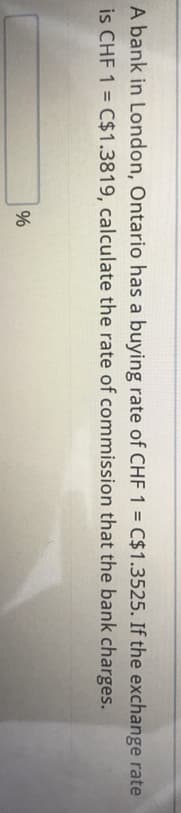

A bank in London, Ontario has a buying rate of CHF 1 = C$1.3525. If the exchange rate is CHF 1 = C$1.3819, calculate the rate of commission that the bank charges. %3D %3D

Q: The foreign exchange department of Bank of America has a bid quote on Canadian dollars (C$) of…

A: Spread % = Ask Price - Bid PriceAsk Price x 100

Q: What is the acid−test ratio for a merchant with the following account balances? (Round your answer…

A: Ratio analysis means where different ratio of various years of years companies has been compared and…

Q: For Questions 13-15 ECQ Incorporated imported an article from South Korea. The invaice value of the…

A: Value added Tax in Philippines The applicable tax rate for Value added tax in Philippines is 12%…

Q: A banker in London is given the following exchange rates: SF in Zurich: 1.8900- 1.8950 SF/1$ £ in…

A: Here, Quote for SF/$ is 1.8900 -1.8950 SF/$ Quote for $/£ is 1.4310-1.4350 $/£ In this, the US…

Q: bank dealing in foreign currency tells you that the foreign currency will buy you $.80 US dollars.…

A: The correct option is (a) a direct quote

Q: or the following practice questions use these rates that your bank has quoted you: EUR/USD:…

A: Given information from question EUR/USD: 1.0175 – 1.0180 GBP/USD: 1.2065 – 1.2070…

Q: A bank is quoting the following exchange rates against the dollar for the Swiss franc and the…

A: Formula used:

Q: For the next few questions, here are the currency rates quoted to you buy ABC Bank, the bank that…

A: Exchange rates between three different pairs of currencies have been given. We have to create the…

Q: The rate charged for issue of foreign currency notes for travelling abroad to the customer.

A: The rates mentioned in each case are selling and buying rates for the market maker or the commercial…

Q: On December 1, 20x1, Entity A sells good to Entity B, on credit, for a total sale price of $1,000.…

A: Foreign exchange currency refers to a currency that is not the functional currency of the entity.

Q: Sonipto needs to purchase Pakistani currency (PAK). He takes C$7,500 to the bank and leaves the bank…

A: The value to convert one currency to another is known as exchange rate. If a certain currency is to…

Q: Mozzie Ltd has a functional currency of A$. On 1 April 2023, Mozzie Ltd sells goods to a customer on…

A: As per IAS 21 The effects of changes in foreign exchange rates, Every organization on reporting…

Q: Hello, please help with letter a. Thank you 1) ABC Corp has Accounts Receivable of FC 400,000 and…

A: Accounts receivables are the sum of money entitled to be received by the company for supply of goods…

Q: Suppose the Bangladesh Bank purchases a government bond from you for TK 10,000. a. Suppose you…

A: A bank is distinguished from other financial institutions through credit creation. Credit creation,…

Q: 4 How much accounts receivable from the transaction is included in Goo's 20x1 statement of financial…

A:

Q: Bank of the Philippine Islands has loaned P12,000 to Aina Company using a 60-day…

A: Bank loan: It is the sum of money acquired by the borrower from bank for a certain period at…

Q: A bank in Toronto charges 2.00% commission to buy and sell currencies. Assume that the current…

A: Exchange rate US$1 = C$1.3283 Commission rate = 2.00%

Q: Dealer 1 offers the following exchange rates: 1 USD = 1.195 CAD1 USD = 0.637 GBPDealer 2 offers the…

A: In order to generate arbitrage profit, first USD will be sold to but CAD, then through dealer 2,…

Q: ABC LTD's average trade receivables and trade payables for an accounting period are R12.5m and R18m…

A: Trade receivables collection period = 365 / (Credit sales / average trade receivables) = 365 /…

Q: New York simultaneously calls Citibank in New York City and Barclays in London. The banks give the…

A: Given, Citi Bank NYC : Bid: $0.7551 = 1.00 Euros Ask: $0.7561 = 1.00 Euros Barcalys London : Bid…

Q: a.If US$1 = C$1.1277, and if the bank in Canada charges 0.9% commission to buy or sell currencies,…

A: You have posted many unrelated questions. I will address first three of them. Please post the blance…

Q: triangle

A: Triangular arbitrage is nothing but the discrepancy that occurs between the foreign currencies when…

Q: A bank in Mississauga has a buying rate of ¥1 = C$0.01275. If the exchange rate is ¥1 = C$0.01315,…

A: Buying rate = ¥1 = C$0.01275 exchange rate = ¥1 = C$0.01315

Q: A traveler received the following quotes from Bank Denmark: Danish Krone 5.88 --- 6.25 /$ How many…

A: Note: It is a situation where multiple questions have been asked, so we are allowed to solve the…

Q: You observed the following quotes between Canadian dollars (C$), euros (€) and Swiss francs (CHF) on…

A: We can convert our currency into another currency by using the exchange rates for two currencies in…

Q: If the exchange rates have risen, the value of the (forward) checks and debt securities will…

A: As per the accounting standard on foreign exchange transactions, the balance sheet should reflect…

Q: Assume the following information: U.S. investors have $1,000,000 to invest: 1-year deposit rate…

A: In the foreign exchange markets linking interest rates, spot exchange rates, and currency rates,…

Q: For the below questions use these rates that your bank has quoted you: EUR/USD: 1.0175 –…

A: As per our guidelines, we are supposed to answer only 3 sub-parts (if there are multiple sub-parts…

Q: Items EURUSO USE/MYR USD/SGD SPOT (28 october 201) 1.1017/18 42200/ 1 MONTH 437/492 74/119 2 MONTH…

A: Note: Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the question…

Q: Peter Sheffield has Euros (E) amounting to €500,000 and is provided with the following quotes: Bank…

A: To determine whether an arbitrage opportunity exists or not, it is required to analyze the buying…

Q: 23 - Our business, 27.06.202. On the date of purchase, $14,000 was exchanged at the exchange rate of…

A: $ 14000 1$ = 6.95

Q: For the below questions use these rates that your bank has quoted you: EUR/USD: 1.0175 –…

A: Solution:- Cross rate means the rate of two foreign currencies of which direct quote is not given.

Q: Sales - P1,000,000 Cost of sales - P500,000 Interest income from bank deposit, Philippines - P40,000…

A: Gross income is the income which is computed by reducing the cost from the total revenues. When…

Q: If Bank A quotes you an exchange rate of $1.11 per pound. The same bank also quotes exchange rates…

A: Solution:- Given that 1 Pound = $1.11 Therefore $1 = 1/1.11 Pounds

Q: Following are the card rates announced by the dealing room at 9.00am in the morning…

A: The selling rate and the buying rate are the exchange rates at which an institution buys or sells…

Q: A bank in London, Ontario charges 3.25% commission to buy and sell currencies. Assume that the…

A: Commission = 3.25% Exchange Rate: 1USD = 1.3015 CAD

Q: You observed the following quotes between Canadian dollars (CS), euros (€) and Swiss francs (CHF) on…

A: The exchange rates between two currencies can be computed by using the rates for those two…

Q: Here are some quotes of the Burundi Franc/U.S. Dollar spot exchange rate given at once via internet…

A: Foreign exchange- Foreign exchange is the conversion of one currency into another at a specific rate…

Q: A bank in Toronto charges 3.25% commission to buy and sell currencies. Assume that the current…

A: Amount of Canadian Dollars that may be required to be paid for purchasing certain amount of US…

Q: Mr. X received a letter from Mr. Y, his brother, to withdraw $1,000 from the PNB(philippine ational…

A: The reportable income is calculated by multiplying the reportable currency with the dollar.

Q: How many Canadian dollars will you have to pay to purchase US$4,000? b. How much commission in…

A: Current exchange rate = US$1 = C$1.1152 Number of US dollars to be purchased = US$4000 Number of…

Q: XYZ entered into a currency swap with its bank, and borrowed $10 million at 9% and swaps for a 11%…

A: Currency Swap In currency swap, two parties agree to trade payments of principal and interest made…

Q: The following exchange rates are available to you: Beginning Funds in Swiss Franc (SF) = 10,000,000…

A: Beginning Funds in Swiss Franc (SF) = 10,000,000Yen / $ = 120SF / $ = 1.6Yen / SF = 80 Exchange…

Q: You are the financial manager for Belltower Associates, which is headquartered in Australia. You…

A: Hedge is a foreign exchange technique under which Importer / Exporter will purchase / Sale the…

Step by step

Solved in 3 steps with 2 images

- 1 A bank in London, Ontario has a buying rate of CHF 1 = C$1.3491. If the exchange rate is CHF 1 = C$1.3785, calculate the rate of commission that the bank charges. 2 Jonathan found US$130 in his attic and sold it to a bank that charged him a commission of 0.35%. How much did he receive from the bank? Assume that the exchange rate was C$1 = US$0.75.A bank in Mississauga has a buying rate of ¥1 = C$0.01275. If the exchange rate is ¥1 = C$0.01315, calculate the rate of commission that the bank charges to buy currencies. Round to two decimal placesA bank in Toronto charges 3.25% commission to buy and sell currencies. Assume that the current exchange rate is US$1 = C$1.3211. a. How many Canadian dollars will you have to pay to purchase US$1,460? Round to the nearest cent b. How much commission in Canadian dollars (C$) will you pay the bank for the above transaction? Round to the nearest cent

- A bank in Toronto charges 3.25% commission to buy and sell currencies. Assume that the current exchange rate is US$1 = C$1.3533. a. How many Canadian dollars will you have to pay to purchase US$1,405? Round to the nearest cent b. How much commission in Canadian dollars (C$) will you pay the bank for the above transaction? 2. Skis are listed by a manufacturer for $850, less trade discounts of 30% and 18%. What further rate of discount should be given to bring the net price to $443?A bank in Toronto charges 2.3% commission to buy and sell currencies. Assume that the current exchange rate is US$1 = C$1.1152. a. How many Canadian dollars will you have to pay to purchase US$4,000? b. How much commission in Canadian dollars (C$) will you pay the bank for the above transaction?Assume the exchange rates in New York for $1 are C$1.1382 and £.6387 while in Toronto, C$1 will buy £.5612. How much profit can you earn on $10,000 using triangle arbitrage?

- The exchange rates in New York for $1 are Can$1.0941 or 0.7257 pounds. In Toronto, Can$1 will buy 0.6722 pounds. How much profit can you earn on $8,500 using triangle arbitrage?" $107.90 $114.25 $120.26 $105.46 $142.81From the following data provided, ascertain what would be the exchange rates that the Bank would quote for an FDI transaction amounting to USD 2 Mn for value cash basis, assuming a margin of 3 paise where., Spot USD/INR = 75.0900/75.1000 ., Cash/Spot : 4/5 paise. Arrive at the exchange rate up to 4 decimal places. Adhere to the steps involved in calculation.1. Emily found US$100 in his attic and sold it to a bank that charged him a commission of 0.60%. How much did he receive from the bank? Assume that the exchange rate was C$1 = US$0.77. 2. A bank in Toronto charges 3.25% commission to buy and sell currencies. Assume that the current exchange rate is US$1 = C$1.3533. a. How many Canadian dollars will you have to pay to purchase US$1,405? Round to the nearest cent b. How much commission in Canadian dollars (C$) will you pay the bank for the above transaction? 3. Skis are listed by a manufacturer for $850, less trade discounts of 30% and 18%. What further rate of discount should be given to bring the net price to $443?

- For the below questions use these rates that your bank has quoted you: EUR/USD: 1.0175 – 1.0180 GBP/USD: 1.2065 – 1.2070 USD/CAD: 1.2930 – 1.2935 USD/JPY: 134.85 – 134.90 AUD/USD: .6905 - .6910 Calculate the following crosses: EUR/GBP EUR/JPY AUD/JPY GBP/CAD GBP/JPY CAD/JPY23 - Our business, 27.06.202. On the date of purchase, $14,000 was exchanged at the exchange rate of $1 = 6.95. Which of the following calculations is correct in this situation? a) 646 Exchange Profits Hs. 97,300 TL (Creditor) B) 646 Exchange Profits Hs. 4.900 TL (Borrower) NS) 646 Exchange Profits Hs. 4.900 TL (Creditor) D) 656 Foreign Exchange Losses Hs. 4.900 TL (Creditor) TO) 656 Foreign Exchange Losses Hs. 4.900 TL (Borrower)For the below questions use these rates that your bank has quoted you: EUR/USD: 1.0175 – 1.0180 GBP/USD: 1.2065 – 1.2070 USD/CAD: 1.2930 – 1.2935 USD/JPY: 134.85 – 134.90 AUD/USD: .6905 - .6910 Calculate the following crosses: GBP/CAD GBP/JPY CAD/JPY