Use the Optimistic, Conservative and Regrets payoff analysis approaches. State which product(s) Mr Sng should invest in and what monetary return he can expect from each approach (ii) As you have only enough funds for one product, identify the most appropriate investment product.

Use the Optimistic, Conservative and Regrets payoff analysis approaches. State which product(s) Mr Sng should invest in and what monetary return he can expect from each approach (ii) As you have only enough funds for one product, identify the most appropriate investment product.

Fundamentals of Financial Management (MindTap Course List)

15th Edition

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter8: Risk And Rates Of Return

Section: Chapter Questions

Problem 22SP

Related questions

Question

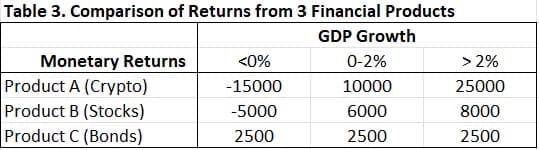

Mr Sng is a retiree in his late sixties. He has $100,000 to invest. He has no regular source of

income and no other assets. He is evaluating between 3 different lump-sum financial products

shown in Table 3. All products require a minimum investment sum of $100,000. Monetary

returns represent the net gain after one year of investing in the product. For example, if Mr Sng

chose to invest in Product B, he may lose $5,000 after one year if the GDP growth is negative.

He will earn $8,000 if the GDP growth exceeds 2% at the end of the year.

If you were in the shoes of Mr Sng, how would you select the appropriate investment product

for a time horizon of one year?

(i) Use the Optimistic, Conservative and Regrets payoff analysis approaches. State which

product(s) Mr Sng should invest in and what monetary return he can expect from each

approach

(ii) As you have only enough funds for one product, identify the most appropriate investment

product. [Hint: Be sure to consider the needs of Mr Sng who is a retiree.]

Do provide all equations, workings , tables and graph available

Transcribed Image Text:Table 3. Comparison of Returns from 3 Financial Products

GDP Growth

Monetary Returns

Product A (Crypto)

Product B (Stocks)

Product C (Bonds)

<0%

-15000

-5000

2500

0-2%

10000

6000

2500

> 2%

25000

8000

2500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning