1) Projected sales are $6,006,000. 2) Cost of goods sold last year includes $998,000 in fixed costs. 3) Operating expense last year includes $246,000 in fixed costs. 4) Interest expense will remain unchanged. 5) The firm will pay cash dividends amounting to 35% of net profits after taxes. 6) Cash and inventories will double. 7) Marketable securities, notes payable, long-term debt, and common stock will remain unchanged. 8) Accounts receivable, accounts payable, and other current liabilities will change in direct response to the change in sales. 9) A new computer system costing $364,000 will be purchased during the year. Total depreciation expense for the year will be $116,00 10) The tax rate will remain at 40%. 1. Prepare a pro forma income statement for next year, using the fixed cost data given to improve the accuracy of the percent-of-sales m . Prepare a pro forma balance sheet for next year, using the information given and the judgmental approach. Include a reconciliation of . Analyze these statements, and discuss the resulting external financing required. Data table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Provincial Imports, Inc. Income Statement for the Year Just Ended $5,006,000 2,741,000 $2,265,000 Sales revenue Less: Cost of goods sold Gross profits Less: Operating expenses Operating profits Less: Interest expense 855,000 $1,410,000 201,000 $1,209,000 Pro Forma Balance Sheet Net profits before taxes Less: Taxes (rate = 40%) Provincial Imports, Inc. 483,600 Net profits after taxes $725,400 for Next Year 253,890 $471,510 Less: Cash dividends (Judgmental Method) To retained earnings Accounts payable (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Taxes payable Provincial Imports, Inc. Balance Sheet Notes payable for the Year Just Ended Other current liabilities Assets Liabilities and Stockholders' Equity Cash $190,000 Accounts payable $700,00 Total current liabilities Marketable securities 230,000 Taxes payable 95,00 Long-term deht

1) Projected sales are $6,006,000. 2) Cost of goods sold last year includes $998,000 in fixed costs. 3) Operating expense last year includes $246,000 in fixed costs. 4) Interest expense will remain unchanged. 5) The firm will pay cash dividends amounting to 35% of net profits after taxes. 6) Cash and inventories will double. 7) Marketable securities, notes payable, long-term debt, and common stock will remain unchanged. 8) Accounts receivable, accounts payable, and other current liabilities will change in direct response to the change in sales. 9) A new computer system costing $364,000 will be purchased during the year. Total depreciation expense for the year will be $116,00 10) The tax rate will remain at 40%. 1. Prepare a pro forma income statement for next year, using the fixed cost data given to improve the accuracy of the percent-of-sales m . Prepare a pro forma balance sheet for next year, using the information given and the judgmental approach. Include a reconciliation of . Analyze these statements, and discuss the resulting external financing required. Data table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Provincial Imports, Inc. Income Statement for the Year Just Ended $5,006,000 2,741,000 $2,265,000 Sales revenue Less: Cost of goods sold Gross profits Less: Operating expenses Operating profits Less: Interest expense 855,000 $1,410,000 201,000 $1,209,000 Pro Forma Balance Sheet Net profits before taxes Less: Taxes (rate = 40%) Provincial Imports, Inc. 483,600 Net profits after taxes $725,400 for Next Year 253,890 $471,510 Less: Cash dividends (Judgmental Method) To retained earnings Accounts payable (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Taxes payable Provincial Imports, Inc. Balance Sheet Notes payable for the Year Just Ended Other current liabilities Assets Liabilities and Stockholders' Equity Cash $190,000 Accounts payable $700,00 Total current liabilities Marketable securities 230,000 Taxes payable 95,00 Long-term deht

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter21: Supply Chains And Working Capital Management

Section: Chapter Questions

Problem 17P: The Raattama Corporation had sales of $3.5 million last year, and it earned a 5% return (after...

Related questions

Question

Pro Forma Balance Sheet

Provincial Imports, Inc.

for Next Year

(Judgmental Method)?????????????

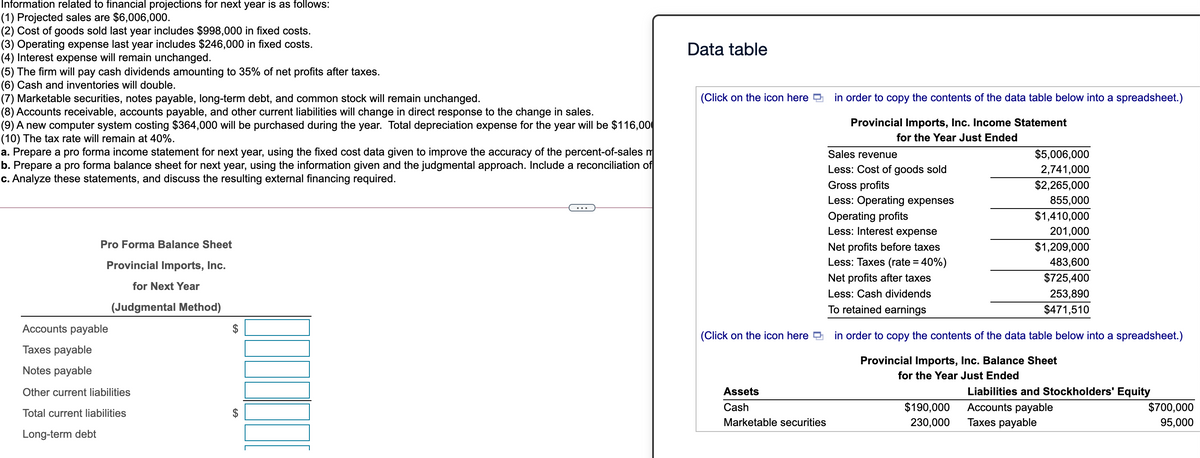

Transcribed Image Text:Information related to financial projections for next year is as follows:

(1) Projected sales are $6,006,000.

(2) Cost of goods sold last year includes $998,000 in fixed costs.

(3) Operating expense last year includes $246,000 in fixed costs.

(4) Interest expense will remain unchanged.

(5) The firm will pay cash dividends amounting to 35% of net profits after taxes.

(6) Cash and inventories will double.

(7) Marketable securities, notes payable, long-term debt, and common stock will remain unchanged.

(8) Accounts receivable, accounts payable, and other current liabilities will change in direct response to the change in sales.

(9) A new computer system costing $364,000 will be purchased during the year. Total depreciation expense for the year will be $116,00

(10) The tax rate will remain at 40%.

a. Prepare a pro forma income statement for next year, using the fixed cost data given to improve the accuracy of the percent-of-sales m

b. Prepare a pro forma balance sheet for next year, using the information given and the judgmental approach. Include a reconciliation of

c. Analyze these statements, and discuss the resulting external financing required.

Data table

(Click on the icon here

in order to copy the contents of the data table below into a spreadsheet.)

Provincial Imports, Inc. Income Statement

for the Year Just Ended

Sales revenue

$5,006,000

Less: Cost of goods sold

Gross profits

Less: Operating expenses

2,741,000

$2,265,000

855,000

..

$1,410,000

Operating profits

Less: Interest expense

201,000

Pro Forma Balance Sheet

Net profits before taxes

Less: Taxes (rate = 40%)

$1,209,000

Provincial Imports, Inc.

483,600

Net profits after taxes

$725,400

for Next Year

Less: Cash dividends

253,890

(Judgmental Method)

To retained earnings

$471,510

Accounts payable

(Click on the icon here D

in order to copy the contents of the data table below into a spreadsheet.)

Taxes payable

Provincial Imports, Inc. Balance Sheet

Notes payable

for the Year Just Ended

Other current liabilities

Assets

Liabilities and Stockholders' Equity

Accounts payable

Taxes payable

Cash

$190,000

$700,000

Total current liabilities

Marketable securities

230,000

95,000

Long-term debt

%24

24

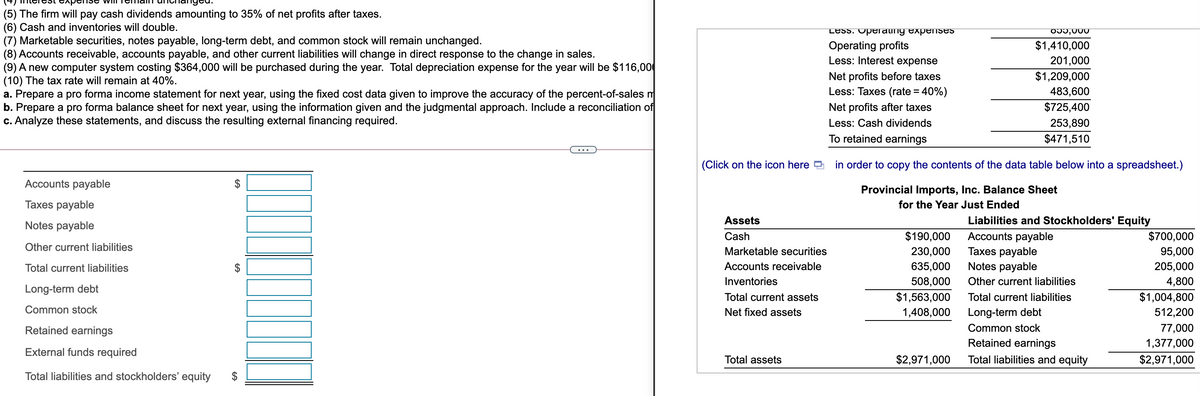

Transcribed Image Text:(5) The firm will pay cash dividends amounting to 35% of net profits after taxes.

(6) Cash and inventories will double.

(7) Marketable securities, notes payable, long-term debt, and common stock will remain unchanged.

(8) Accounts receivable, accounts payable, and other current liabilities will change in direct response to the change in sales.

(9) A new computer system costing $364,000 will be purchased during the year. Total depreciation expense for the year will be $116,000

(10) The tax rate will remain at 40%.

a. Prepare a pro forma income statement for next year, using the fixed cost data given to improve the accuracy of the percent-of-sales m

b. Prepare a pro forma balance sheet for next year, using the information given and the judgmental approach. Include a reconciliation of

c. Analyze these statements, and discuss the resulting external financing required.

Less. Operaling expenses

OJ3,000

$1,410,000

Operating profits

Less: Interest expense

201,000

$1,209,000

Net profits before taxes

Less: Taxes (rate = 40%)

483,600

Net profits after taxes

$725,400

Less: Cash dividends

253,890

To retained earnings

$471,510

(Click on the icon here D

in order to copy the contents of the data table below into a spreadsheet.)

Accounts payable

$

Provincial Imports, Inc. Balance Sheet

Taxes payable

for the Year Just Ended

Notes payable

Assets

Liabilities and Stockholders' Equity

Accounts payable

Taxes payable

Notes payable

Cash

$190,000

$700,000

Other current liabilities

Marketable securities

230,000

95,000

Total current liabilities

$

Accounts receivable

635,000

205,000

Inventories

508,000

Other current liabilities

4,800

Long-term debt

$1,563,000

$1,004,800

512,200

Total current assets

Total current liabilities

Common stock

Net fixed assets

1,408,000

Long-term debt

Retained earnings

Common stock

77,000

Retained earnings

1,377,000

External funds required

Total assets

$2,971,000

Total liabilities and equity

$2,971,000

Total liabilities and stockholders' equity

24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 8 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning