Stuart Manufacturing Company was started on January 1, year 1, when it acquired $89,000 cash by issuing common stock. Stuart immediately purchased office furniture and manufacturing equipment costing $32,000 and $40,000, respectively. The office furniture had an eight-year useful life and a zero salvage value. The manufacturing equipment had a $4,000 salvage value and an expected useful life of six years. The company paid $12,000 for salaries of administrative personnel and $21,000 for wages to production personnel. Finally, the company paid $26,000 for raw materials that were used to make inventory. All inventory was started and completed during the year. Stuart completed production on 10,000 units of product and sold 8,000 units at a price of $9 each in year 1. (Assume that all transactions are cash transactions and that product costs are computed in accordance with GAAP.) Required a. Determine the total product cost and the average cost per unit of the inventory produced in year 1. (Round "Average cost per unit" to 2 decimal places.) b. Determine the amount of cost of goods sold that would appear on the year 1 income statement. (Do not round intermediate calculations.) c. Determine the amount of the ending inventory balance that would appear on the December 31, year 1, balance sheet. (Do not round intermediate calculations.) d Determine the amount of net income that wOuld appear on the vear 1 income statement

Stuart Manufacturing Company was started on January 1, year 1, when it acquired $89,000 cash by issuing common stock. Stuart immediately purchased office furniture and manufacturing equipment costing $32,000 and $40,000, respectively. The office furniture had an eight-year useful life and a zero salvage value. The manufacturing equipment had a $4,000 salvage value and an expected useful life of six years. The company paid $12,000 for salaries of administrative personnel and $21,000 for wages to production personnel. Finally, the company paid $26,000 for raw materials that were used to make inventory. All inventory was started and completed during the year. Stuart completed production on 10,000 units of product and sold 8,000 units at a price of $9 each in year 1. (Assume that all transactions are cash transactions and that product costs are computed in accordance with GAAP.) Required a. Determine the total product cost and the average cost per unit of the inventory produced in year 1. (Round "Average cost per unit" to 2 decimal places.) b. Determine the amount of cost of goods sold that would appear on the year 1 income statement. (Do not round intermediate calculations.) c. Determine the amount of the ending inventory balance that would appear on the December 31, year 1, balance sheet. (Do not round intermediate calculations.) d Determine the amount of net income that wOuld appear on the vear 1 income statement

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 5PA: Jada Company had the following transactions during the year: Purchased a machine for $500,000 using...

Related questions

Question

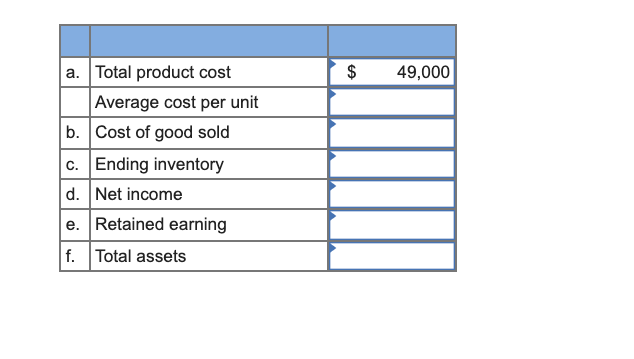

Transcribed Image Text:a. Total product cost

Average cost per unit

b. Cost of good sold

$

49,000

c. Ending inventory

d. Net income

e. Retained earning

f. Total assets

%24

Transcribed Image Text:Stuart Manufacturing Company was started on January 1, year 1, when it acquired $89,000 cash by issuing common stock. Stuart

immediately purchased office furniture and manufacturing equipment costing $32,000 and $40,000, respectively. The office furniture

had an eight-year useful life and a zero salvage value. The manufacturing equipment had a $4,000 salvage value and an expected

useful life of six years. The company paid $12,000 for salaries of administrative personnel and $21,000 for wages to production

personnel. Finally, the company paid $26,000 for raw materials that were used to make inventory. All inventory was started and

completed during the year. Stuart completed production on 10,000 units of product and sold 8,000 units at a price of $9 each in year 1.

(Assume that all transactions are cash transactions and that product costs are computed in accordance with GAAP.)

Required

a. Determine the total product cost and the average cost per unit of the inventory produced in year 1. (Round "Average cost per unit"

to 2 decimal places.)

b. Determine the amount of cost of goods sold that would appear on the year 1 income statement. (Do not round intermediate

calculations.)

c. Determine the amount of the ending inventory balance that would appear on the December 31, year 1, balance sheet. (Do not round

intermediate calculations.)

d. Determine the amount of net income that would appear on the year 1 income statement.

e. Determine the amount of retained earnings that would appear on the December 31, year 1, balance sheet.

f. Determine the amount of total assets that would appear on the December 31, year 1, balance sheet.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning