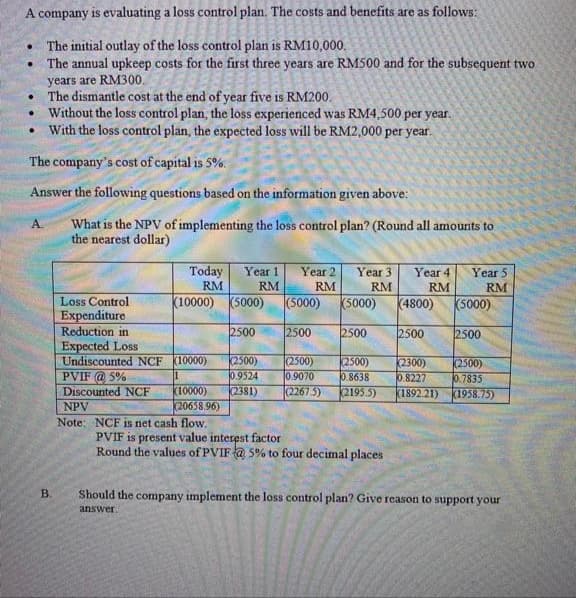

A company is evaluating a loss control plan. The costs and benefits are as follows: • The initial outlay of the loss control plan is RM10,000. ● The annual upkeep costs for the first three years are RM500 and for the subsequent two years are RM300. ● The dismantle cost at the end of year five is RM200. ● Without the loss control plan, the loss experienced was RM4,500 per year. With the loss control plan, the expected loss will be RM2,000 per year. . The company's cost of capital is 5%. Answer the following questions based on the information given above: A mounts to What is the NPV of implementing the loss control plan? (Round all amour the nearest dollar) Year 1 Year 2 Year 3 Year 4 Year 5 Today RM RM RM RM RM RM (10000) (5000) (5000) (5000) (4800) (5000) Loss Control Expenditure Reduction in 2500 2500 2500 2500 2500 Expected Loss Undiscounted NCF (10000) (2500) (2500) (2500) (2300) (2500) PVIF @ 5% 0.9524 10.9070 0.8638 0.8227 0.7835 Discounted NCF (10000) (2381) (2267.5) (2195.5) (1892.21) (1958.75) NPV (20658.96) Note: NCF is net cash flow. PVIF is present value interest factor Round the values of PVIF @ 5% to four decimal places B. Should the company implement the loss control plan? Give reason to support your answer.

A company is evaluating a loss control plan. The costs and benefits are as follows: • The initial outlay of the loss control plan is RM10,000. ● The annual upkeep costs for the first three years are RM500 and for the subsequent two years are RM300. ● The dismantle cost at the end of year five is RM200. ● Without the loss control plan, the loss experienced was RM4,500 per year. With the loss control plan, the expected loss will be RM2,000 per year. . The company's cost of capital is 5%. Answer the following questions based on the information given above: A mounts to What is the NPV of implementing the loss control plan? (Round all amour the nearest dollar) Year 1 Year 2 Year 3 Year 4 Year 5 Today RM RM RM RM RM RM (10000) (5000) (5000) (5000) (4800) (5000) Loss Control Expenditure Reduction in 2500 2500 2500 2500 2500 Expected Loss Undiscounted NCF (10000) (2500) (2500) (2500) (2300) (2500) PVIF @ 5% 0.9524 10.9070 0.8638 0.8227 0.7835 Discounted NCF (10000) (2381) (2267.5) (2195.5) (1892.21) (1958.75) NPV (20658.96) Note: NCF is net cash flow. PVIF is present value interest factor Round the values of PVIF @ 5% to four decimal places B. Should the company implement the loss control plan? Give reason to support your answer.

Chapter9: Capital Budgeting And Cash Flow Analysis

Section: Chapter Questions

Problem 18P

Related questions

Question

Answer B part also

Transcribed Image Text:A company is evaluating a loss control plan. The costs and benefits are as follows:

The initial outlay of the loss control plan is RM10,000.

The annual upkeep costs for the first three years are RM500 and for the subsequent two

years are RM300.

.

The dismantle cost at the end of year five is RM200.

●

Without the loss control plan, the loss experienced was RM4,500 per year.

With the loss control plan, the expected loss will be RM2,000 per year.

●

The company's cost of capital is 5%.

Answer the following questions based on the information given above:

A

What is the NPV of implementing the loss control plan? (Round all amounts to

the nearest dollar)

Year 2

Year 3

Year 4 Year 5

Today Year 1

RM

RM

RM

RM

RM

RM

(10000) (5000)

(5000)

(5000)

(4800)

(5000)

Loss Control

Expenditure

Reduction in

2500

2500

2500

2500

2500

Expected Loss

Undiscounted NCF

10000)

(2500)

(2500) (2500) (2300)

(2500)

PVIF @ 5%

1

0.9524

0.9070

0.8638

0.8227 0.7835

Discounted NCF

(10000)

(2381)

(2267.5) (2195.5)

(1892.21) (1958.75)

NPV

(20658.96)

Note: NCF is net cash flow.

PVIF is present value interest factor

Round the values of PVIF @ 5% to four decimal places

B.

Should the company implement the loss control plan? Give reason to support your

answer.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning