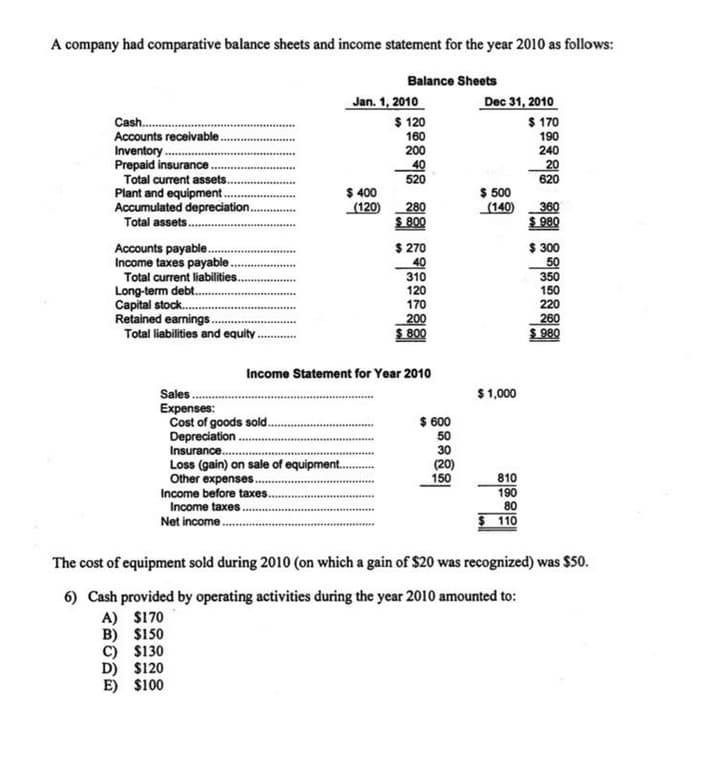

A company had comparative balance sheets and income statement for the year 2010 as follows: Balance Sheets Dec 31, 2010 Jan. 1, 2010 $ 120 160 200 40 520 $ 170 190 240 20 620 Cash. Accounts receivable . Inventory .. Prepaid insurance. Total current assets.. Plant and equipment. Accumulated depreciation.. Total assets.. $ 400 (120) 280 S 800 $ 500 360 S 980 (140) $ 270 40 310 $ 300 50 350 Accounts payable. Income taxes payable. Total current liabilities. Long-term debt. Capital stock. Retained earnings. Total liabilities and equity. 150 220 260 S 980 120 170 200 S 800 Income Statement for Year 2010 Sales. Expenses: Cost of goods sold. Depreciation. Insurance. Loss (gain) on sale of equipment.. Other expenses.. Income before taxes. Income taxes. Net income. $1,000 $ 600 50 30 (20) 150 810 190 80 $ 110 The cost of equipment sold during 2010 (on which a gain of $20 was recognized) was $50. 6) Cash provided by operating activities during the year 2010 amounted to: A) $170 B) $150 C) $130 D) $120 E) $100

A company had comparative balance sheets and income statement for the year 2010 as follows: Balance Sheets Dec 31, 2010 Jan. 1, 2010 $ 120 160 200 40 520 $ 170 190 240 20 620 Cash. Accounts receivable . Inventory .. Prepaid insurance. Total current assets.. Plant and equipment. Accumulated depreciation.. Total assets.. $ 400 (120) 280 S 800 $ 500 360 S 980 (140) $ 270 40 310 $ 300 50 350 Accounts payable. Income taxes payable. Total current liabilities. Long-term debt. Capital stock. Retained earnings. Total liabilities and equity. 150 220 260 S 980 120 170 200 S 800 Income Statement for Year 2010 Sales. Expenses: Cost of goods sold. Depreciation. Insurance. Loss (gain) on sale of equipment.. Other expenses.. Income before taxes. Income taxes. Net income. $1,000 $ 600 50 30 (20) 150 810 190 80 $ 110 The cost of equipment sold during 2010 (on which a gain of $20 was recognized) was $50. 6) Cash provided by operating activities during the year 2010 amounted to: A) $170 B) $150 C) $130 D) $120 E) $100

Excel Applications for Accounting Principles

4th Edition

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Gaylord N. Smith

Chapter14: Statement Of Cash Flows (cashflow)

Section: Chapter Questions

Problem 1R: The comparative balance sheet of Prime Sports Gear, Inc., at December 31, the end of the fiscal...

Related questions

Question

Transcribed Image Text:A company had comparative balance sheets and income statement for the year 2010 as follows:

Balance Sheets

Jan. 1, 2010

$ 120

Cash.

Accounts receivable

Inventory.

Prepaid insurance.

Total current assets..

Plant and equipment..

Accumulated depreciation.

Total assets..

Dec 31, 2010

$ 170

190

240

20

620

160

200

40

520

$ 400

(120)

$ 500

(140)

280

360

S 800

$ 980

Accounts payable.

Income taxes payable..

Total current liabilities.

Long-term debt.

Capital stock.

Retained earnings.

Total liabilities and equity.

$ 270

40

310

120

$ 300

50

350

150

220

260

S 980

170

200

S 800

Income Statement for Year 2010

Sales .

Expenses:

Cost of goods sold..

Depreciation ..

Insurance.

Loss (gain) on sale of equipment..

Other expenses..

Income before taxes..

Income taxes..

$1,000

$ 600

50

30

(20)

150

810

190

80

$ 110

Net income.

The cost of equipment sold during 2010 (on which a gain of $20 was recognized) was $50.

6) Cash provided by operating activities during the year 2010 amounted to:

A) $170

B) $150

C) $130

D) $120

E) $100

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning