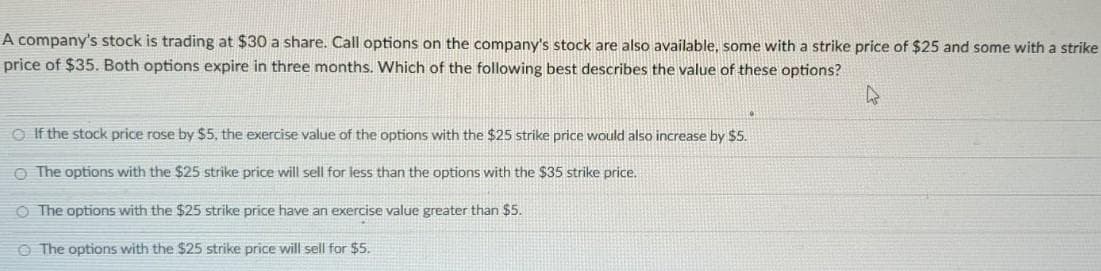

A company's stock is trading at $30 a share. Call options on the company's stock are also available, some with a strike price of $25 and some with a strike price of $35. Both options expire in three months. Which of the following best describes the value of these options?

Q: Which of the following statement is true? a. Put-call parity holds for American options, just like…

A: The answer to the question is given below :

Q: Bey Bikes is considering a project that has the following cash flow and WACC data. What is the…

A: Discounted payback is an important capital budgeting metric. This is used to determine the financial…

Q: Three $25,000, 11% bonds with semi-annual coupons redeemable at par were bought eight years before…

A: Price of the bond is the PV of future coupons and par value discounted using the Yield to maturity.…

Q: Josh wants to borrow money for a kitchen renovation. He has saved $2500 already but the cost…

A: Loan refers to an amount that is taken by the borrower from the lender whose repayment is to eb…

Q: Lois received a 9-year subsidized student of $38,000 at an anual interest rate of 3.125%. Determin…

A: A subsidized loan is a type of loan that is offered by the government, typically through the…

Q: 6. Sharon lives in Saskatoon. She wants to go to the West Edmonton Mall for a shopping trip with her…

A: Financial planning is the process of creating a roadmap to help you achieve your financial goals. It…

Q: Sorry but correct answer =31470.44, can you do it using formulas no tables, please

A: To find the total fund the insurer needs to hold today, we need to calculate the present value of…

Q: A donor pledges money to the organization but has not paid it yet. The donor does not indicate how…

A: This will be regarded as an increase in net assets without any restrictions from the donor as the…

Q: You are advising a high income client and speaking on the advantages of investing in Municipal…

A: When investing in municipal bonds, one of the advantages is that the interest income is typically…

Q: Amortization schedule. Chuck Ponzi has talked an elderly woman into loaning him $45,000 for a new…

A: Step 1 A loan's or an intangible asset's book value can be periodically reduced over a certain…

Q: What would happen to market efficiency if all investors attempted to follow a passive strategy?

A: A passive strategy is a type of investment strategy that involves holding a diversified portfolio of…

Q: Discuss: Miller and Scholes (1972) model of corporate dividend policy that assumed market…

A: The Miller and Scholes model of corporate dividend policy, first proposed in 1972, is a theoretical…

Q: Given the following information: Percent of capital structure: Debt Preferred stock Common equity…

A: Cost of each source of capital is calculated below After tax cost of debt = Bond yield to…

Q: Below is information regarding the capital structure of Micro Advantage Incorporated. On the basis…

A: The WACC refers to the average return that the company provides to all its stakeholders. It takes…

Q: You are the loan department supervisor for a bank. This installment loan is being paid off early,…

A: Step 1 Rebate Fee is the agreed-upon sum that the Agent must pay to the Borrower on behalf of the…

Q: Recently, a certain bank offered a 10-year CD that earns 2.58% compounded continuously. Use the…

A: (a) Amount invested, P = $30,000 Interest rate, r = 2.58% Period, t = 10 years The future value…

Q: Go to finance yahoo and search for bonds. Address the following about the bond that you select and…

A: There are various types of bonds, including: Government bonds: issued by national governments and…

Q: Problem 2. Consider the following straddle portfolio Vn = PBS (tn, Sn) + CBS (tn, Sn) with to = 0,t₁…

A: Straddle: It is a derivative strategy involving both calls and put options. Both options have the…

Q: Firm Z has invested $4 million in marketing campaign to assess the demand for a product Manish. This…

A: NPV is defined as the sum of the present values of all future cash inflows less the sum of the…

Q: The following information is available for compton company retired $45000 of 9.25% bonds before they…

A: Bond Book Value = Amount paid on retirement - loss on the retirement

Q: Liam plans to print the Scenarios section of the Loan Calculator Prepare for printing as follows:…

A: In the first scenario, Liam is considering borrowing additional money to renovate the Charles Street…

Q: Discuss how The Migration Analysis Method can mitigate future credit risk issues for Washington…

A: Credit risk management The process of locating, evaluating, and reducing risks connected to lending…

Q: Samuelson's has a debt-equity ratio of 45 percent, sales of $11,000, net Income of $2,300, and total…

A: Debt - equity ratio = 45% total debt= $11700 Debt - equity ratio = long term debtshareholders fund…

Q: A new investment opportunity for you is an annuity that pays $650 at the beginning of each year for…

A: An annuity is a financial product that provides a series of regular payments to an individual over a…

Q: Find the simple interest earned. $420 principal, 9% exact, 90 days

A: Simple interest is the method of calculating interest in which the principal amount remains the same…

Q: Suppose you know that a company's stock currently sells for $65.90 per share and required return on…

A: Stock price (P0) = $65.90 Required return (r) = 0.12 Dividend yield = 0.06 (i.e. 0.12 / 2) Capital…

Q: what are the the foreign exchange exposure of a multinational company with it's headquarters in…

A: Foreign exchange exposure refers to the risk faced by a multinational company of losing money due to…

Q: A firm has net working capital of $580, net fixed assets of $2,326, sales of $6,900, and current…

A: Sales are the total revenue generated by a firm. There are several costs that are deducted from the…

Q: Kathy Hansen has a revolving credit account. The finance charge is calculated on the previous…

A: A credit card is a payment card that allows a cardholder to borrow money from a financial…

Q: You need to have $30,750 in 11 years. You can earn an annual interest rate of 6 percent for the…

A: To calculate the deposit amount we will use the below formula Deposit amount =…

Q: should the opportunity cost be included in order to determine earnings before interest and tax? give…

A: Earning before interest and tax important Matrix as it help us to understand the total funding…

Q: our sister just deposited $5,000 Into an investment account. She belleves that she will earn an…

A: The concept of time value of money will be used here. Since future value has to be computed we will…

Q: Discuss the findings and conclusions of Miller (1977) when personal taxes are incorporated in the…

A: In 1977, economist Merton Miller extended the famous Modigliani and Miller (M&M) theorem by…

Q: A purchaser has a total weekly income of $788 The lender is using a 26% housing expense ratio. Based…

A: Housing expense ratio is compares housing expense to pre-tax income.

Q: How do you complete a discounted cash flow analysis and what values are needed to complete one? I am…

A: Discounted cash flow (DCF) analysis is a valuation method used to estimate the value of an…

Q: Alice acquired his sister’s share of their business by agreeing to make payments of $5000 at the end…

A: A series of regular fixed periodic payments made indicates an annuity. The current worth of all the…

Q: ou observed that high-level managers make superior returns on investments in their company’s stock.…

A: The Efficient Market Hypothesis (EMH) is a theory in finance that states that financial markets are…

Q: Debt can be issued at a yield percent, dividend of $4.40. The flotation cost on the preferred stock…

A: Before tax cost of debt = 11% Tax rate = 20% Preferred stock price (P) = $60 Dividend (D) = $6.40…

Q: Using as few factors as possible, determine the equivalent annuity A from the following cash flows.…

A: Equal annual annuity is a capital budgeting method in which we compute the single amount of annual…

Q: Give typing answer with explanation and conclusion What types of restrictions are imposed on…

A: Step 1 A bank is a type of financial entity that lends money while both taking deposits from the…

Q: An agreement stipulates payments of $5000,$3500 and $6000 in three, six and nine months,…

A: Present value is a financial concept that represents the value of a future sum of money in terms of…

Q: *A TV costing £800 pounds is paid by equal payments made at the end of the week for three years.…

A: This is a question from loan amortization. It's based on time value of money concept. The weekly…

Q: A credit card bill for $657 was due on April 14. Purchases of $155.56 were made on April 19. The…

A: the average daily balance technique multiplies the credit card amount for each day of a billing…

Q: Jessica is single and owns her own home. She makes $120,000 per year from her job and has no other…

A: Mortgage lenders use the overall debt service percentage as a lending metric to determine a…

Q: Assume the Canadian dollar rose from US$0.9475 to US$0.9875. A client owns an investment that pays…

A: old value = US$0.9475 New value = US$0.9875 Interest rate = 6%

Q: Suppose a 9-year bond has a face value of $1,000 and has a semi-annual YTM of 0.085. It pays…

A: For the calculation of the bond's price, we will use the below formula Bond's price =…

Q: A contract requires lease payments of $700 at the beginning of every month for 4 years. a. What is…

A: The concept of money's time worth reveals that any money's sum is worth more than what it will be in…

Q: Jessica owes $75000 to be amortized with equal semi-annual payments over 3 years at j2 = 6%. What is…

A: Step 1 Payment is the exchange of money, products, or services for agreed-upon amounts of acceptable…

Q: Suppose that it is january 15 now. A copper fabricator knows it will require 100,000 pounds of…

A: May futures price is 120 cents per pound spot 125 cents

Q: (a) How many payments will the mortgagor have to make? (b) What is the size of the last payment? (c)…

A: First, we need to determine the equivalent interest rate using the formula below as the compounding…

Give typing answer with explanation and conclusion

Step by step

Solved in 3 steps

- Assume that the current stock price is $50 per share, that call options can be purchased with an exercise price of $60 per share, that bank loans can be obtained for a 10 percent nominal rate, and that at expiration of the option in three months, the stock will either be valued at $30 or $70. Show that it is possible to replicate the stock payoff by borrowing and buying a call option.The stock of Suncor Energy is currently trading for $36 per share. An investor expects the stock price to move up in the next two months, and decided to invest $7, 200 in this stock. If the investor invests all the money in the stock, how much is the profit or loss if the stock price in two months turns out to be i) 40 or ii) 32? If the investor invests all the money in call options with a strike price of $35 and price of the call is $2 per share, how much is the profit or loss if the stock price in two months turns out to be i) 40 or ii) 32?The common stock of the CGI Inc. has been trading in a narrow range around $35 per share for months, and you believe it is going to stay in that range for the next three months. The price of a three-month put option with an exercise price of $35 is $2, and a call with the same expiration date and exercise price sells for $3. Suppose you write a strap ( = write 2 calls and write 1 put with the same strike price) and the stock price winds up to be $37 at contract expiration. What was your net profit on the strap? A. $200 B. $300 C. $400 D. $500 E. $700

- The CEO of SubShack was granted 100,000 options. The stock price at the time of the granting of the options was $35 and the options have an exercise price of $40. The risk free rate was 3% and the options expire in 5 years. The variance on the stock is .06, or 6.0% What is the value of the options contract (use Black Scholes formula and show all formulas and steps for d1, d2, N(d1), N(d2) and the continuous discount rate)? If he had negotiated a larger salary and only 10,000 options, what would be the value of the options contract?The common stock of the C.A.L.L. Corporation has been trading in a narrow range around $40 per share for months, and you believe it is going to stay in that range for the next 6 months. The price of a 6-month put option with an exercise price of $40 is $8.49. Required: If the semiannual risk-free interest rate is 3%, what must be the price of a 6-month call option on C.A.L.L. stock at an exercise price of $40 if it is at the money? (The stock pays no dividends.) What would be a simple options strategy using a put and a call to exploit your conviction about the stock price’s future movement? What is the most money you can make on this position? How far can the stock price move in either direction before you lose money? How can you create a position involving a put, a call, and riskless lending that would have the same payoff structure as the stock at expiration? What is the net cost of establishing that position now?The common stock of the C.A.L.L. Corporation has been trading in a narrow range around $50per share for months, and you believe it is going to stay in that range for the next 3 months. Theprice of a 3-month put option with an exercise price of $50 is $4.a. If the risk-free interest rate is 10% per year, what must be the price of a 3-month call optionon C.A.L.L. stock at an exercise price of $50 if it is at the money? (The stock pays nodividends.)b. What would be a simple options strategy using a put and a call to exploit your convictionabout the stock price’s future movement? What is the most money you can make on thisposition? How far can the stock price move in either direction before you lose money?c. How can you create a position involving a put, a call, and riskless lending that would havethe same payoff structure as the stock at expiration? What is the net cost of establishing thatposition now?

- Your company sold call options on a stock. The option expires in 6 months, the risk-free rate is 6%, and the strike price is $50. The stock is currently trading at $52 dollars and has a volatility of 35%. How many shares of stock should you own in your hedging portfolio per call option sold?You purchase 36 call options on Greshak Corp. to increase returns on your equity portfolio. The three month calls specify the strike price is $48.00 and require a premium of $3.25. If Greshak's stock is trading at $52.00 at the time the options expire, what are your options worth? What was your net profit (in dollars and as an annualized percentage)? What would your profit in dollars and as an annualized percentage had been if the stock instead sold for $51.00/share at expiration? How about $50.00/share?A stock is expected to pay a dividend of $1 per share in 2 months. An investor purchased a forward contract on the stock at a forward price of $50 some time ago. The contract now has 3 months to its delivery date. The stock is currently trading at $55 and the risk free rate is 4% on a continuously compounded basis. Consider the following statements. I. The price of a forward contract on the stock with 3 months to the delivery date is $54.55 II. The value of the investor’s forward position is $5.50 Which of the following is correct? (No excel pls) a. Statement I is incorrect, Statement II is correct. b. Both statements are correct. c. Both statements are incorrect. d. Statement I is correct, Statement II is incorrect.

- A stock currently trades for $120 per share. Call options on the stock are available with a strike price of $125. The options expire in one month. The annualized risk free rate is 3%, and the expected volatility (annual) for the stock is 35%. Use the Black-Scholes option pricing model to calculate the price of the call option.A stock has a current price of $267. A trader writes 7 naked option contracts on the stock, each contract covering 100 shares. The option price is $2, the strike price is $230, and the time to maturity is 4 months. What is the margin requirement if the options are call options (in $)?You shorted a call option on Intuit stock with a strike price of $38. When you sold (wrote) the option, you received $3. The option will expire in exactly three months' time. a. If the stock is trading at $49 in three months, what will your payoff be? What will your profit be? b. If the stock is trading at $35 in three months, what will your payoff be? What will your profit be? c. Draw a payoff diagram showing the payoff at expiration as a function of the stock price at expiration. d. Redo c, but instead of showing payoffs, show profits. Question content area bottom Part 1 a. The payoff of the short is $ short is $ enter your response here. enter your response here, and the profit of the. Please step by step answer.