A bond with a face value of $1,000 has 10 years until maturity, carries a coupon rate of 7.9%, and sells for $1,110. Interest is paid annually. (Assume a face value of $1,000 and annual coupon payments.) a. If the bond has a yield to maturity of 10.1% 1 year from now, what will its price be at that time? (Do not round intermediate calculations. Round your answer to nearest whole number.) Price 874 o. What will be the rate of return on the bond? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. Negative amount should be indicated by a minus sign.) Rate of return % c. If the inflation rate during the year is 3%, what is the real rate of return on the bond? (Assume annual interest payments.) (Do hot round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. Negative amount should be indicated by a minus sign.) Real rate of return

A bond with a face value of $1,000 has 10 years until maturity, carries a coupon rate of 7.9%, and sells for $1,110. Interest is paid annually. (Assume a face value of $1,000 and annual coupon payments.) a. If the bond has a yield to maturity of 10.1% 1 year from now, what will its price be at that time? (Do not round intermediate calculations. Round your answer to nearest whole number.) Price 874 o. What will be the rate of return on the bond? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. Negative amount should be indicated by a minus sign.) Rate of return % c. If the inflation rate during the year is 3%, what is the real rate of return on the bond? (Assume annual interest payments.) (Do hot round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. Negative amount should be indicated by a minus sign.) Real rate of return

Fundamentals of Financial Management, Concise Edition (MindTap Course List)

9th Edition

ISBN:9781305635937

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter7: Bonds And Their Valuation

Section: Chapter Questions

Problem 16P: BOND VALUATION You are considering a 10-year, 1,000 par value bond. Its coupon rate is 8%, and...

Related questions

Question

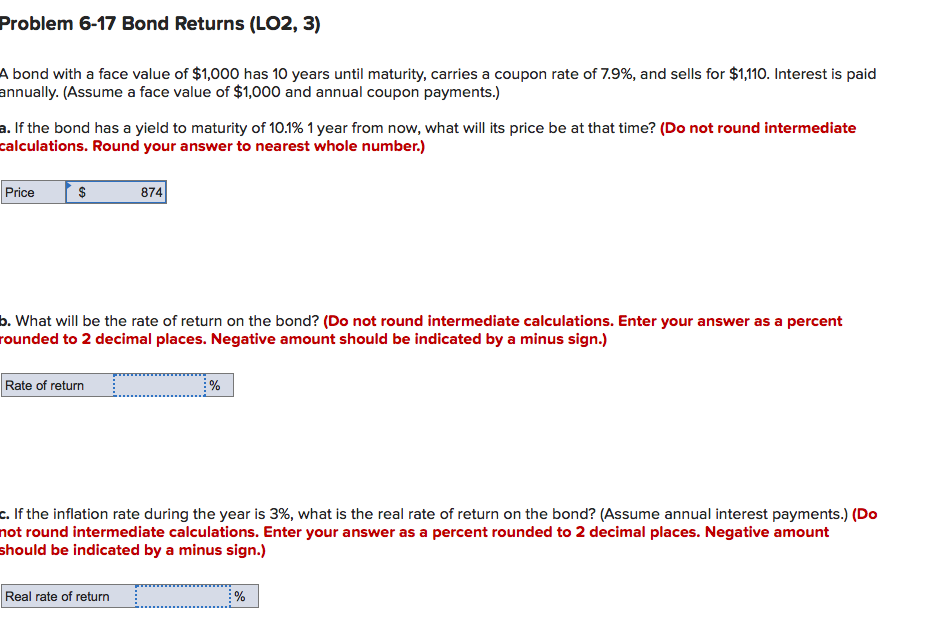

Transcribed Image Text:Problem 6-17 Bond Returns (LO2, 3)

A bond with a face value of $1,000 has 10 years until maturity, carries a coupon rate of 7.9%, and sells for $1,110. Interest is paid

annually. (Assume a face value of $1,000 and annual coupon payments.)

a. If the bond has a yield to maturity of 10.1% 1 year from now, what will its price be at that time? (Do not round intermediate

calculations. Round your answer to nearest whole number.)

Price

$

874

b. What will be the rate of return on the bond? (Do not round intermediate calculations. Enter your answer as a percent

rounded to 2 decimal places. Negative amount should be indicated by a minus sign.)

Rate of return

%

c. If the inflation rate during the year is 3%, what is the real rate of return on the bond? (Assume annual interest payments.) (Do

not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. Negative amount

should be indicated by a minus sign.)

Real rate of return

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 4 images

Recommended textbooks for you

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning