a) Build an Excel worksheet to model the two options and help the firm decide which to choose. You can ignore depreciation or tax effects in your analysis (i.e., evaluate the options simply based on their respective cash flows). b) Assuming that the equipment dealer is exactly indifferent between the construction firm purchasing or leasing, what is the dealer's implied required rate of return?

a) Build an Excel worksheet to model the two options and help the firm decide which to choose. You can ignore depreciation or tax effects in your analysis (i.e., evaluate the options simply based on their respective cash flows). b) Assuming that the equipment dealer is exactly indifferent between the construction firm purchasing or leasing, what is the dealer's implied required rate of return?

Fundamentals of Financial Management, Concise Edition (MindTap Course List)

9th Edition

ISBN:9781305635937

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter12: Cash Flow Estimation And Risk Analysis

Section: Chapter Questions

Problem 11P: REPLACEMENT ANALYSIS St. Johns River Shipyards is considering the replacement of an 8-year-old...

Related questions

Question

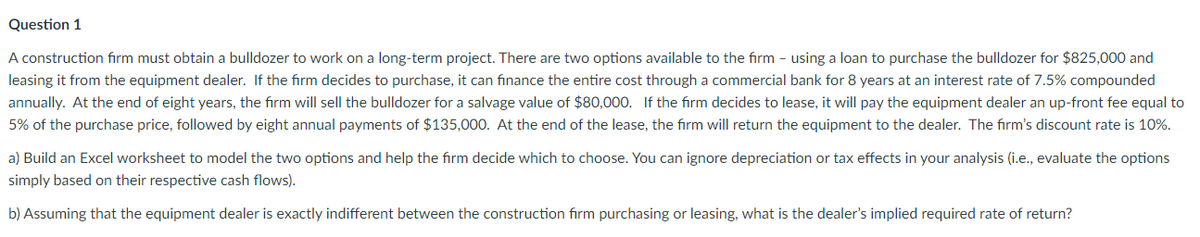

Transcribed Image Text:Question 1

A construction firm must obtain a bulldozer to work on a long-term project. There are two options available to the firm - using a loan to purchase the bulldozer for $825,000 and

leasing it from the equipment dealer. If the firm decides to purchase, it can finance the entire cost through a commercial bank for 8 years at an interest rate of 7.5% compounded

annually. At the end of eight years, the firm will sell the bulldozer for a salvage value of $80,000. If the firm decides to lease, it will pay the equipment dealer an up-front fee equal to

5% of the purchase price, followed by eight annual payments of $135,000. At the end of the lease, the firm will return the equipment to the dealer. The firm's discount rate is 10%.

a) Build an Excel worksheet to model the two options and help the firm decide which to choose. You can ignore depreciation or tax effects in your analysis (i.e., evaluate the options

simply based on their respective cash flows).

b) Assuming that the equipment dealer is exactly indifferent between the construction firm purchasing or leasing, what is the dealer's implied required rate of return?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 7 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning