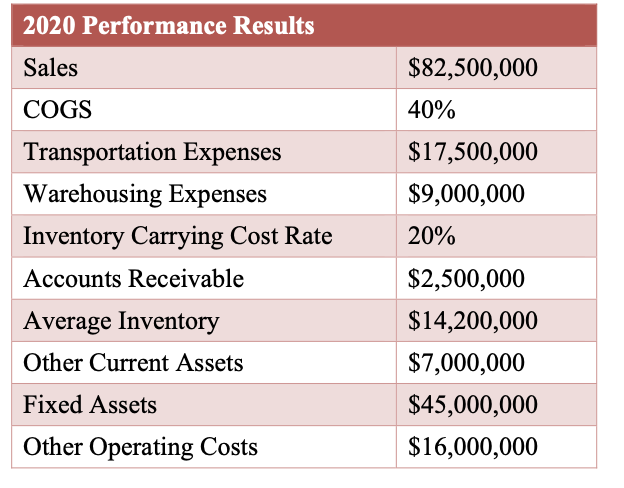

A Christchurch manufacturer of cables and electronic components reports the 2020 results shown in the table. PROPOSED CHANGES The supply chain manager is working to reduce inventory levels by 30% (given the low inventory turnover rate), but is also concerned that reduced inventories will reduce product availability for fulfilling customer orders. Therefore, a $250,000 investment in new processing equipment will be required. The benefit of this new equipment will be a reduction in COGS to 38% of sales revenue. The new production process will also require a more premium form of transportation for customer delivery so as maintain the current cycle time that customers expect. Transportation costs are expected to rise by 5% over current levels. No other changes are expected. Determine Inventory turnover rate, Asset turnover rate, and ROA for the proposed changes Should the manager move ahead with these plans? Explain your recommendation.

BASE CASE

A Christchurch manufacturer of cables and electronic components reports the 2020 results shown in the table.

PROPOSED CHANGES

The supply chain manager is working to reduce inventory levels by 30% (given the low inventory turnover rate), but is also concerned that reduced inventories will reduce product availability for fulfilling customer orders. Therefore, a $250,000 investment in new processing equipment will be required. The benefit of this new equipment will be a reduction in COGS to 38% of sales revenue. The new production process will also require a more premium form of transportation for customer delivery so as maintain the current cycle time that customers expect. Transportation costs are expected to rise by 5% over current levels. No other changes are expected.

-

Determine Inventory turnover rate, Asset turnover rate, and ROA for the proposed changes

-

Should the manager move ahead with these plans? Explain your recommendation.

Step by step

Solved in 4 steps