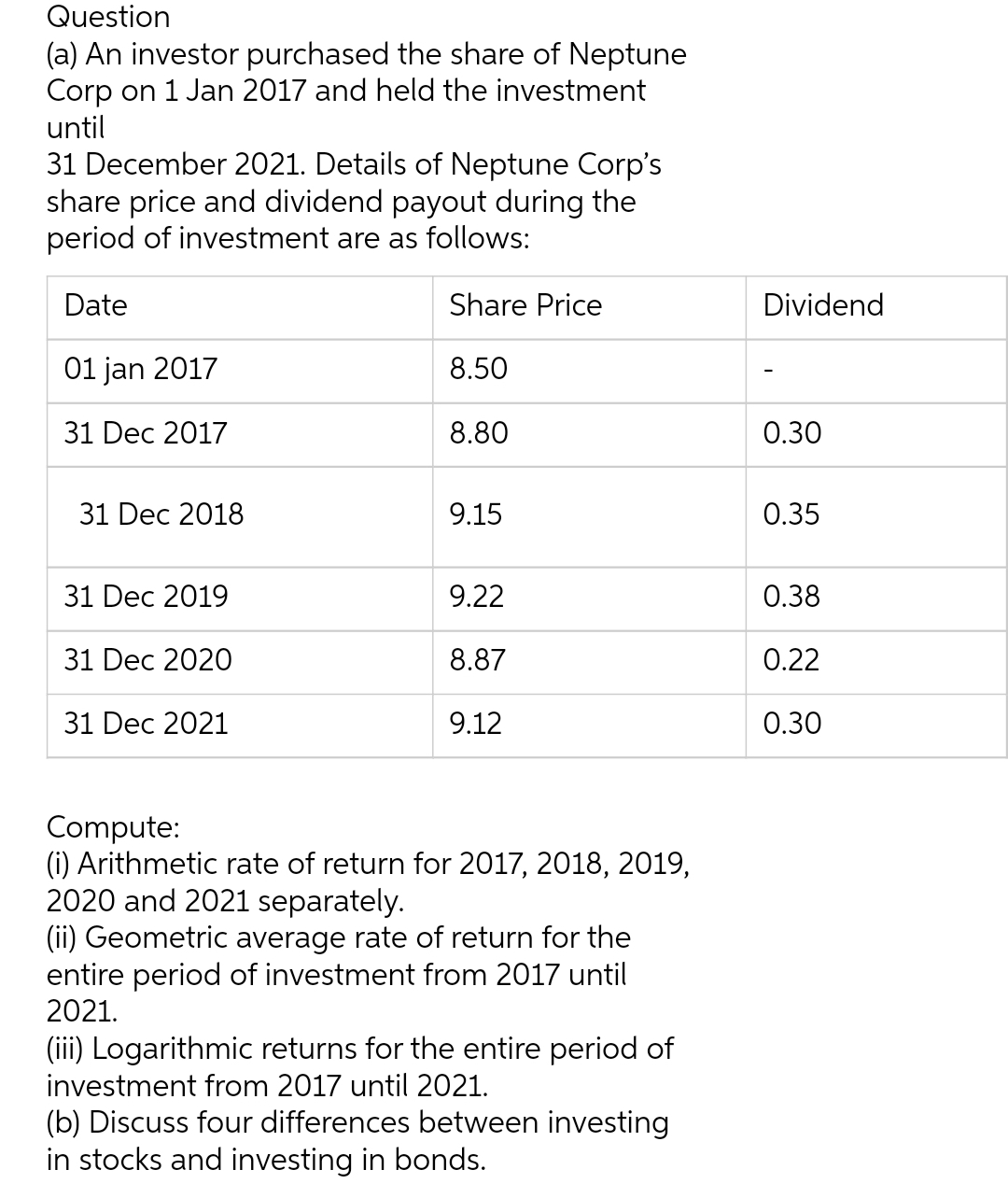

(a) An investor purchased the share of Neptune Corp on 1 Jan 2017 and held the investment until 31 December 2021. Details of Neptune Corp's share price and dividend payout during the period of investment are as follows: Date Share Price 01 jan 2017 8.50 31 Dec 2017 8.80 31 Dec 2018 9.15 31 Dec 2019 9.22 31 Dec 2020 8.87 31 Dec 2021 9.12 Dividend 0.30 0.35 0.38 0.22 0.30

(a) An investor purchased the share of Neptune Corp on 1 Jan 2017 and held the investment until 31 December 2021. Details of Neptune Corp's share price and dividend payout during the period of investment are as follows: Date Share Price 01 jan 2017 8.50 31 Dec 2017 8.80 31 Dec 2018 9.15 31 Dec 2019 9.22 31 Dec 2020 8.87 31 Dec 2021 9.12 Dividend 0.30 0.35 0.38 0.22 0.30

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter15: Investments And Fair Value Accounting

Section: Chapter Questions

Problem 28E

Related questions

Question

Transcribed Image Text:Question

(a) An investor purchased the share of Neptune

Corp on 1 Jan 2017 and held the investment

until

31 December 2021. Details of Neptune Corp's

share price and dividend payout during the

period of investment are as follows:

Date

Share Price

01 jan 2017

8.50

31 Dec 2017

8.80

31 Dec 2018

9.15

31 Dec 2019

9.22

31 Dec 2020

8.87

31 Dec 2021

9.12

Compute:

(i) Arithmetic rate of return for 2017, 2018, 2019,

2020 and 2021 separately.

(ii) Geometric average rate of return for the

entire period of investment from 2017 until

2021.

(iii) Logarithmic returns for the entire period of

investment from 2017 until 2021.

(b) Discuss four differences between investing

in stocks and investing in bonds.

Dividend

0.30

0.35

0.38

0.22

0.30

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning