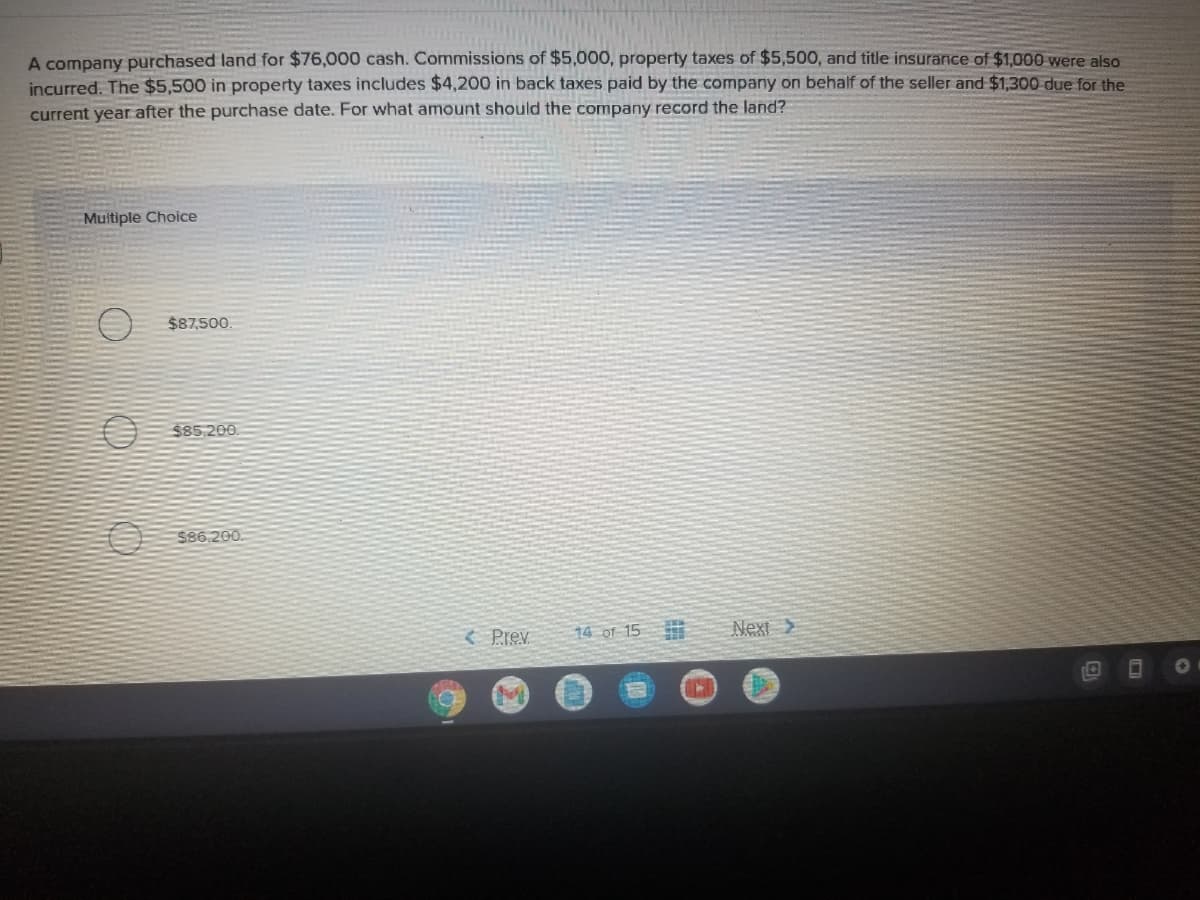

A company purchased land for $76,000 cash. Commissions of $5,000, property taxes of $5,500, and title insurance of $1,000 were also incurred. The $5,500 in property taxes includes $4,200 in back taxes paid by the company on behalf of the seller and $1,300 due for the current year after the purchase date. For what amount should the company record the land?

A company purchased land for $76,000 cash. Commissions of $5,000, property taxes of $5,500, and title insurance of $1,000 were also incurred. The $5,500 in property taxes includes $4,200 in back taxes paid by the company on behalf of the seller and $1,300 due for the current year after the purchase date. For what amount should the company record the land?

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 5MC: Ngo Company purchased a truck for $54,000. Sales tax amounted to $5,400; shipping costs amounted to...

Related questions

Question

Transcribed Image Text:A company purchased land for $76,000 cash. Commissions of $5,000, property taxes of $5,500, and title insurance of $1,000 were also

incurred. The $5,500 in property taxes includes $4,200 in back taxes paid by the company on behalf of the seller and $1,300 due for the

current year after the purchase date. For what amount should the company record the land?

Muitiple Choice

$87,500.

$85.200.

$86,200.

< Prev

14 of 15

Next >

Transcribed Image Text:Saved

apter 10 1

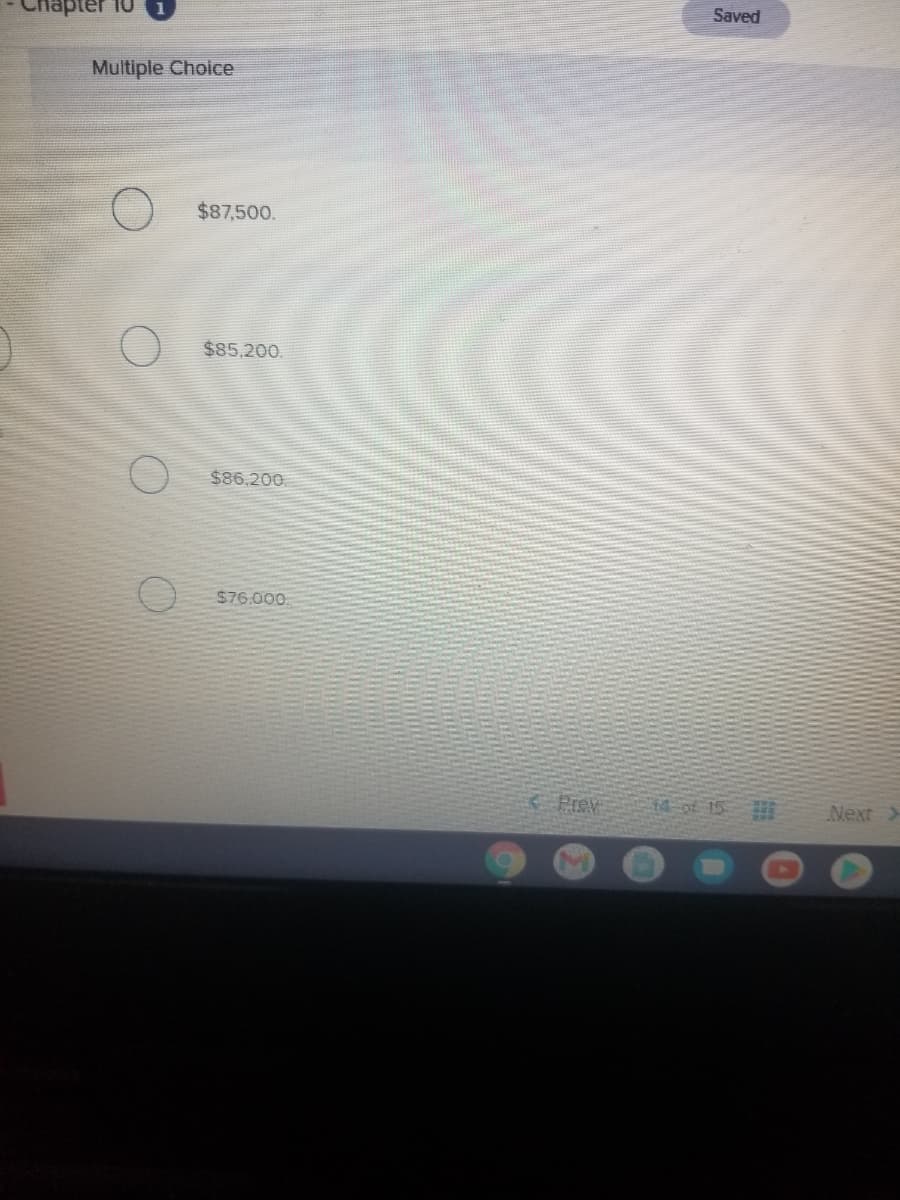

Multiple Choice

$87,500.

$85,200,

$86,200

$76,000.

K Prev

14-of 15

Next>

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning