The following are comparative balance sheets for Concord Company. Assets Cash Accounts receivable Inventory Land CONCORD Company Comparative Balance Sheets December 31 Equipment Accumulated depreciation-equipment Total Liabilities and Stockholders' Equity Accounts payable Bonds payable Common stock ($1 par) Retained earnings 2022 $73,000 86,500 170,000 72,900 261,000 (66,000) $597,400 $35,400 148,800 216,500 196,700 65077 100 2021 $33,400 70,900 187,000 100,300 200,700 (34,200) $558,100 $47,000 203,600 175,300 132,200 $550 400

The following are comparative balance sheets for Concord Company. Assets Cash Accounts receivable Inventory Land CONCORD Company Comparative Balance Sheets December 31 Equipment Accumulated depreciation-equipment Total Liabilities and Stockholders' Equity Accounts payable Bonds payable Common stock ($1 par) Retained earnings 2022 $73,000 86,500 170,000 72,900 261,000 (66,000) $597,400 $35,400 148,800 216,500 196,700 65077 100 2021 $33,400 70,900 187,000 100,300 200,700 (34,200) $558,100 $47,000 203,600 175,300 132,200 $550 400

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter16: Financial Statement Analysis

Section: Chapter Questions

Problem 6BE

Related questions

Question

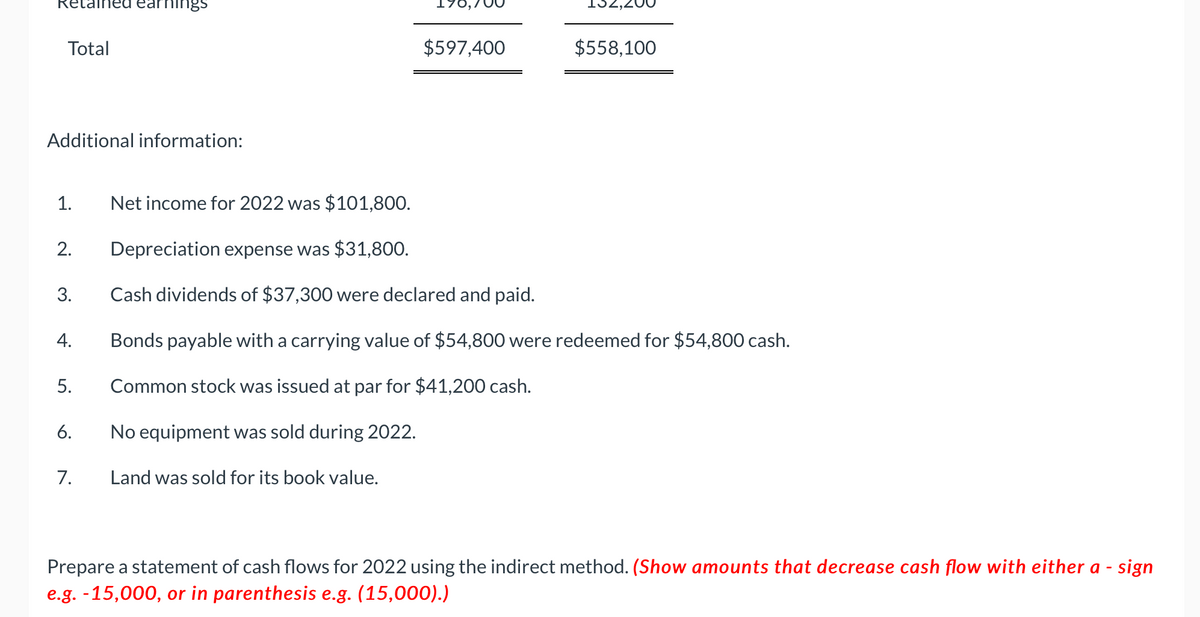

Transcribed Image Text:Retained earnings

Total

Additional information:

1.

2.

3.

4.

5.

6.

7.

$597,400

$558,100

Net income for 2022 was $101,800.

Depreciation expense was $31,800.

Cash dividends of $37,300 were declared and paid.

Bonds payable with a carrying value of $54,800 were redeemed for $54,800 cash.

Common stock was issued at par for $41,200 cash.

No equipment was sold during 2022.

Land was sold for its book value.

Prepare a statement of cash flows for 2022 using the indirect method. (Show amounts that decrease cash flow with either a - sign

e.g. -15,000, or in parenthesis e.g. (15,000).)

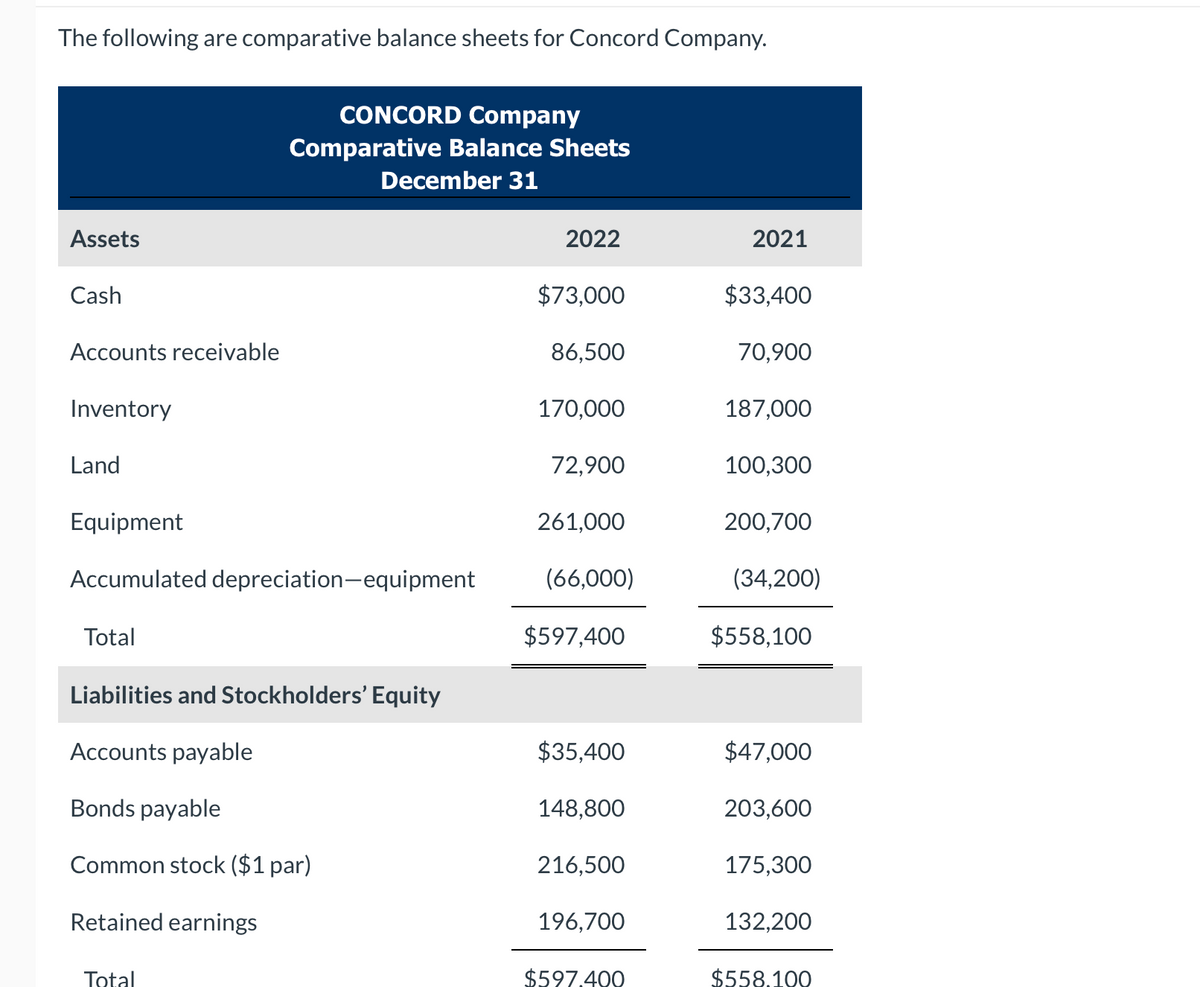

Transcribed Image Text:The following are comparative balance sheets for Concord Company.

Assets

Cash

Accounts receivable

Inventory

Land

Equipment

Accumulated depreciation-equipment

Total

CONCORD Company

Comparative Balance Sheets

December 31

Liabilities and Stockholders' Equity

Accounts payable

Bonds payable

Common stock ($1 par)

Retained earnings

Total

2022

$73,000

86,500

170,000

72,900

261,000

(66,000)

$597,400

$35,400

148,800

216,500

196,700

$597.400

2021

$33,400

70,900

187,000

100,300

200,700

(34,200)

$558,100

$47,000

203,600

175,300

132,200

$558.100

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,