a) average fixed cost, b) average variable cost, and c) total profit?

Accounting Information Systems

11th Edition

ISBN:9781337552127

Author:Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan Hill

Publisher:Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan Hill

Chapter17: Acquiring And Implementing Accounting Information Systems

Section: Chapter Questions

Problem 5P: TM Office Supplies, Inc., is a wholesale distributor of office supplies. It sells pencils and pens,...

Related questions

Question

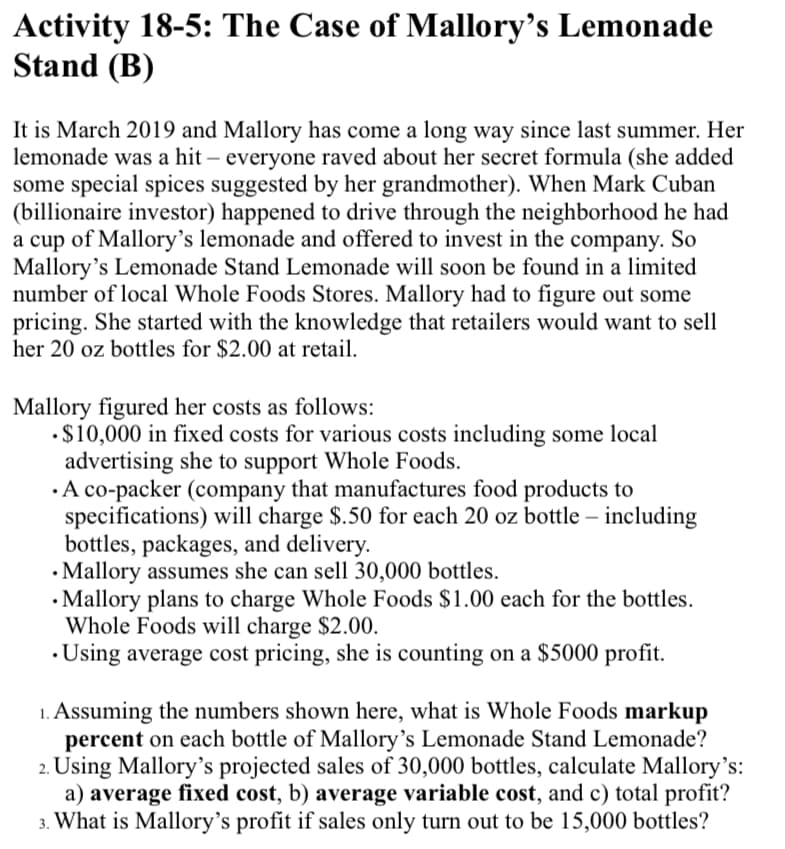

Transcribed Image Text:Activity 18-5: The Case of Mallory's Lemonade

Stand (B)

It is March 2019 and Mallory has come a long way since last summer. Her

lemonade was a hit – everyone raved about her secret formula (she added

some special spices suggested by her grandmother). When Mark Cuban

(billionaire investor) happened to drive through the neighborhood he had

a cup of Mallory's lemonade and offered to invest in the company. So

Mallory's Lemonade Stand Lemonade will soon be found in a limited

number of local Whole Foods Stores. Mallory had to figure out some

pricing. She started with the knowledge that retailers would want to sell

her 20 oz bottles for $2.00 at retail.

Mallory figured her costs as follows:

•$10,000 in fixed costs for various costs including some local

advertising she to support Whole Foods.

· A co-packer (company that manufactures food products to

specifications) will charge $.50 for each 20 oz bottle – including

bottles, packages, and delivery.

• Mallory assumes she can sell 30,000 bottles.

• Mallory plans to charge Whole Foods $1.00 each for the bottles.

Whole Foods will charge $2.00.

• Using average cost pricing, she is counting on a $5000 profit.

1. Assuming the numbers shown here, what is Whole Foods markup

percent on each bottle of Mallory's Lemonade Stand Lemonade?

2. Using Mallory's projected sales of 30,000 bottles, calculate Mallory's:

a) average fixed cost, b) average variable cost, and c) total profit?

3. What is Mallory's profit if sales only turn out to be 15,000 bottles?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting Information Systems

Finance

ISBN:

9781337552127

Author:

Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan Hill

Publisher:

Cengage Learning

Accounting Information Systems

Finance

ISBN:

9781337552127

Author:

Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan Hill

Publisher:

Cengage Learning