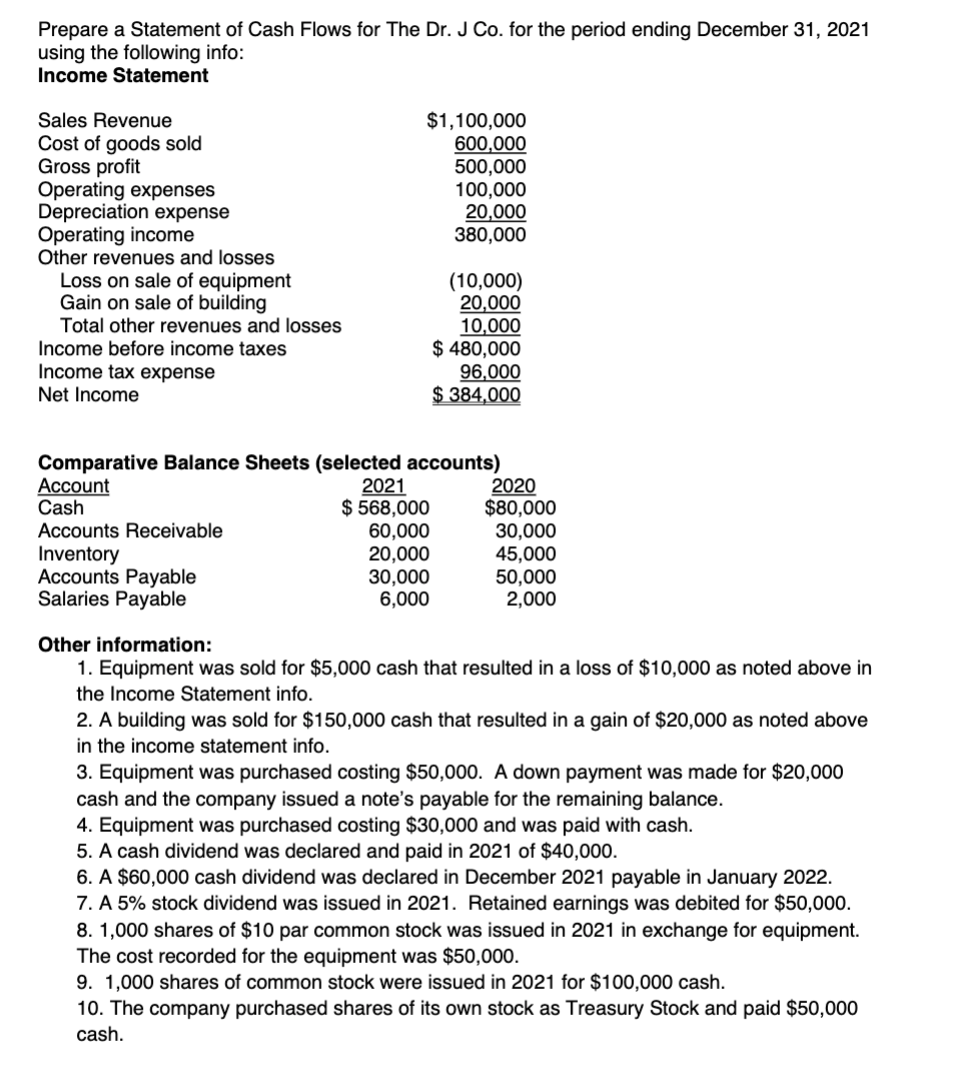

Prepare a Statement of Cash Flows for The Dr. J Co. for the period ending December 31, 2021

Prepare a Statement of Cash Flows for The Dr. J Co. for the period ending December 31, 2021

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter12: The Statement Of Cash Flows

Section: Chapter Questions

Problem 12.17E

Related questions

Question

please help me

Transcribed Image Text:Prepare a Statement of Cash Flows for The Dr. J Co. for the period ending December 31, 2021

using the following info:

Income Statement

Sales Revenue

Cost of goods sold

Gross profit

Operating expenses

Depreciation expense

Operating income

Other revenues and losses

Loss on sale of equipment

Gain on sale of building

Total other revenues and losses

Income before income taxes

Income tax expense

Net Income

Comparative Balar

Account

Cash

Accounts Receivable

Inventory

Accounts Payable

Salaries Payable

$1,100,000

600,000

500,000

100,000

20,000

380,000

(10,000)

20,000

10,000

$ 480,000

96,000

$384,000

Sheets (selected accounts)

2021

$ 568,000

60,000

20,000

30,000

6,000

2020

$80,000

30,000

45,000

50,000

2,000

Other information:

1. Equipment was sold for $5,000 cash that resulted in a loss of $10,000 as noted above in

the Income Statement info.

2. A building was sold for $150,000 cash that resulted in a gain of $20,000 as noted above

in the income statement info.

3. Equipment was purchased costing $50,000. A down payment was made for $20,000

cash and the company issued a note's payable for the remaining balance.

4. Equipment was purchased costing $30,000 and was paid with cash.

5. A cash dividend was declared and paid in 2021 of $40,000.

6. A $60,000 cash dividend was declared in December 2021 payable in January 2022.

7. A 5% stock dividend was issued in 2021. Retained earnings was debited for $50,000.

8. 1,000 shares of $10 par common stock was issued in 2021 in exchange for equipment.

The cost recorded for the equipment was $50,000.

9. 1,000 shares of common stock were issued in 2021 for $100,000 cash.

10. The company purchased shares of its own stock as Treasury Stock and paid $50,000

cash.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College