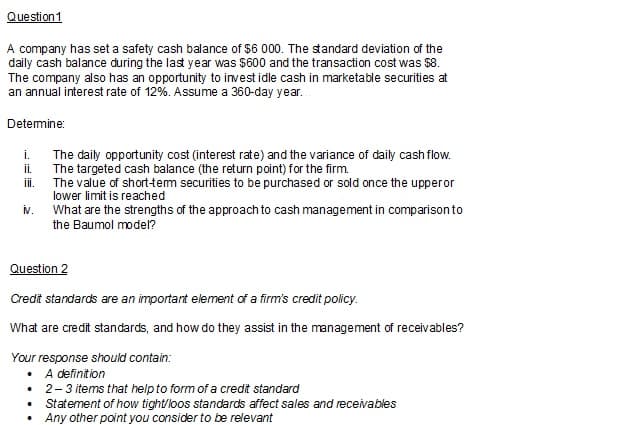

A company has set a safety cash balance of $6 000. The standard deviation of the daily cash balance during the last year was $600 and the transaction cost was $8. The company also has an opportunity to invest idle cash in marketable securities at an annual interest rate of 12%. Assume a 360-day year. Determine: i. IL ii. N. The daily opportunity cost (interest rate) and the variance of daily cash flow. The targeted cash balance (the return point) for the firm The value of short-term securities to be purchased or sold once the upperor lower limit is reached What are the strengths of the approach to cash management in comparison to the Baumol model?

A company has set a safety cash balance of $6 000. The standard deviation of the daily cash balance during the last year was $600 and the transaction cost was $8. The company also has an opportunity to invest idle cash in marketable securities at an annual interest rate of 12%. Assume a 360-day year. Determine: i. IL ii. N. The daily opportunity cost (interest rate) and the variance of daily cash flow. The targeted cash balance (the return point) for the firm The value of short-term securities to be purchased or sold once the upperor lower limit is reached What are the strengths of the approach to cash management in comparison to the Baumol model?

Chapter14: Capital Structure Management In Practice

Section: Chapter Questions

Problem 29P

Related questions

Question

100%

Transcribed Image Text:Question 1

A company has set a safety cash balance of $6 000. The standard deviation of the

daily cash balance during the last year was $600 and the transaction cost was $8.

The company also has an opportunity to invest idle cash in marketable securities at

an annual interest rate of 12%. Assume a 360-day year..

Determine:

i.

ii.

iii.

iv.

The daily opportunity cost (interest rate) and the variance of daily cash flow.

The targeted cash balance (the return point) for the firm.

The value of short-term securities to be purchased or sold once the upper or

lower limit is reached

What are the strengths of the approach to cash management in comparison to

the Baumol model?

Question 2

Credit standards are an important element of a firm's credit policy.

What are credit standards, and how do they assist in the management of receivables?

Your response should contain:

• A definition

• 2-3 items that help to form of a credit standard

•

Statement of how tight/loos standards affect sales and receivables

Any other point you consider to be relevant

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 5 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning