3. What accounting principle is being violated in the following: a. The owner mixed up his personal expenses with the operating expenses of the corporation. b. The owner did not report the portion of receivables pledged to obtain bank loans. c. The owner believes it is foolish to report financial information on a yearly basis. Instead, the owner believes that financial information should be disclosed only when significant new information is available related to the company's operations. d. Because the enterprise's income is low this year, the owner decided to ignore depreciation incurred this year. e. Inventories costing P100,000 is reported at its current market value of P140,000.

3. What accounting principle is being violated in the following: a. The owner mixed up his personal expenses with the operating expenses of the corporation. b. The owner did not report the portion of receivables pledged to obtain bank loans. c. The owner believes it is foolish to report financial information on a yearly basis. Instead, the owner believes that financial information should be disclosed only when significant new information is available related to the company's operations. d. Because the enterprise's income is low this year, the owner decided to ignore depreciation incurred this year. e. Inventories costing P100,000 is reported at its current market value of P140,000.

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter4: Gross Income

Section: Chapter Questions

Problem 19P

Related questions

Question

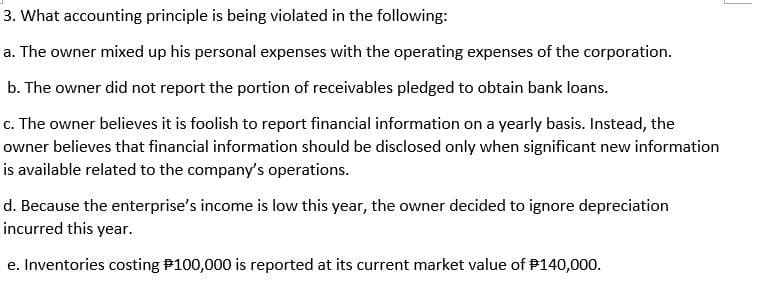

Transcribed Image Text:3. What accounting principle is being violated in the following:

a. The owner mixed up his personal expenses with the operating expenses of the corporation.

b. The owner did not report the portion of receivables pledged to obtain bank loans.

c. The owner believes it is foolish to report financial information on a yearly basis. Instead, the

owner believes that financial information should be disclosed only when significant new information

is available related to the company's operations.

d. Because the enterprise's income is low this year, the owner decided to ignore depreciation

incurred this year.

e. Inventories costing P100,000 is reported at its current market value of P140,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning