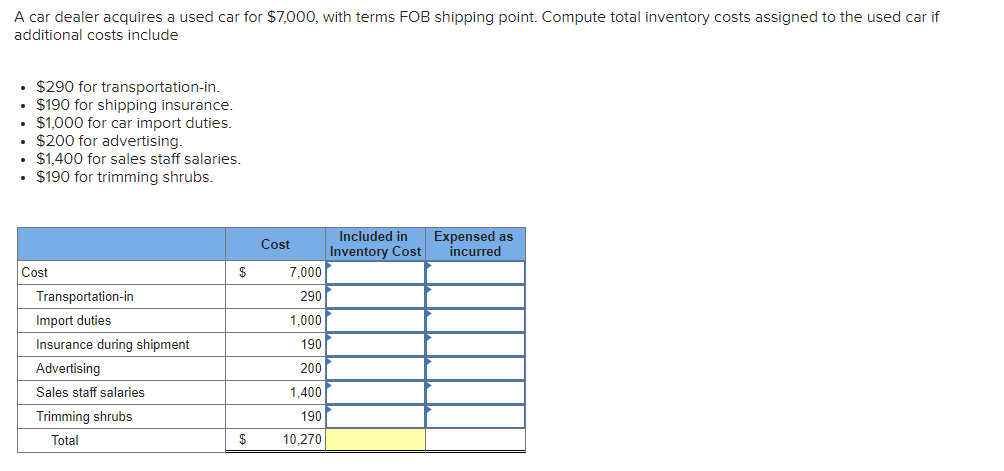

A car dealer acquires a used car for $7,000, with terms FOB shipping point. Compute total inventory costs assigned to the used car if additional costs include • $290 for transportation-in. • $190 for shipping insurance. $1,000 for car import duties. • $200 for advertising. $1,400 for sales staff salaries. • $190 for trimming shrubs. Cost Transportation-in Import duties Insurance during shipment Advertising Sales staff salaries Trimming shrubs Total $ $ Cost 7,000 290 1,000 190 200 1,400 190 10,270 Included in Expensed as Inventory Cost incurred

A car dealer acquires a used car for $7,000, with terms FOB shipping point. Compute total inventory costs assigned to the used car if additional costs include • $290 for transportation-in. • $190 for shipping insurance. $1,000 for car import duties. • $200 for advertising. $1,400 for sales staff salaries. • $190 for trimming shrubs. Cost Transportation-in Import duties Insurance during shipment Advertising Sales staff salaries Trimming shrubs Total $ $ Cost 7,000 290 1,000 190 200 1,400 190 10,270 Included in Expensed as Inventory Cost incurred

Chapter12: Current Liabilities

Section: Chapter Questions

Problem 8PB: Air Compressors Inc. purchases compressor parts for its inventory from a supplier. The following...

Related questions

Question

Transcribed Image Text:A car dealer acquires a used car for $7,000, with terms FOB shipping point. Compute total inventory costs assigned to the used car if

additional costs include

• $290 for transportation-in.

$190 for shipping insurance.

$1,000 for car import duties.

$200 for advertising.

$1,400 for sales staff salaries.

$190 for trimming shrubs.

Cost

Transportation-in

Import duties

Insurance during shipment

Advertising

Sales staff salaries

Trimming shrubs

Total

$

$

Cost

7,000

290

1,000

190

200

1,400

190

10,270

Included in

Inventory Cost

Expensed as

incurred

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage