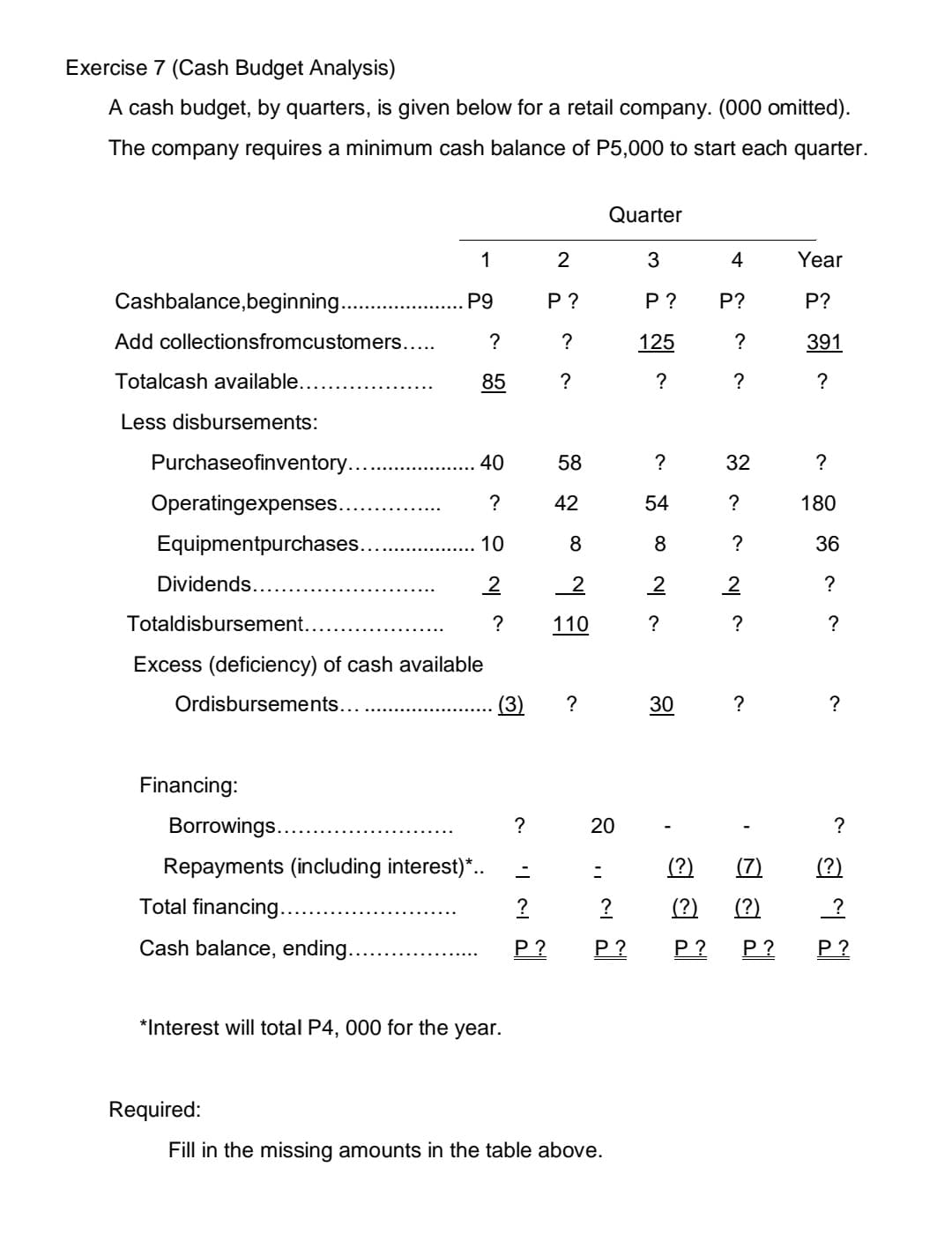

A cash budget, by quarters, is given below for a retail company. (000 omitted). The company requires a minimum cash balance of P5,000 to start each quarter. Quarter 1 4 Year Cashbalance,beginning.. P9 P ? P ? P? P? Add collectionsfromcustomers.... ? ? 125 ? 391 Totalcash available.. 85 ? ? ? ? Less disbursements: Purchaseofinventory. 40 58 ? 32 ? Operatingexpenses.. ? 42 54 ? 180 Equipmentpurchases... 10 8 8 ? 36 Dividends... 2 2 2 Totaldisbursement. ? 110 ? ? Excess (deficiency) of cash available Ordisbursements... (3) 30 ? ? Financing: Borrowings... 20 ? Repayments (including interest)*.. (?) Total financing... ? ? (?) Cash balance, ending.. P ? Р? Р? P ? P ? *Interest will total P4, 000 for the year.

Master Budget

A master budget can be defined as an estimation of the revenue earned or expenses incurred over a specified period of time in the future and it is generally prepared on a periodic basis which can be either monthly, quarterly, half-yearly, or annually. It helps a business, an organization, or even an individual to manage the money effectively. A budget also helps in monitoring the performance of the people in the organization and helps in better decision-making.

Sales Budget and Selling

A budget is a financial plan designed by an undertaking for a definite period in future which acts as a major contributor towards enhancing the financial success of the business undertaking. The budget generally takes into account both current and future income and expenses.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images