(a) Belief that a company will remain in business for the foreseeable future. (Note: Do not use the historical cost principle.) Indicates that personal and business recordkeeping should be separately (b) maintained. Only those things that can be expressed in money are included in the accounting (c) records. (d) Separates financial information into time periods for reporting purposes. (e) Measurement basis used when a reliable estimate of fair value is not available. (f) Dictates that companies should disclose all circumstances and events that make a difference to financial statement users

(a) Belief that a company will remain in business for the foreseeable future. (Note: Do not use the historical cost principle.) Indicates that personal and business recordkeeping should be separately (b) maintained. Only those things that can be expressed in money are included in the accounting (c) records. (d) Separates financial information into time periods for reporting purposes. (e) Measurement basis used when a reliable estimate of fair value is not available. (f) Dictates that companies should disclose all circumstances and events that make a difference to financial statement users

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter1: Accounting As A Form Of Communication

Section: Chapter Questions

Problem 1.15MCE

Related questions

Question

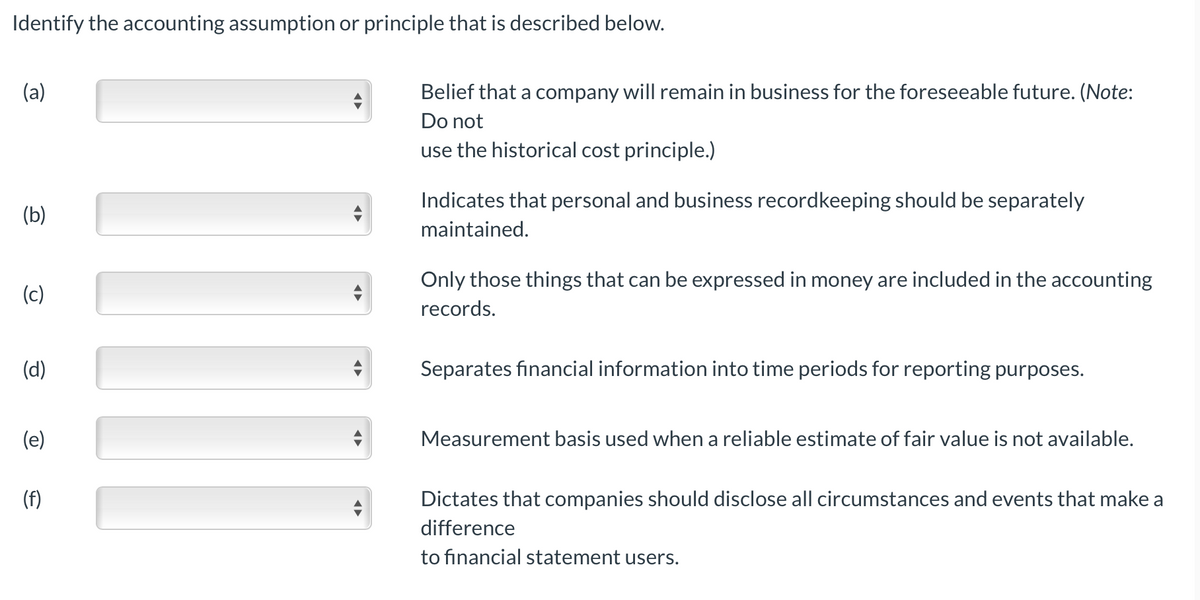

Transcribed Image Text:Identify the accounting assumption or principle that is described below.

(a)

Belief that a company will remain in business for the foreseeable future. (Note:

Do not

use the historical cost principle.)

Indicates that personal and business recordkeeping should be separately

(b)

maintained.

Only those things that can be expressed in money are included in the accounting

(c)

records.

(d)

Separates financial information into time periods for reporting purposes.

(e)

Measurement basis used when a reliable estimate of fair value is not available.

(f)

Dictates that companies should disclose all circumstances and events that make a

difference

to financial statement users.

Expert Solution

Step 1

Since you have posted a question with multiple sub-

Accounting assumptions and principles are the rules to be followed by the business organizations for conducting their day-to-day business operations effectively and for the preparation of financial statements. They ensure the consistency, reliability and accuracy of financial statements.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning