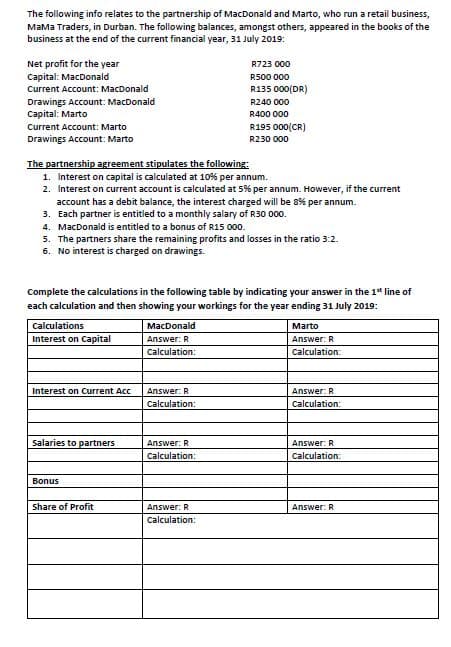

The following info relates to the partnership of MacDonald and Marto, who run a retail business, MaMa Traders, in Durban. The following balances, amongst others, appeared in the books of the business at the end of the current financial year, 31 July 2019: Net profit for the year Capital: MacDonald R723 000 R500 000 Current Account: MacDonald R135 000(DR) Drawings Account: MacDonald Capital: Marto Current Account: Marto R240 000 R400 000 R195 000(CR) Drawings Account: Marto R230 000 The partnership agreement stipulates the following: 1. Interest on capital is calculated at 10% per annum. 2. Interest on current account is calculated at 5% per annum. However, if the current account has a debit balance, the interest charged will be s% per annum. 3. Each partner is entitled to a monthly salary of R30 000. 4. MacDonald is entitled to a bonus of R15 000. 5. The partners share the remaining profits and losses in the ratio 3:2. 6. No interest is charged on drawings. Complete the calculations in the following table by indicating your answer in the 1" line of each calculation and then showing your workings for the year ending 31 July 2019: Calculations MacDonald Marto Interest on Capital Answer: R Answer: R Calculation: Calculation: Interest on Current Acc Answer: R Answer: R Calculation: Calculation: Salaries to partners Answer: R Answer: R Calculation: Calculation: Bonus share of Profit Answer: R Answer: R Calculation:

The following info relates to the partnership of MacDonald and Marto, who run a retail business, MaMa Traders, in Durban. The following balances, amongst others, appeared in the books of the business at the end of the current financial year, 31 July 2019: Net profit for the year Capital: MacDonald R723 000 R500 000 Current Account: MacDonald R135 000(DR) Drawings Account: MacDonald Capital: Marto Current Account: Marto R240 000 R400 000 R195 000(CR) Drawings Account: Marto R230 000 The partnership agreement stipulates the following: 1. Interest on capital is calculated at 10% per annum. 2. Interest on current account is calculated at 5% per annum. However, if the current account has a debit balance, the interest charged will be s% per annum. 3. Each partner is entitled to a monthly salary of R30 000. 4. MacDonald is entitled to a bonus of R15 000. 5. The partners share the remaining profits and losses in the ratio 3:2. 6. No interest is charged on drawings. Complete the calculations in the following table by indicating your answer in the 1" line of each calculation and then showing your workings for the year ending 31 July 2019: Calculations MacDonald Marto Interest on Capital Answer: R Answer: R Calculation: Calculation: Interest on Current Acc Answer: R Answer: R Calculation: Calculation: Salaries to partners Answer: R Answer: R Calculation: Calculation: Bonus share of Profit Answer: R Answer: R Calculation:

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

Transcribed Image Text:The following info relates to the partnership of MacDonald and Marto, who run a retail business,

MaMa Traders, in Durban. The folliowing balances, amongst others, appeared in the books of the

business at the end of the current financial year, 31 July 2019:

Net profit for the year

Capital: MacDonald

Current Account: MacDonald

R723 000

R500 000

R135 000(DR)

Drawings Account: MacDonald

Capital: Marto

R240 000

R400 000

Current Account: Marto

R195 000(CR)

Drawings Account: Marto

R230 000

The partnership agreement stipulates the following

1. Interest on capital is calculated at 10% per annum.

2. Interest on current account is calculated at 5% per annum. However, if the current

account has a debit balance, the interest charged will be 8% per annum.

3. Each partner is entitled to a monthly salary of R30 000.

4. MacDonald is entitled to a bonus of R15 000.

5. The partners share the remaining profits and losses in the ratio 3:2.

6. No interest is charged on drawings.

Complete the calculations in the following table by indicating your answer in the 1* line of

each calculation and then showing your workings for the year ending 31 July 2019:

Calculations

MacDonald

Marto

Interest on Capital

Answer: R

Answer: R

Calculation:

Calculation:

Interest on Current Acc

Answer: R

Answer: R

Calculation:

Calculation:

Salaries to partners

Answer: R

Answer: R

Calculation:

Calculation:

Bonus

Share of Profit

Answer: R

Answer: R

Calculation:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education