Please do not give solution in image format thanku

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter7: Operating Assets

Section: Chapter Questions

Problem 40E

Related questions

Question

Please do not give solution in image format thanku

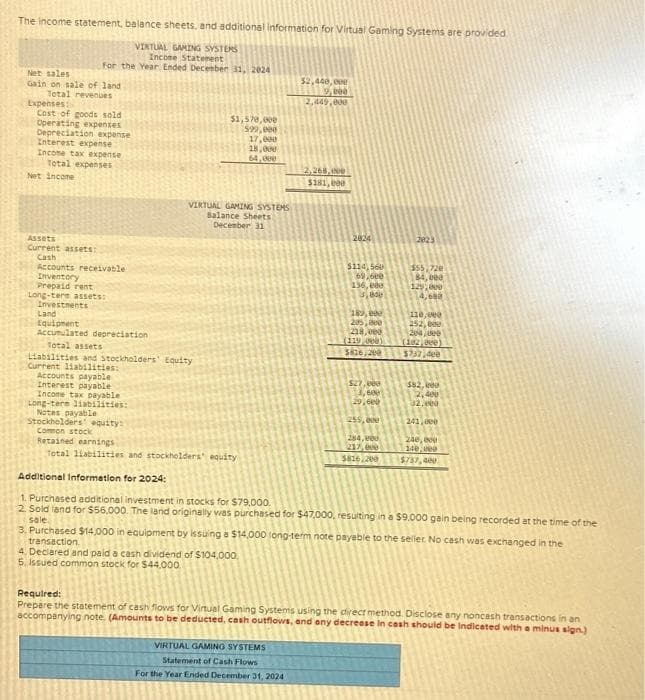

Transcribed Image Text:The income statement, balance sheets, and additional information for Virtual Gaming Systems are provided

VIRTUAL GAMING SYSTEMS

Income Statement

For the Year Ended December 31, 2024

Net sales

Gain on sale of land

Total revenues

Expenses:

Cost of goods sold

Operating expenses

Depreciation expense

Interest expense

Income tax expense

Total expenses

Net Income

Assets

Current assets:

Cash

Accounts receivable

Inventory

Prepaid rent

Long-term assets:

Investments

Land

Equipment

Accumulated depreciation

Total assets

Liabilities and stockholders' Equity

Current liabilities:

Accounts payable

Interest payable

Income tax payable

Long-tere liabilities:

Notes payable

Stockholders equity:

Common stock

$1,570,000

599,000

17,000

18,000

64,000

VIRTUAL GAMING SYSTEMS

Balance Sheets

December 31

Retained earnings

Total liabilities and stockholders equity

$2,440,00

9,000

2,449,000

4. Declared and paid a cash dividend of $104,000.

5. Issued common stock for $44.000.

2,268,000

$181,000

2824

VIRTUAL GAMING SYSTEMS

Statement of Cash Flows

For the Year Ended December 31, 2024

$114,560

69,600

136,880

3,800

180,00

205,000

218,000

(119,008)

3836,200

$27.000

3,600

29,6

255,000

284,ved

217,000

5816,200

2823

$55,720

84,000

129,000

14,688

110,00

252,000

204,000

(102,00)

$737.400

$82,00

2,400

32,00

241,000

Additional Information for 2024:

1. Purchased additional investment in stocks for $79,000.

2. Sold land for $56,000. The land originally was purchased for $47,000, resulting in a $9.000 gain being recorded at the time of the

sale

240,000

140,000

$737,400

3. Purchased $14,000 in equipment by issuing a $14,000 long-term note payable to the seller. No cash was exchanged in the

transaction.

Required:

Prepare the statement of cash flows for Virtual Gaming Systems using the direct method. Disclose any noncash transactions in an

accompanying note. (Amounts to be deducted, cash outflows, and any decrease in cash should be indicated with a minus sign.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning