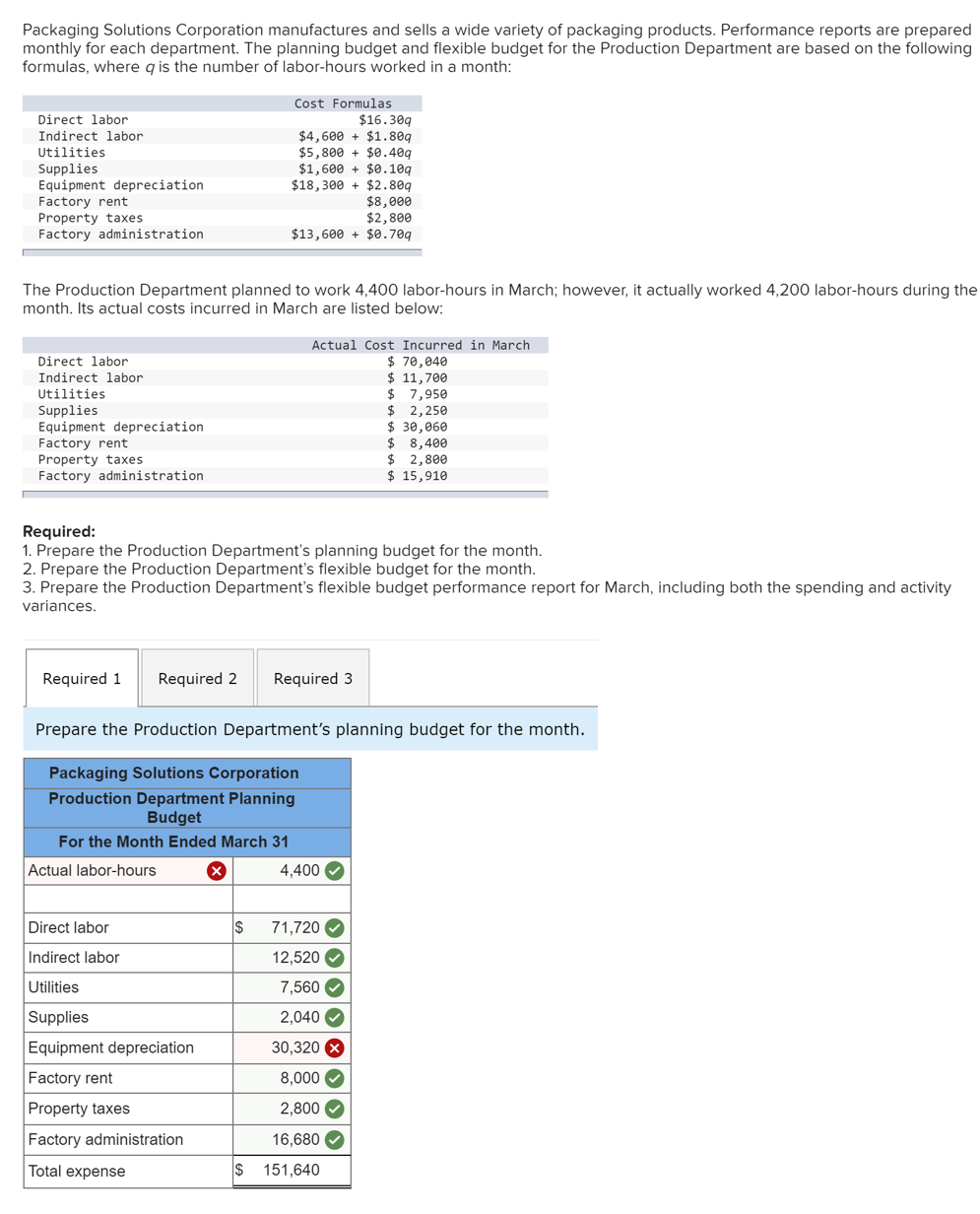

Packaging Solutions Corporation manufactures and sells a wide variety of packaging products. Performance reports are prepared monthly for each department. The planning budget and flexible budget for the Production Department are based on the following formulas, where q is the number of labor-hours worked in a month: Cost Formulas Direct labor $16.30g $4,600 + $1.80g $5,800 + $0.40g $1,600 + $0.10g $18,300 + $2.80g $8,000 Indirect labor Utilities Supplies Equipment depreciation Factory rent Property taxes Factory administration $2,800 $13,600 + $e.70g The Production Department planned to work 4,400 labor-hours in March; however, it actually worked 4,200 labor-hours during the month. Its actual costs incurred in March are listed below: Actual Cost Incurred in March $ 70,040 $ 11,700 $ 7,950 $ 2,250 $ 30,060 $ 8,400 $ 2,800 $ 15,910 Direct labor Indirect labor Utilities Supplies Equipment depreciation Factory rent Property taxes Factory administration Required: 1. Prepare the Production Department's planning budget for the month. 2. Prepare the Production Department's flexible budget for the month. 3. Prepare the Production Department's flexible budget performance report for March, including both the spending and activity variances. Required 1 Required 2 Required 3 Prepare the Production Department's planning budget for the month. Packaging Solutions Corporation Production Department Planning Budget For the Month Ended March 31 Actual labor-hours 4,400 Direct labor 71,720 Indirect labor 12,520 O Utilities 7,560 Supplies 2,040 Equipment depreciation 30,320 Factory rent 8,000 Property taxes 2,800 Factory administration 16,680 Total expense $ 151,640

Packaging Solutions Corporation manufactures and sells a wide variety of packaging products. Performance reports are prepared monthly for each department. The planning budget and flexible budget for the Production Department are based on the following formulas, where q is the number of labor-hours worked in a month: Cost Formulas Direct labor $16.30g $4,600 + $1.80g $5,800 + $0.40g $1,600 + $0.10g $18,300 + $2.80g $8,000 Indirect labor Utilities Supplies Equipment depreciation Factory rent Property taxes Factory administration $2,800 $13,600 + $e.70g The Production Department planned to work 4,400 labor-hours in March; however, it actually worked 4,200 labor-hours during the month. Its actual costs incurred in March are listed below: Actual Cost Incurred in March $ 70,040 $ 11,700 $ 7,950 $ 2,250 $ 30,060 $ 8,400 $ 2,800 $ 15,910 Direct labor Indirect labor Utilities Supplies Equipment depreciation Factory rent Property taxes Factory administration Required: 1. Prepare the Production Department's planning budget for the month. 2. Prepare the Production Department's flexible budget for the month. 3. Prepare the Production Department's flexible budget performance report for March, including both the spending and activity variances. Required 1 Required 2 Required 3 Prepare the Production Department's planning budget for the month. Packaging Solutions Corporation Production Department Planning Budget For the Month Ended March 31 Actual labor-hours 4,400 Direct labor 71,720 Indirect labor 12,520 O Utilities 7,560 Supplies 2,040 Equipment depreciation 30,320 Factory rent 8,000 Property taxes 2,800 Factory administration 16,680 Total expense $ 151,640

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter9: Evaluating Variances From Standard Costs

Section: Chapter Questions

Problem 16E: Thomas Textiles Corporation began November with a budget for 60,000 hours of production in the...

Related questions

Question

100%

Please help me correct the boxes with X's. Thanks! :)

Transcribed Image Text:Packaging Solutions Corporation manufactures and sells a wide variety of packaging products. Performance reports are prepared

monthly for each department. The planning budget and flexible budget for the Production Department are based on the following

formulas, where q is the number of labor-hours worked in a month:

Cost Formulas

Direct labor

$16.30g

$4,600 + $1.80q

$5,800 + $0.40g

$1,600 + $0.10g

$18,300 + $2.80g

$8,000

$2,800

$13,600 + $0.70g

Indirect labor

Utilities

Supplies

Equipment depreciation

Factory rent

Property taxes

Factory administration

The Production Department planned to work 4,400 labor-hours in March; however, it actually worked 4,200 labor-hours during the

month. Its actual costs incurred in March are listed below:

Actual Cost Incurred in March

$ 70,040

$ 11,700

$ 7,950

$ 2,250

$ 30,060

$ 8,400

$ 2,800

$ 15,910

Direct labor

Indirect labor

Utilities

Supplies

Equipment depreciation

Factory rent

Property taxes

Factory administration

Required:

1. Prepare the Production Department's planning budget for the month.

2. Prepare the Production Department's flexible budget for the month.

3. Prepare the Production Department's flexible budget performance report for March, including both the spending and activity

variances.

Required 1

Required 2

Required 3

Prepare the Production Department's planning budget for the month.

Packaging Solutions Corporation

Production Department Planning

Budget

For the Month Ended March 31

Actual labor-hours

4,400 O

Direct labor

$

71,720

Indirect labor

12,520

Utilities

7,560

Supplies

2,040

Equipment depreciation

30,320 X

Factory rent

8,000

Property taxes

2,800

Factory administration

16,680

Total expense

151,640

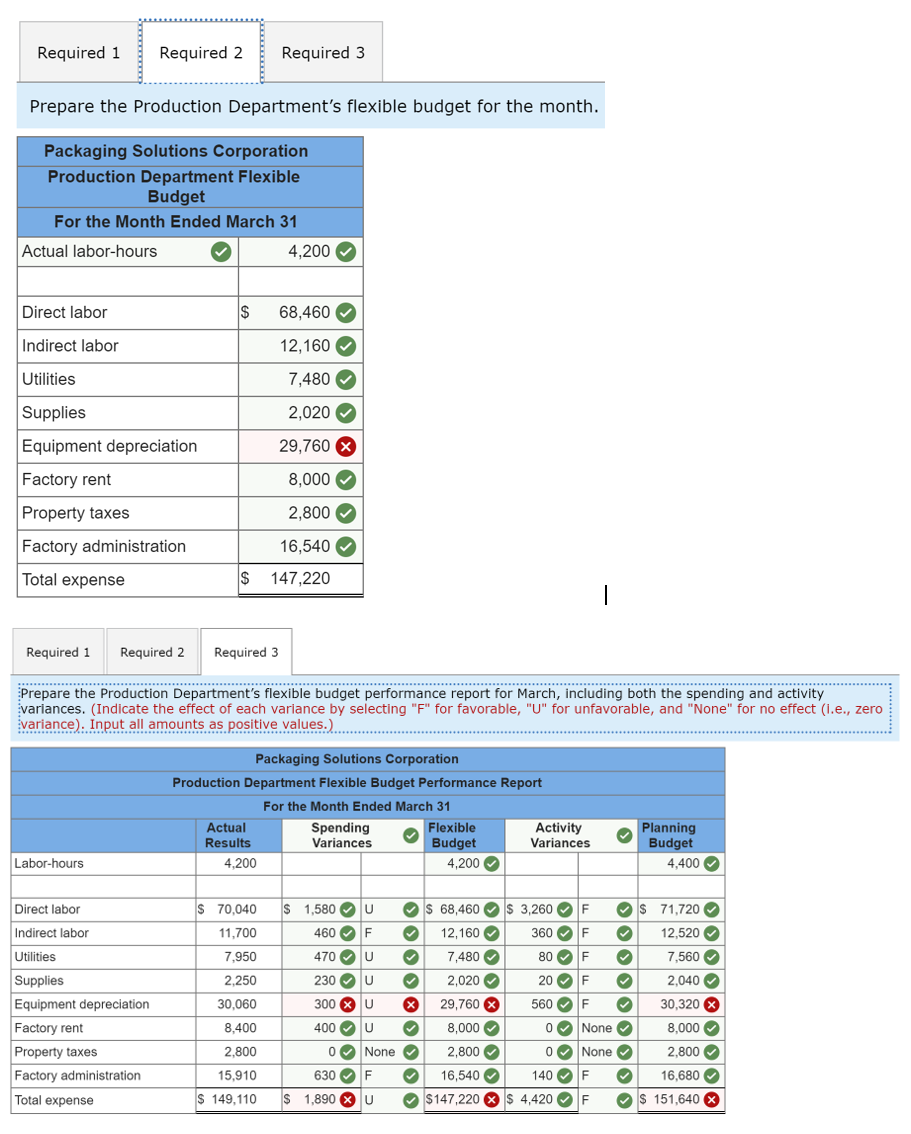

Transcribed Image Text:Required 1

Required 2

Required 3

Prepare the Production Department's flexible budget for the month.

Packaging Solutions Corporation

Production Department Flexible

Budget

For the Month Ended March 31

Actual labor-hours

4,200

Direct labor

68,460

Indirect labor

12,160

Utilities

7,480 O

Supplies

2,020

Equipment depreciation

29,760 X

Factory rent

8,000

Property taxes

2,800

Factory administration

16,540

Total expense

$

147,220

Required 1

Required 2

Required 3

Prepare the Production Department's flexible budget performance report for March, including both the spending and activity

variances. (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero

variance). Input all amounts as positive values.)

Packaging Solutions Corporation

Production Department Flexible Budget Performance Report

For the Month Ended March 31

Spending

Variances

Flexible

Budget

4,200 O

Activity

Variances

Planning

Budget

4,400 O

Actual

Results

Labor-hours

4,200

Direct labor

S 70,040

$ 1,580 OU

Os 68,460 $ 3,260 O F

Os 71,720 O

Indirect labor

11,700

460 O F

12,160 O

360 O F

12,520 O

Utilities

7,950

470 O U

7,480 O

80 O F

7,560 O

Supplies

Equipment depreciation

2,250

230 OU

2,020 O

20 OF

2,040 O

30,060

300 XU

29,760 X

560 OF

30,320 x

Factory rent

8,400

400 Ou

8,000 O

0O None

8,000 O

Property taxes

2,800

0O None

2,800 O

0 O None V

2,800 O

Factory administration

15,910

630 O F

16,540 O

140 O F

16,680 O

Total expense

S 149,110

$ 1,890 Xu

O $147,220 x $ 4,420 O F

$ 151,640 X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College