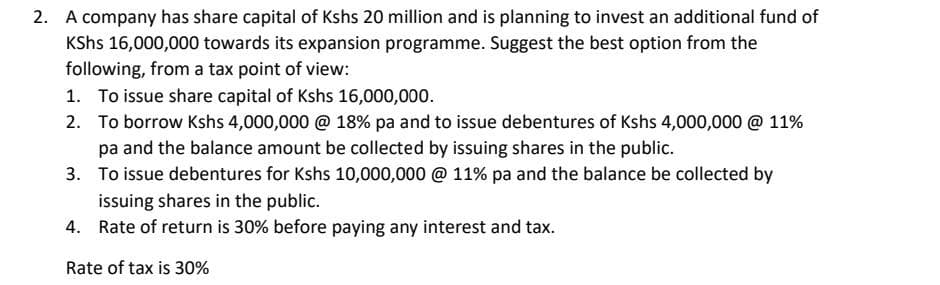

A company has share capital of Kshs 20 million and is planning to invest an additional fund of KShs 16,000,000 towards its expansion programme. Suggest the best option from the following, from a tax point of view: 1. To issue share capital of Kshs 16,000,000. 2. To borrow Kshs 4,000,000 @ 18% pa and to issue debentures of Kshs 4,000,000 @ 11% pa and the balance amount be collected by issuing shares in the public. 3. To issue debentures for Kshs 10,000,000 @ 11% pa and the balance be collected by issuing shares in the public. 4. Rate of return is 30% before paying any interest and tax. 20%

Q: Mr. Olaf earned an $89.000 salary, and Mrs. Olaf earned a $40,330 salary. The couple had no other…

A: Tax liability is the amount you owe the government in taxes. It is the total sum of taxes you owe…

Q: A company reports the following beginning inventory and two purchases for the month of January. On…

A: Weighted Average Method - Under this method of inventory valuation company takes average of the cost…

Q: Apple sells bonds with a $100 Face Value with a 4% coupon rate. What is the amount of the…

A: Introduction:- The coupon rate is the interest payments that are made to bondholders Generally…

Q: Sugar, Incorporated sells $938,600 of goods during the year that have a cost of $797,200. Inventory…

A: Inventory turnover ratio is an efficiency ratio that measure how fast an entity is able to sell its…

Q: Momentum Products Incorporated just recorded an adjusting journal entry for the current year's…

A: Journal entry for recording the estimated bad debts increases the allowance for doubtful accounts.…

Q: Allowance for Doubtful Accounts. An evaluation of accounts receivable indicates that the proper…

A: Bad Debts : When the debtors or customers does not paid the dues from a long time or become…

Q: Karim Corporation requires a minimum $8,100 cash balance, Loans taken to meet this requirement cost…

A: Budgeting - Budgeting is the process of estimating future operations based on past performance. %…

Q: Assume you have developed and tested a prototype electronic product and are about to start your new…

A: Inventory refers to the stock of raw materials, semi-finished and finished goods owned by the entity…

Q: Given the following Year 12 balance sheet data for a footwear company: Balance Sheet Data Cash on…

A: Introduction: A debt-to-assets ratio is a type of leverage ratio that shows the proportion of a…

Q: The following is the Balance sheet of Moin lilited as on 31st march 2020. You are required to…

A: The current ratio is a measurement of the short-term solvency of an organization. This ratio refers…

Q: After liquidating noncash assets and paying creditors, account balances in the Oriole Co. are Cash…

A: Dissolution of a partnership firm is a process in which relationship between the partners of the…

Q: Common-size and trend percents for Roxi Company's sales, cost of goods sold, and expenses follow.…

A: Net Income: A company's "net income" is the amount of money it retains after paying all of its…

Q: Barga Company's.net sales for Year 1 and Year 2 are $660,000 and $744,000, respectively. Its…

A: Days' Sales Uncollected is a liquidity ratio that shows the number of days' sales that have not been…

Q: Prepare a budgeted income statement for the year. E10.26 (LO 3) Haven Company has accumulated the…

A: An income statement is a financial report that indicates the revenue and expenses of a business. It…

Q: sted a prototype electronic product and are about to start your new business. You have purchase…

A: Inventories refer to the stock piled up in the company's warehouses for the purpose of selling them…

Q: ccounting 1. The auditor spends significant time auditing cash discounts and sales returns because…

A: Audit and duties of auditor : Audit is the internal and external check of the financial statements,…

Q: Prepare a cash budget for two months. P10.50B (LO 4) Nigh Company prepares monthly cash budgets.…

A: Budgets are prepared in order to predict the financial outcomes of the upcoming transactions. Cash…

Q: MCO Leather manufactures leather purses. Each purse requires 2 pounds of direct materials at a cost…

A: The question is based on the concept of Cost Accounting. Direct material budget is used to calculate…

Q: cost leadership and differenti

A: Strategy refers to the work at the business where a person should focus on his efforts to achieve…

Q: Prepare a budgeted multiple-step income statement for 2022. CORONADO INDUSTRIES Budgeted Income…

A: In the context of the given question, we are required to prepare a budgeted income statement for…

Q: An entity borrows RM3,000,000 from a bank for the purpose of its office building expansion. The…

A: Capital expenditure: It is the fund that are utilized by an organization to gain, improve or…

Q: A $250 petty cash fund has cash of $15 and receipts of $230. The journal entry to replenish the…

A: Particulars Debit (in $) Credit (in $) Expenses Cash short and over [250 - (230+15)]…

Q: Determine which of the Santas segments would be reportable segments using the three criteria as…

A:

Q: Last year Minden Company introduced a new product and sold 25,800 units of it at a price of $95 per…

A:

Q: Nabb & Fry Co. reports net income of $29,000. Interest allowances are Nabb $6,400 and Fry $5,100,…

A:

Q: Current Attempt in Progress Coronado Industries’ balance sheet at December 31, 2021, is…

A:

Q: Required information Select the correct answer for each of the following questions On December 31,…

A: Pension A pension is a type of benefit plan in which the employer contributes a fixed amount from…

Q: Post Company Sign Company Item Debit Credit Debit Credit Cash 10,000 15,000 Accounts Receivable…

A: Introduction Journal entries are the method of recording of business transactions during an…

Q: Required 1. Prepare the journal entry to recognize bad debts under the following assumptions: (a)…

A: In the normal course of business, it possible that some of the receivables of the Business Entity…

Q: Heiner Company began business on July 1, 2022 and made the following four inventory purchases in…

A: Introduction:- LIFO means Last-in-first-out It is one of the inventory valuation method. As per…

Q: On January 1, 20x1, LOMI Ko charges an initial fee of P8,000,000 for the franchise, with P1,600,000…

A: Lets understand the basics. When franchise agreement made between the franchiser and franchisee then…

Q: Analyze and journalize these transactions. James Mead invested in a new company. The investments…

A: Journal Entry :- It is the process of Recording transaction of Business. Every transaction have 2…

Q: QUESTION 4 Below is the trial balance as at 31 December 2021 of K.S.Raswoth runs a stationery…

A: Financial statement analysis refers to the process of analyzing the financial statements of a…

Q: Prepare a Statement of Cash Flows for The Dr. J Co. for the period ending December 31, 2021

A: Given in the question: Account 2021 2020 Cash $5,68,000 $80,000 Accounts…

Q: eppertree Company’s financial statements on December 31, 2021, showed the following: Net Sales $…

A: Financial records are those documents which reflect or summarize business transactions. A proper…

Q: The following information is available from previously prepared budgets for the month of January…

A: 1. Retained Earnings - Retained Earnings is the retained accumulated profit of the company over the…

Q: How to complete this balance sheet?

A: If there is a note which is payable in more than one year, then it is notes payable (non- current).

Q: Suppose the charge account of Strong's Mailing Service at the local supply store had a 1.8% interest…

A: The billing cycle is the time gap between two closing dates of the company. The ending balance is…

Q: Heiner Company began business on July 1, 2022 and made the following four inventory purchases in…

A: The First in first out method refers to the assumption that the goods which are received first are…

Q: Which of the following is NOT an acceptable basis on which to measure an expense? A cash outflow. O…

A: Measurement of expenses defines a projection of expenses to be incurred in a time frame or for an…

Q: Which of the following statements is true? Oa. A one-time election is available to taxpayers 55…

A: A one-time election is available to taxpayers 55 years of age or older which allows them to sell…

Q: Bairstow Company manufactures and sells a single product. The following costs were incurred during…

A: Variable Costing - Variable costing is based on the distinction between fixed and variable costs.…

Q: Calculate the labour turnover rate by applying a) Separation Method b) Replacement Method c) Flux…

A: 1. Separation Method: Under this percentage of number of Employees left during the year are…

Q: rporation entered into a 20 year franchise that allows ZZ Corporation the right to use its…

A: The franchise is special type of business in which business is done under the agreement and annual…

Q: If the ending balance in accounts payable increases from one period to the next, which of the…

A: Introduction: Accounts payable (AP) is a balance-sheet liability and a short-term debt in which a…

Q: (Ignore income taxes in this problem.) The management of Stanforth Corporation is investigating…

A: The simple rate of return can be calculated by dividing operating income by initial investment.…

Q: Prince Corporation acquired 100 percent of Sword Company on January 1, 20X7, for $195,000. The trial…

A: It is one of the important tools, to prepare the consolidated financial statements of patent and…

Q: A network consists of the activities in the following list. Times are given in weeks Activity…

A: Slack is the spare time in any activity which if utilized, i.e. if that activity is delayed by that…

Q: If the stated interest rate exceeds the market interest rate, a bond will sell at a premium. True or…

A: Bonds are the financial instruments, which are issued so as to raise debt with a fixed interest…

Q: You want to buy a new sports coupe for $75,600, and the finance office at the dealership has quoted…

A: Monthly installments=Amount of loan×APR12 months×1+APR12 monthstotal period1+APR12 monthstotal…

Step by step

Solved in 2 steps

- Krishna Enterprises Ltd is considering different methods to finance its expansion proposal. Estimated funds required are ₹ 60,00,000. Two alternative methods are available for raising the funds:I To raise ₹ 60,00,000 by issuing Equity Shares of ₹100 each ,II To raise ₹ 25,00,000 by issuing Equity Shares of ₹ 100 each and ₹ 35,00,000 through Term Loan @ 10% interest per annum.The existing capital structure of the company consists of 20,000 equity shares of ₹ 100 each and the expected EBIT (Earnings before interest and tax) is ₹ 11,40,000. Corporate tax rate is 25%, Advise the company on the basis of EPS in each alternative.Cybernauts, Ltd., is a new firm that wishes to determine an appropriate capital structure. It can issue 16 percent debt or 15 percent preferred stock. The total capitalization of the company will be $5 million, and common stock can be sold at $20 per share. The company is expected to have a 50 percent tax rate (federal plus state). Four possible capital structures being considered are as follows: PLAN DEBT PREFERRED EQUITY 1 0% 0% 100% 2 30 0 70 3 50 0 50 4 50 20 30 a. Construct an EBIT - EPS chart for the four plans. (EBIT is expected to be $1 million.) Be sure to identify the relevant indifference points and determine the horizontal - axis intercepts. b. Which plan is best? Why?1) Assume a VC firm raised $6B in committed capital for a 10-year investment fund. Each year, 2% of the committed capital will go to management fees, or 20% total. The remaining 80%, or $4.8B, will be invested in start-up firms. The firm also charges 20% carried interest on the profits of the fund. Assume the fund is worth $77.6B at the end of 10 years. What is the annual IRR based on the $6B initial investment? This is what the investors earned, after expenses. Note that you must take out the carried interest to find out the amount that goes to the investors. 2) A firm needs to raise $474.2 million in its IPO to fund its next investment project. The flotation costs (aka underwriting fees) are equal to 7%. How much does the firm need to raise so that they are left with the amount they need after flotation costs? 3) Determine how many new shares of stock would need to be sold in an IPO with the following characteristics: Pre-IPO valuation: $2 billion Number of existing shares…

- The company requires P1,000,000 for its proposed plan. The following financial alternatives are available:● Plan I: 100% Equity Capital (Face Value P100)● Plan II: 50% Equity Capital (Face Value P100) and 50% Debenture (interest rate 6%)● Plan III: 50% Equity Capital (Face Value P100) and 50% Preference Shares (rate of dividend 6%)● Plan IV: 25% Equity Capital (Face Value $100), 25% Debentures (interest rate 6%), and 50% Preference Shares (rate of dividend 6%) The rate of tax applicable to the company is 50%. The company expects an EBIT of P4,000,000. Calculate the indifference point of EBIT between Plan I and Plan III. Plan I: There is no fixed financial charge (debenture interest or preference dividend). Therefore, there is no financial break-even. Plan II: Fixed financial charges amount to P30,000 (interest on debentures). Therefore, the financial break-even is P30,000.Plan III: In the case of Plan III, the fixed financial charge is P30,000 (preference dividend).…The company requires P1,000,000 for its proposed plan. The following financial alternatives are available:● Plan I: 100% Equity Capital (Face Value P100)● Plan II: 50% Equity Capital (Face Value P100) and 50% Debenture (interest rate 6%)● Plan III: 50% Equity Capital (Face Value P100) and 50% Preference Shares (rate of dividend 6%)● Plan IV: 25% Equity Capital (Face Value $100), 25% Debentures (interest rate 6%), and 50% Preference Shares (rate of dividend 6%)The rate of tax applicable to the company is 50%. The company expects an EBIT of P4,000,000. Calculate the indifference point of EBIT between Plan I and Plan III.Plan I: There is no fixed financial charge (debenture interest or preference dividend). Therefore, there is no financial break-even.Plan II: Fixed financial charges amount to P30,000 (interest on debentures). Therefore, the financial break-even is P30,000.Plan III: In the case of Plan III, the fixed financial charge is P30,000 (preference dividend).…Food and Health Company is expanding and has an average-risk project under consideration. The company decides to fund the project in the same manner as the company’s existing capital structure. The cost of debt is 9.00%, the cost of preferred stock is 12.00%, the cost of common stock is 16.00%, and the WACC adjusted for taxes is 11.50%. Incremental cash flows: Category T0 T1 T2 T3 Investment -$2,500,000 NWC -$250,000 $250,000 Operating Cash Flow $750,000 $750,000 $750,000 Salvage $50,000 If the internal rate of return (IRR) of the project is estimated to be 11%, according to the IRR decision making rule, should this project be accepted? Why or why not?

- Food and Health Company is expanding and has an average-risk project under consideration. The company decides to fund the project in the same manner as the company’s existing capital structure. The cost of debt is 9.00%, the cost of preferred stock is 12.00%, the cost of common stock is 16.00%, and the WACC adjusted for taxes is 11.50%. Incremental cash flows: Category T0 T1 T2 T3 Investment -$2,500,000 NWC -$250,000 $250,000 Operating Cash Flow $750,000 $750,000 $750,000 Salvage $50,000 Given the expected incremental cash flows provided in this question what is the net present value (NPV) of this project? Show all steps, workings, and formula(s) clearly.The Elkmont Corporation needs to raise $63.8 million to finance its expansion into new markets. The company will sell new shares of equity via a general cash offering to raise the needed funds. The offer price is $22 per share and the company’s underwriters charge a spread of 7.5 percent, how many shares need to be sold?A company wants to raise 2 crorefrom different sources. The EBIT of the firm is Rs. 80,00,000. There are three alternative plans available for the firm. Plan A:Raise the fund entirely through equity shares of Rs. 100 each.Plan B:50% amount through issue of 8% debentures & 50% by equity at Rs 50/share Plan C:25% amount through issue of 13% preference shares, 30% amount by issue of 9% debentures and remaining amount by equity at Rs 90 each.The tax rate is 30%. If the objective of the company is to maximize EPS, which is the best alternative? (solve using excel)

- The financial manager of a company has formulated various financial plans to finance Rs. 30,00,000 required to implement various capital budgeting projects. You are required to determine the indifference point for each plan, assuming 55 % corporate tax rate and the face value of equity shares Rs. 100 AND also show verification table. a) Either equity capital of Rs. 30,00,000 OR 12 % Preference share capital of Rs. 10,00,000, 10 % Debentures and Rs. 10,00,000 equities. b) Either equity share capital of Rs. 20,00,000(Fully paid) and 10 % Debentures of Rs. 10,00,000 OR 12 % preference share capital of Rs. 10,00,000, 10 % Debentures of Rs. 8,00,000 and Rs. 12,00,000 by issuing equity shares (Fully paid).Question is Peter Johnson, the CFO of Homer Industries, Inc is trying to determine the Weighted Cost of Capital (WACC) based on two different capital structures under consideration to fund a new project. Assume the company’s tax rate is 30%. Component Scenario 1 Scenario 2 Cost of Capital Tax Rate Debt $4,000,000.00 $1,000,000.00 8% 30% Preferred Stock 1,200,000.00 1,500,000.00 10% Common Stock 1,000,000.00 3,700,000.00 13% Total $6,200,000.00 $6,200,000.00 1-a. Complete the table below to determine the WACC for each of the two capital structure scenarios. (Enter your answer as a whole percentage rounded to 2 decimal places (e.g. .3555 should be entered as 35.55).) Senario 1 weight % Senario 2 Weight% Senario 1 Weighted Cost Senario 2 weight cost Cost of capital Tax Rate Debt 64.52 16.13…Peter Johnson, the CFO of Homer Industries, Inc is trying to determine the Weighted Cost of Capital (WACC) based on two different capital structures under consideration to fund a new project. Assume the company’s tax rate is 30%. Component Scenario 1 Scenario 2 Cost of Capital Tax Rate Debt $5,000,000.00 $2,000,000.00 8% 30% Preferred Stock 1,200,000.00 2,200,000.00 10% Common Stock 1,800,000.00 3,800,000.00 13% Total $8,000,000.00 $8,000,000.00 1-a. Complete the table below to determine the WACC for each of the two capital structure scenarios. (Enter your answer as a whole percentage rounded to 2 decimal places (e.g. .3555 should be entered as 35.55).) Scenario 1 weight % Scenario 2 weight % Scenario1 weighted cost Scenario 2 weighted cost cost of capital tax rate Dept ? ? ? ? 8% 30% Preferred stock ? ? ? ? 10% Common stock ? ? ? ? 13% Total ? ? ? ? 1-b. Which capital structure shall Mr. Johnson choose to fund the new project?…