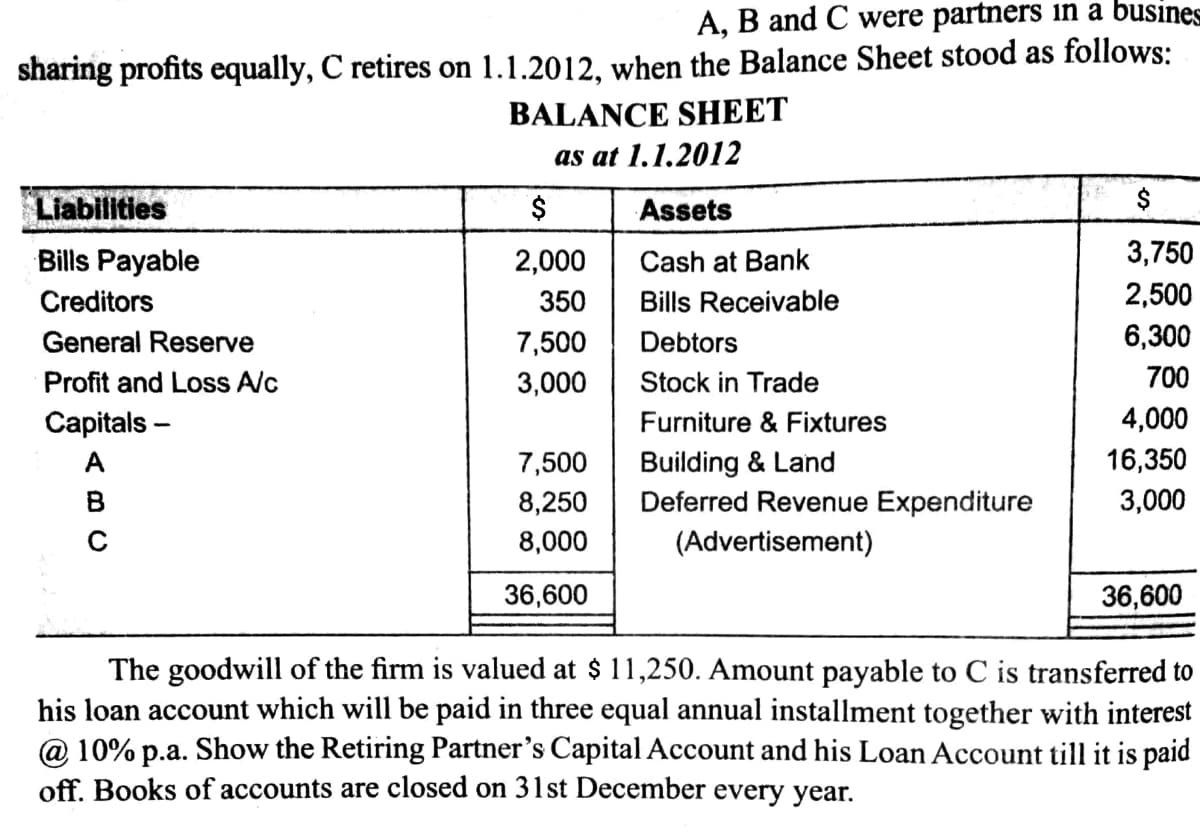

A, B and C were partners in a busines sharing profits equally, C retires on 1.1.2012, when the Balance Sheet stood as follows: BALANCE SHEET as at 1.1.2012 Liabilities $ Assets Bills Payable 2,000 Cash at Bank 3,750 Creditors 350 Bills Receivable 2,500 General Reserve 7,500 Debtors 6,300 Profit and Loss A/c 3,000 Stock in Trade 700 Capitals - Furniture & Fixtures 4,000 16,350 Building & Land Deferred Revenue Expenditure A 7,500 8,250 3,000 8,000 (Advertisement) 36,600 36,600

A, B and C were partners in a busines sharing profits equally, C retires on 1.1.2012, when the Balance Sheet stood as follows: BALANCE SHEET as at 1.1.2012 Liabilities $ Assets Bills Payable 2,000 Cash at Bank 3,750 Creditors 350 Bills Receivable 2,500 General Reserve 7,500 Debtors 6,300 Profit and Loss A/c 3,000 Stock in Trade 700 Capitals - Furniture & Fixtures 4,000 16,350 Building & Land Deferred Revenue Expenditure A 7,500 8,250 3,000 8,000 (Advertisement) 36,600 36,600

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter19: Accounting For Partnerships

Section: Chapter Questions

Problem 5CE

Related questions

Question

Transcribed Image Text:A, B and C were partners in a busines

sharing profits equally, C retires on 1.1.2012, when the Balance Sheet stood as follows:

BALANCE SHEET

as at 1.1.2012

Liabilities

Assets

$

Bills Payable

2,000

Cash at Bank

3,750

Creditors

350

Bills Receivable

2,500

General Reserve

7,500

Debtors

6,300

Profit and Loss A/c

3,000

Stock in Trade

700

Capitals -

Furniture & Fixtures

4,000

Building & Land

Deferred Revenue Expenditure

A

7,500

16,350

B

8,250

3,000

8,000

(Advertisement)

36,600

36,600

The goodwill of the firm is valued at $ 11,250. Amount payable to C is transferred to

his loan account which will be paid in three equal annual installment together with interest

@ 10% p.a. Show the Retiring Partner's Capital Account and his Loan Account till it is paid

off. Books of accounts are closed on 31st December every year.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning