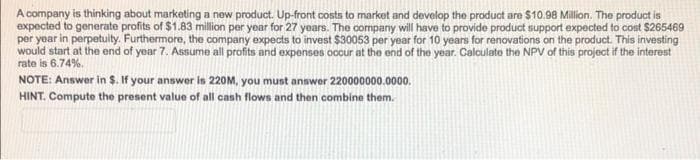

A company is thinking about marketing a new product. Up-front costs to market and develop the product are $10.98 Million. The product is expected to generate profits of $1.83 million per year for 27 years. The company will have to provide product support expected to cost $265469 per year in perpetuity. Furthermore, the company expects to invest $30053 per year for 10 years for renovations on the product. This investing would start at the end of year 7. Assume all profits and expenses occur at the end of the year. Calculate the NPV of this project if the interest rate is 6.74%. NOTE: Answer in $. If your answer is 220M, you must answer 220000000.0000. HINT. Compute the present value of all cash flows and then combine them.

A company is thinking about marketing a new product. Up-front costs to market and develop the product are $10.98 Million. The product is expected to generate profits of $1.83 million per year for 27 years. The company will have to provide product support expected to cost $265469 per year in perpetuity. Furthermore, the company expects to invest $30053 per year for 10 years for renovations on the product. This investing would start at the end of year 7. Assume all profits and expenses occur at the end of the year. Calculate the NPV of this project if the interest rate is 6.74%. NOTE: Answer in $. If your answer is 220M, you must answer 220000000.0000. HINT. Compute the present value of all cash flows and then combine them.

Chapter9: Capital Budgeting And Cash Flow Analysis

Section: Chapter Questions

Problem 18P

Related questions

Question

Qd 212.

Transcribed Image Text:A company is thinking about marketing a new product. Up-front costs to market and develop the product are $10.98 Million. The product is

expected to generate profits of $1.83 million per year for 27 years. The company will have to provide product support expected to cost $265469

per year in perpetuity. Furthermore, the company expects to invest $30053 per year for 10 years for renovations on the product. This investing

would start at the end of year 7. Assume all profits and expenses occur at the end of the year. Calculate the NPV of this project if the interest

rate is 6.74%.

NOTE: Answer in $. If your answer is 220M, you must answer 220000000.0000.

HINT. Compute the present value of all cash flows and then combine them.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning