Pure Self-Employment

Chapter1: Federal Income Taxation—an Overview

Section: Chapter Questions

Problem 67IIP

Related questions

Question

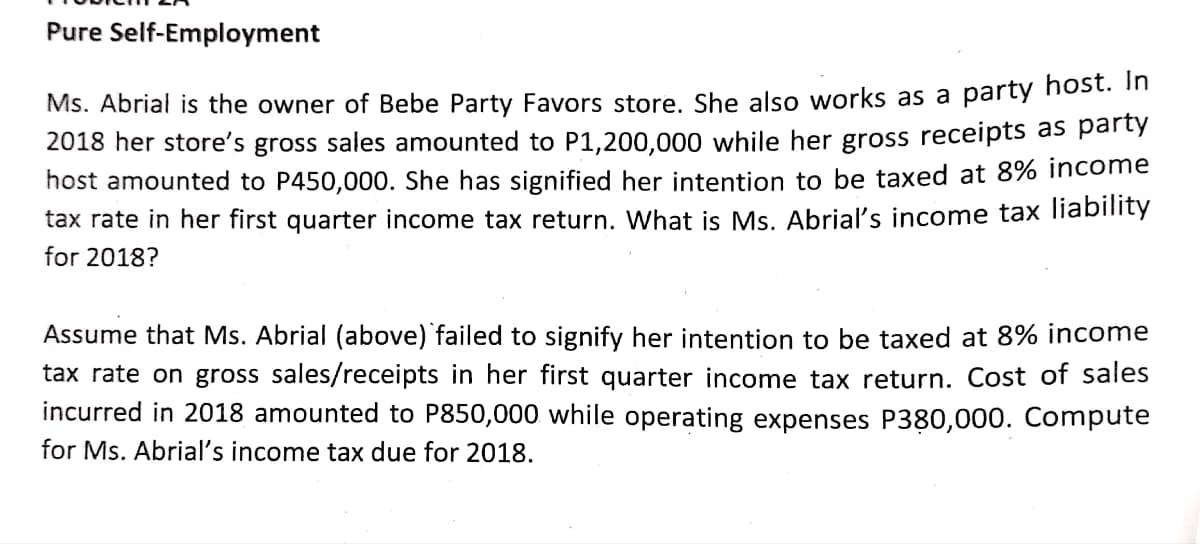

Transcribed Image Text:Pure Self-Employment

Ms. Abrial is the owner of Bebe Party Favors store. She also works as a party nost. "

2018 her store's gross sales amounted to P1,200,000 while her gross receipts as party

host amounted to P450,000. She has signified her intention to be taxed at 8% income

tax rate in her first quarter income tax return. What is Ms. Abrial's income tax liability

for 2018?

Assume that Ms. Abrial (above) failed to signify her intention to be taxed at 8% income

tax rate on gross sales/receipts in her first quarter income tax return. Cost of sales

incurred in 2018 amounted to P850,000 while operating expenses P380,000. Compute

for Ms. Abrial's income tax due for 2018.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you