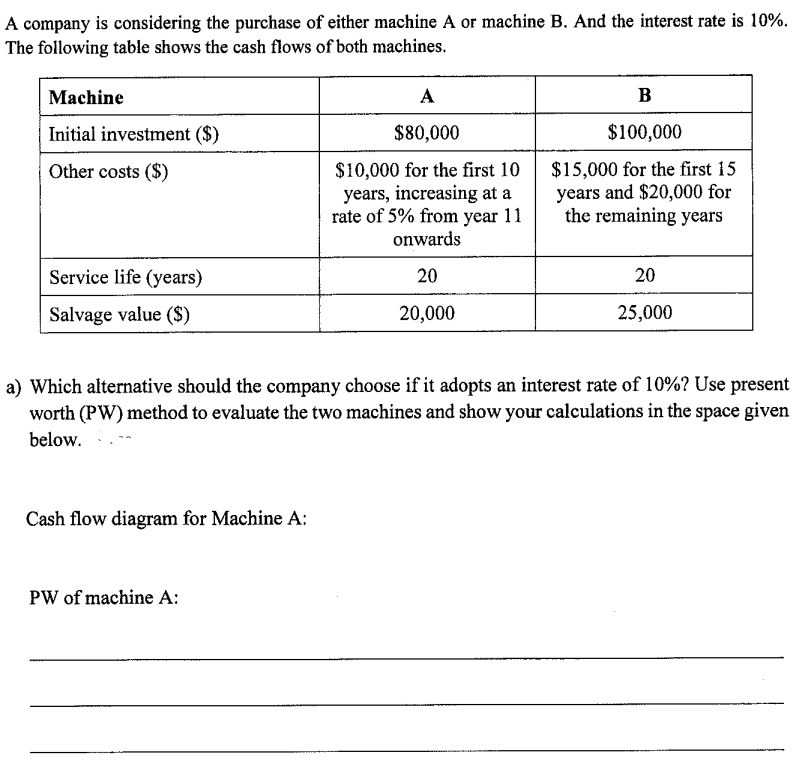

A company is considering the purchase of either machine A or machine B. And the interest rate is 10%. The following table shows the cash flows of both machines. Machine Initial investment ($) Other costs ($) Service life (years) Salvage value ($) Cash flow diagram for Machine A: A $80,000 $10,000 for the first 10 years, increasing at a rate of 5% from year 11 onwards 20 20,000 PW of machine A: B $100,000 $15,000 for the first 15 years and $20,000 for the remaining years a) Which alternative should the company choose if it adopts an interest rate of 10%? Use present worth (PW) method to evaluate the two machines and show your calculations in the space given below. 20 25,000

A company is considering the purchase of either machine A or machine B. And the interest rate is 10%. The following table shows the cash flows of both machines. Machine Initial investment ($) Other costs ($) Service life (years) Salvage value ($) Cash flow diagram for Machine A: A $80,000 $10,000 for the first 10 years, increasing at a rate of 5% from year 11 onwards 20 20,000 PW of machine A: B $100,000 $15,000 for the first 15 years and $20,000 for the remaining years a) Which alternative should the company choose if it adopts an interest rate of 10%? Use present worth (PW) method to evaluate the two machines and show your calculations in the space given below. 20 25,000

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter14: Pricing Techniques And Analysis

Section: Chapter Questions

Problem 1.1CE: What life cycle cost concept begins raising concerns by year 5 with any electric vehicle (EV)? If...

Related questions

Question

Transcribed Image Text:A company is considering the purchase of either machine A or machine B. And the interest rate is 10%.

The following table shows the cash flows of both machines.

Machine

Initial investment ($)

Other costs ($)

Service life (years)

Salvage value ($)

Cash flow diagram for Machine A:

A

$80,000

$10,000 for the first 10

years, increasing at a

rate of 5% from year 11

onwards

20

20,000

PW of machine A:

B

$100,000

$15,000 for the first 15

years and $20,000 for

the remaining years

a) Which alternative should the company choose if it adopts an interest rate of 10%? Use present

worth (PW) method to evaluate the two machines and show your calculations in the space given

below.

20

25,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 6 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning