A company's sales in 2020 were $3.8 million and its total spontaneous se the firm's spontaneous liabilities consisted of $8.3 milllion in wages payable, $8.8 million in accounts payable, and $5.1 million in accrued expenses. The firm's profit margin is 9.7% and Its dividend payout ratio is 9.1%. The balance sheet at year-end is similar in percentage of sales to that of previous years and this will continue in the future. Required: What is the percentage increase in sales that the company must achieve in order to avoid raising funds externally?

A company's sales in 2020 were $3.8 million and its total spontaneous se the firm's spontaneous liabilities consisted of $8.3 milllion in wages payable, $8.8 million in accounts payable, and $5.1 million in accrued expenses. The firm's profit margin is 9.7% and Its dividend payout ratio is 9.1%. The balance sheet at year-end is similar in percentage of sales to that of previous years and this will continue in the future. Required: What is the percentage increase in sales that the company must achieve in order to avoid raising funds externally?

Chapter14: Capital Structure Management In Practice

Section: Chapter Questions

Problem 3P

Related questions

Question

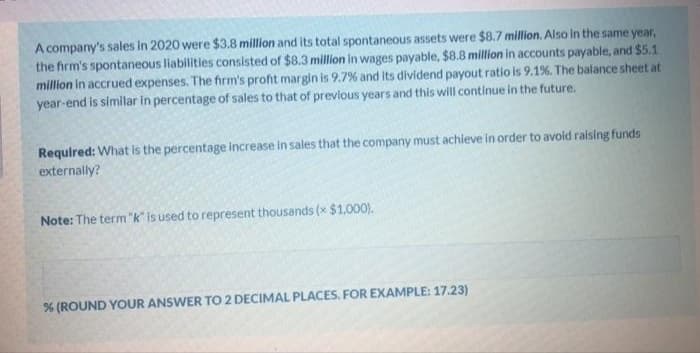

Transcribed Image Text:A company's sales in 2020 were $3.8 million and its total spontaneous assets were $8.7 million. Also in the same year,

the firm's spontaneous liabilities consisted of $8.3 million in wages payable, $8.8 million in accounts payable, and $5.1

million in accrued expenses. The firm's profit margin is 9.7% and its dividend payout ratio is 9.1%. The balance sheet at

year-end is similar in percentage of sales to that of prevlous years and this will continue in the future.

Required: What is the percentage increase in sales that the company must achieve in order to avoid raising funds

externally?

Note: The term "k" is used to represent thousands (x $1,000).

% (ROUND YOUR ANSWER TO 2 DECIMAL PLACES. FOR EXAMPLE: 17.23)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning