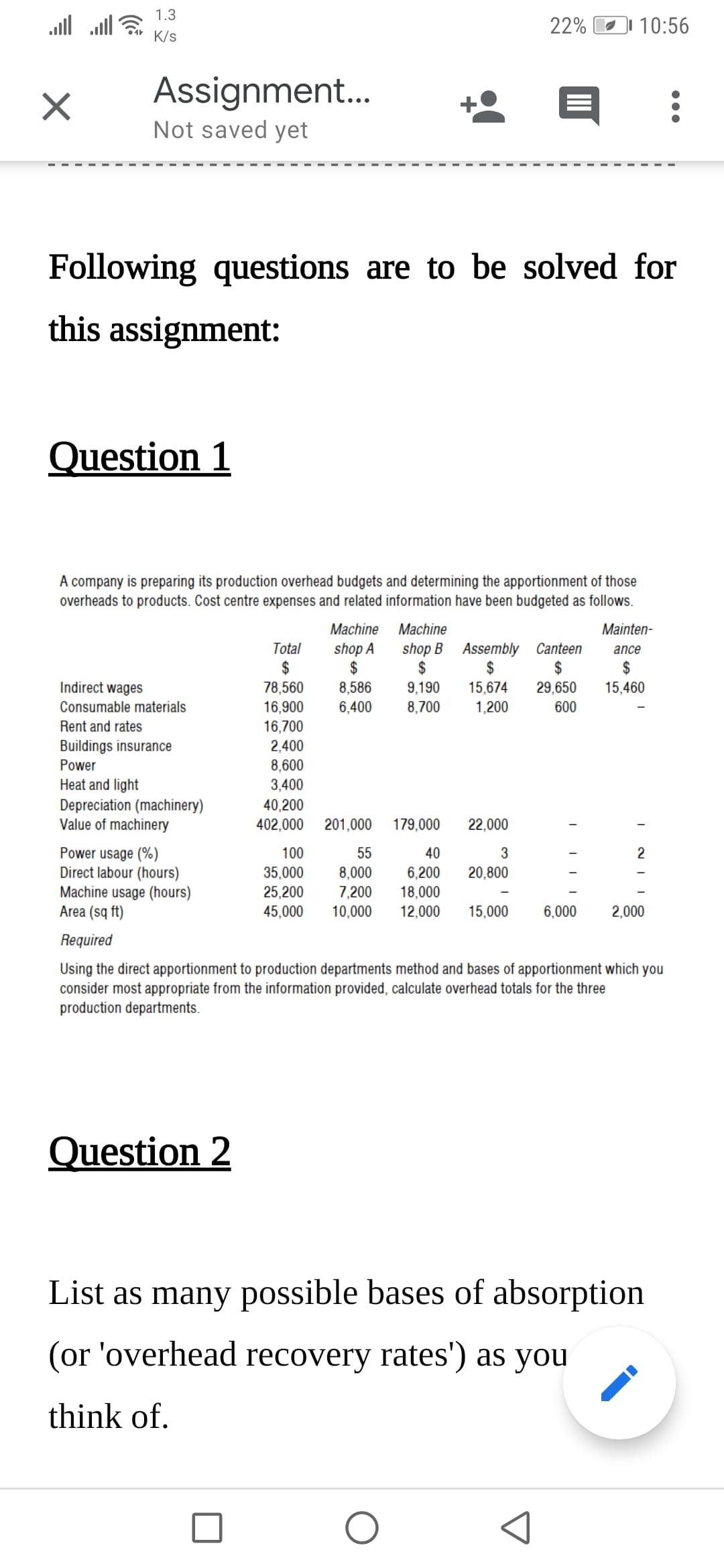

A company is preparing its production overhead budgets and determining the apportionment of those overheads to products. Cost centre expenses and related information have been budgeted as follows. Machine Machine Mainten- Total $ shop B Assembly $ Canteen shop A 2$ 8,586 6,400 ance 2$ 29,650 2$ Indirect wages 78,560 9,190 15,674 15,460 Consumable materials 16,900 8,700 1,200 600 Rent and rates 16,700 Buildings insurance Power 2,400 8,600 Heat and light 3,400 40,200 Depreciation (machinery) Value of machinery 402,000 201,000 179,000 22,000 Power usage (%) Direct labour (hours) Machine usage (hours) Area (sq ft) 100 55 40 2 35,000 8,000 6,200 20,800 25,200 7,200 18,000 45,000 10,000 12,000 15,000 6,000 2,000 Required Using the direct apportionment to production departments method and bases of apportionment which you consider most appropriate from the information provided, calculate overhead totals for the three production departments.

A company is preparing its production overhead budgets and determining the apportionment of those overheads to products. Cost centre expenses and related information have been budgeted as follows. Machine Machine Mainten- Total $ shop B Assembly $ Canteen shop A 2$ 8,586 6,400 ance 2$ 29,650 2$ Indirect wages 78,560 9,190 15,674 15,460 Consumable materials 16,900 8,700 1,200 600 Rent and rates 16,700 Buildings insurance Power 2,400 8,600 Heat and light 3,400 40,200 Depreciation (machinery) Value of machinery 402,000 201,000 179,000 22,000 Power usage (%) Direct labour (hours) Machine usage (hours) Area (sq ft) 100 55 40 2 35,000 8,000 6,200 20,800 25,200 7,200 18,000 45,000 10,000 12,000 15,000 6,000 2,000 Required Using the direct apportionment to production departments method and bases of apportionment which you consider most appropriate from the information provided, calculate overhead totals for the three production departments.

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter11: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 11.16E

Related questions

Question

Transcribed Image Text:1.3

ll all a

22%

)I 10:56

K/s

Assignment.

Not saved yet

Following questions are to be solved for

this assignment:

Question 1

A company is preparing its production overhead budgets and determining the apportionment of those

overheads to products. Cost centre expenses and related information have been budgeted as follows.

Machine

Machine

Mainten-

shop A

2$

shop B Assembly Canteen

$

9,190

8,700

Total

ance

2$

78,560

16,900

16,700

$

$

2$

Indirect wages

8,586

15,674

29,650

15,460

Consumable materials

6,400

1,200

600

Rent and rates

2,400

8,600

3,400

40,200

402,000

Buildings insurance

Power

Heat and light

Depreciation (machinery)

Value of machinery

201,000

179,000

22,000

Power usage (%)

Direct labour (hours)

Machine usage (hours)

Area (sq ft)

100

55

40

3

2

35,000

8,000

6,200

18,000

12,000

20,800

25,200

45,000

7,200

10,000

15,000

6,000

2,000

Required

Using the direct apportionment to production departments method and bases of apportionment which you

consider most appropriate from the information provided, calculate overhead totals for the three

production departments.

Question 2

List as many possible bases of absorption

(or 'overhead recovery rates') as you

think of.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College