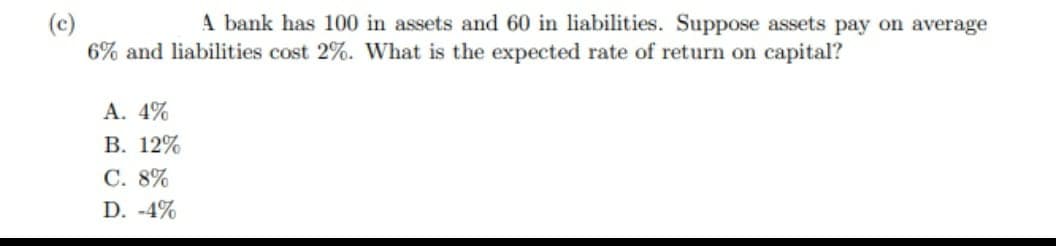

A bank has 100 in assets and 60 in liabilities. Suppose assets pay on average 6% and liabilities cost 2%. What is the expected rate of return on capital? A. 4% B. 12% C. 8% D. -4%

Q: Would the tax treatment of dividend income versus capital gains income affect the managers’…

A: Dividends and stock repurchases: Dividends are cash disbursements to a company's common…

Q: Determine the APY you would pay using an equation. The APY paid would be % per year.

A: Annual percentage yield (APY) refers to a yield or real interest rate which an investor is expect…

Q: Blaxo Balloons manufactures and distributes birthday balloons. At the beginning of the year Blaxo's…

A: Solution:- Rate of return means the percentage of extra amount earned on initial amount invested.…

Q: 10 [9] Tory signed a 10-yr contract to play for a football team at a salary of $5,000,000 per year.…

A: Time value of money (TVM) refers to the method or technique which is used to measure the amount of…

Q: Computing rates of return) From the following price data, compute the annual rates of return for…

A: As per the information provided :

Q: The DuPont system of analysis allows firms to break down their return on equity down into all of the…

A: Dupont analysis is very important analysis being performed in business. This shows return on equity…

Q: A manufacturing company is considering two types of industrial projects that require the same level…

A: Incremental IRR: The incremental IRR, also well-known as the incremental internal rate of return,…

Q: 16) Find the gaps in the following table: Item Capital (S) 12,350 a. b. ?? C. 33,266 d. ?? e. 11,900…

A: Solution:- Capital employed means the amount invested in the business. So, Capital = Assets –…

Q: Assume the Black-Scholes framework for a stock. You are given: i) The current stock price is 40 ii)…

A: An option contract gives the right to its buyer to sell or buy the assets or securities at today’s…

Q: Project A requires an initial outlay at t = 0 of $1,000, and its cash flows are the same in Years 1…

A: Here we will use the concept of time value of money. As per the concept of time value of money the…

Q: An employee is entitled to a 10 yearly grant of 25,000 pesos each starting at the end of the…

A: “Hi There, Thanks for posting the questions. As per our Q&A guidelines, must be answered only…

Q: Consider the following scenario analysis: Rate of Return Stocks Bonds Scenario Recession Probability…

A: The expected return is calculated by multiplying the return by probability. Expected Return =…

Q: At the end of 2020, the Light Bulb Company announced it had produced a gross profit of R1 million.…

A: Operating Profit or Earnings before Interest and taxes is calculated with the help of following…

Q: Your broker charges $0.0011 per share per trade. The exchange charges $0.0065 per share per trade…

A: At any particular time, the term "bid" refers to the greatest price a buyer is willing to pay for a…

Q: A primary market is: -the financial market where new security is sold for the first time. -the…

A: Primary market is a type of capital market where securities will be issued for first time. The…

Q: URGENT PLEASE HELPPP I CANNOT FIND QUESTION B

A: Bond refers to the investments that the investor makes for lending money to the company or…

Q: Based on the information below, calculate the profit margin for Starbuck’s and Dunkin and choose the…

A: Profit margin is one of the important ratio being used by the business. This is used for analysing…

Q: a man brought equipment worth P124,587 payable in 15 quarterly payments, each installment payable at…

A: Mortgage/ Borrowings: Borrowings are the loan which is taken by the individual to meet its…

Q: Carry out the PESTLE analysis for GERMANY.

A: PESTLE analysis is referred as the study of the key external factors like - political, economic,…

Q: If the U.S. Treasury deposits income tax receipts into its account at the Federal Reserve, then

A: As per Bartleby honor code, when multiple questions are asked, the expert is required to solve the…

Q: A shirt factory has just installed a boiler. It is expected that there will be no maintenance…

A: Here, To Find: Present value of money at time zero =?

Q: The CFO of Expansion Group Ltd. has been presented with an opportunity to undertake a 7-year project…

A: We will first calculate the NPV calculation after that we will calculate the NPV using those…

Q: Should Chen buy the new machine? Do not round intermediate calculations. Round your answer to the…

A: Net Present Value: It is a measure of absolute profitability in dollar terms for a project or…

Q: Onse took a loan of P2,000 that is repaid by a payment of P3,500 made 24 months later. Find the…

A: Present Value refers to the discounted value of a single cash flow or multiple cash flows today…

Q: Circuit City’s inventory turnover is twice as fast as the industry average. It is safe to assume…

A: Inventory turnover ratio is one of the efficiency ratio being used in business. This shows how much…

Q: The National Lottery decided to make 2020 a year of CHARITIES. They gave a big donation of R42 345…

A: Given, The donation amount is R 42,345,335

Q: The Paulson Company's year-end balance sheet is shown below. Its cost of common equity is 16%, its…

A: WACC can be calculated as: = (Weight of equity * Cost of equity) + (Weight of debt * Cost of debt)

Q: What is the cash flow of a 6% coupon bond that pays interest annually, matures in 9 years, and was…

A: Given, The coupon rate is 6% term of bond is 9 years Par value of bond is $1000

Q: LAGER Ltd, a listed company, has had the following balance sheets from 2016 to 2018 (reported in…

A: Data given: LAGER LTD…

Q: 4-49. Consider the accompanying cash-flow diagram. (See Figure P4-49.) a. If P = $1,000, A = $200,…

A: A. Investment = 1000 A = 200 Interest = 12% N = ? B. Investment = 1000 A = 200 Interest = ? N =…

Q: The Price Company will produce 55,000 widgets next year. Variable costs will equal 40 percent of…

A: Solution:- Earnings before interest and taxes (EBIT) means the operating income of an entity before…

Q: Your employer, a mid-sized human resources management company, is considering expansion into related…

A:

Q: 2. UNIV Dreamers Publishing has a choice of publishing one of two financial economics books. It…

A: The expected Profit us calculated with the help of following formula Expected Profit = Proft ×…

Q: The used equipment can be sold today for $4.6 million, and its tax rate is 25%. What is the…

A: After Tax Salvage Value: It is computed by reducing the tax on profit on the sale of equipment from…

Q: 4. You are in your 4th year now and realize that you need to create a budget for yourself. You make…

A: Solution:- When an equal payment is made each period at end of period, it is called ordinary…

Q: Let's say we have two credit cards from two different people. The first user's credit card has an…

A: APR is referred to as the Annual Percentage Rate and is the amount of interest that will be…

Q: Computech Corporation is expanding rapidly and currently needs to retain all of its earnings; hence,…

A: The price of share today will be calculated by using dividend discount model. The perpetuity Value…

Q: The cost of equity capital is all of the following EXCEPT: for A) The minimum rate that a firm…

A: The minimum rate of return required to earn on equity capital without affecting the market value of…

Q: What is the Year-0 net cash flow? $ What are the net operating cash flows in Years 1, 2, and 3?…

A: Cash Flow: These represent the amount of cash generated by the project from its normal operations.…

Q: A company is considering investment of k1,000,000 in a project. The following are the forecasts,…

A: 1. Payback Period is the length of time required to recover the cost of Investment. (a) When Cash…

Q: Mr Ahmad wants to borrow $30,000 for a delivery Van for his Bakery business, which is rovided by…

A: Amount to borrow is $30,000 Interest rate is 9% per year Compounded monthly Time period is 5 year To…

Q: 8. An annuity of $5,000 payable every 3 months for 5 years is deferred for 2 years. If money is…

A: Amount of annuity is 5,000 Payment mode Quarterly Time period is 5 years Deferral period is 2 years…

Q: Delaney purchased 500 shares of Upriver Tours stock on Wednesday, July 7. Edward purchased 100…

A: Date Person No. of shares purchased July 7 D 500 July 8 E 100 Dividend declared: June 20…

Q: Suppose that National Waferonics has before it a proposal for a four-year financial lease.…

A: Calculation of after discount rate: After-tax discount rate = 14(1-21%) = 11.06%

Q: t purchased new goods worth 100,000 EUR from your supplier. Your supplier offers you to pay within…

A: Supplier provide credit for payment but due to this default on loan occurs but due to this they give…

Q: If P44,873 is deposited each year for 6 years at an interest rate of 14.225% compounded semi…

A: Here we will use the concept of time value of money. The concept of time value of money states that…

Q: An amortized loan means that the principal is gradually paid off during the life of the loan. True…

A: The question is related true or false.

Q: cently paid a dividend, D0, of $2.50. It expects to have nonconstant growth of 20% for 2 years…

A: Present value of dividends and present value of horizon value would give the value of stock today on…

Q: TV Azteca is a Mexican corporation listed on the NYSE and the BMV. This firm needs to finance an…

A: Note: The post above has several subparts. The first three have been solved below.

Q: [CLO-5] Determine the value of X for these two investment alternatives to be equivalent at an…

A: Time value of money (TVM) refers to the method or technique which is used to measure the amount of…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- Chasse Building Supply Inc. reported net cash provided by operating activities of $243,000, capital expenditures of $112,900, cash dividends of $35,800, and average maturities of long-term debt over the next 5 years of $122,300. What is Chasses free cash flow and cash flow adequacy ratio? a. $94,300 and 0.77, respectively c. $130,100 and 1.06, respectively b. $94,300 and 0.82, respectively d. $165,900 and 1.36, respectivelyA bank with $10,000 in assets has ROA =2% and ROE - 10%. What is its leverage ratio (TA/Equity)? A 2.5 B 5 C 4 D 1.25a)Assume that the following data is extracted from the financial statements of Richy-Rich bank: equity is $350 million, interest expense is $115 million, provision for loan loss (P) is $35 million, noninterest income is $30 million, noninterest expense is $50 million and a tax rate is 33%. What is the minimum total interest income required to give a return on equity (ROE) of 20%? Show workings when necessary. b) Be-smart Bank reported an equity multipler ratio of 6.5 at the end of year 2021. If the bank’s total debt at the end of year 2021 was $5 million, how much of its assets were financed with equity? Show calculations when necessary. c) What are the main sources of funding for commercial banks? Using bullet points, classify these sources and briefly describe each category.

- 1 If Net Income is $15,000 and Total Assets are $100,000, for every $1 in assets, how much net profit should the bank have? 2 If Net Income is $10,000 and Total Equity Capital (Bank Capital) is $40,000, for every $1 in equity what is the shareholder’s return?Suppose Bank A has $35 million in rate-sensitive assets, $70 million in fixed rate assets, $70 million in rate sensitive liabilities, and $35 million in fixed rate liabilities and equity capital. Calculate the change in Bank A’s profit as a result of an increase in market interest rates of 2 percentage points.The First National Bank of Trinidad reports a net interest margin of 5.83 percent. It has totalinterest revenues of $275 million and total interest expenses of $210 million. What will be thebank's earning assets total?A. $4,717 millionB. $3,602 millionC. $1,115 millionD. $3,790 million

- Suppose an SEVP tells you that last year a bank had total interest expenses on all borrowings of BDT 12 million and noninterest expenses of BDT 5 million, while interest income from earning assets totaled BDT 16 million and noninterest revenues totaled BDT 2 million. Suppose further that assets amounted to BDT 480 million, of which earning assets represented 85 percent of that total asset while total interest-bearing liabilities amounted to 75 percent of total assets. See if you can determine the bank’s net interest and non-interest margins and its earnings base and earnings spread for the most recent year.Consider a bank with return on assets of .15 or 15%. The equity multiplier for this bank is 1.333. What is the return on equity of this bank?First National Bank has a debt-to-equity ratio of 3. Its weighted average cost of capitalis 12.50% and its cost of debt is 8%. First National Bank is subject to a 25% corporatetax rate.a. What is First National Bank cost of equity?b. What is First National Bank un-levered cost of capital?c. What would be its weighted average cost of capital is debt equity ratio is 0.5? 4? please provide step by step

- ) Prince Edward Bank considers increasing a type of loans in the credit portfolio by $3,500,000,which will generate a gross income of 2.5%p.a. The bank assumes PD is 10% and estimates LGDis 20% and EAD as 80%. The net income, which is gross income minus Expected Loss (i.e. EL),will be used in the RAROC analysis. When doing so, the Bank refers to the net income andunexpected loss (i.e. UL) as the capital-as-risk estimation.Required:If the ROE of Prince Edward Bank is targeted at 25%, analyze whether the loans could be addedto the portfolio by RARoC analysisA bank has earning assets of $100 million including $30 million of securities that pay an interest rate of 3%, and $70 million of loans that pay an interest rate of 6% financed by $100 million of deposits paying an interest rate of 3%. What is the bank's Net Interest Margin (NIM)?A bank has capital of $200 and a leverage ratio of 5.If the value of the bank's assets declines by 10percent,then its capital will be reduced toa.$100b.$150c.$180d.$185