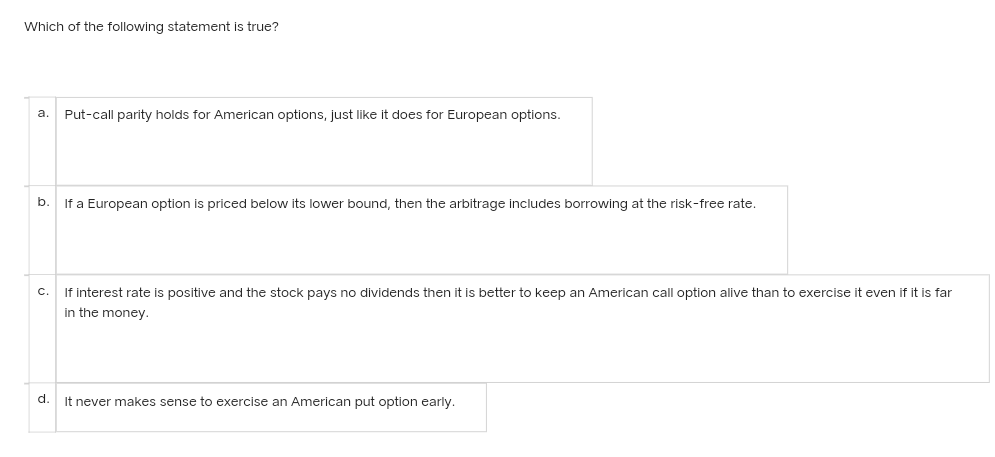

Which of the following statement is true? a. Put-call parity holds for American options, just like it does for European options. b. If a European option is priced below its lower bound, then the arbitrage includes borrowing at the risk-free rate. C. If interest rate is positive and the stock pays no dividends then it is better to keep an American call option alive than to exercise it even if it is far in the money. d. It never makes sense to exercise an American put option early.

Q: Preliminary plans are under way for the construction of a new stadium for a major league baseball…

A:

Q: a firm will pay dividend of $2.40 next year. the dividend is expected to grow at constant rate of 2%…

A: The Dividend Discount Model (DDM) is a method used to value the stock of a company based on the…

Q: You invest $19,000 at 6% interest, compounded monthly, for 2 years. Use the compound interest…

A:

Q: How much must be deposited today into the following account in order to have a $145,000 college fund…

A: Present Value: It represents the current worth of the future expected cash flow. It is estimated by…

Q: 1. The interest rate is 5.7% p.a. effective and the rate of inflation is 1.1% p.a. Compute the real…

A: 1). Real interest rate is calculated using following equation Real interest rate = (1+Nominal…

Q: A start-up entrepreneur should ask which reflective question when developing the venture?

A: option D, "How will you manage the project from your idea to full-scale launch?" is the most…

Q: *A TV costing £800 pounds is paid by equal payments made at the end of the week for three years.…

A: This is a question from loan amortization. It's based on time value of money concept. The weekly…

Q: Financial arguments for the MD to improve health and safety 7 What financial arguments could you use…

A: Health and safety refers to the measures taken to ensure the physical, mental, and emotional…

Q: Argument if dividend policy matters, backed by academic literature. You are required to demonstrate…

A: Dividend policy refers to the decision-making process of a company regarding the distribution of…

Q: As part of establishing the market or product priorities, management accountants are vital in:…

A: Management accountants can provide valuable insights and financial analysis to inform decisions…

Q: Liabilities and equity Accounts payable Notes payable Accruals Total current liabilities Long-term…

A: Free cash flow is the money that a business makes after deducting the costs of operating and…

Q: You currently have $5,000. First United Bank will pay you an annual interest rate of 8.1, while…

A: The concept of time value of money will be used here. Future value or amount is obtained by…

Q: Question 2 Freedom Bank has received a loan application from a private company Automatic…

A: Z Score: Z-score is a model for predicting a company's likelihood of insolvency, particularly in the…

Q: how do we calculate dividend when there is eps retention ratio and dps retention ratio?

A: The dividend payment to the shareholders based on the company's earnings and its dividend payout…

Q: The future value of a single sum A. is generally larger than the present sum. B. decreases…

A: The future value (FV) is the value of an investment or sum of money at a specified future date,…

Q: "the fund now to cover these liabilities is £855720.40, rounded to £92719.50 to 2 decimal places"…

A: At the outset, let me tell you the previous solution provided by the expert is conceptually…

Q: Problem 1 Dundee Inc. bonds are currently selling for $1,250. They pay an annual coupon of $90, have…

A: Yield to maturity (YTM) - It is the rate earned by the bondholder during the life of the bond…

Q: Question 1 Which one of the following is not included as part of the basis for cultural competence,…

A: Cultural competence is an important skill for managing diversity in the workplace. It involves…

Q: Colton Corporation's semiannual bonds have a 12-year maturity, an 6.10% nominal coupon paid…

A: The bond is selling at par. Therefore, the nominal yield should be equal to the coupon rate. Nominal…

Q: determine the size of the payments that must be made to a sinking fund in order to accumulate…

A: To determine the size of the payments that must be made to a sinking fund, we can use the TVM (Time…

Q: Ofri and Miles pay for their children to attend a private school instead of the nearby public school…

A: Private schools are educational institutions that are not funded or run by the government. Instead,…

Q: 3. Cynthia is a DJ in Kamloops. She has a MasterCard. The credit limit is $4000. Interest is…

A: Credit cards are one of the payment options available for making payments at pre-approved limits by…

Q: a) Calculate the after-tax cost of borrowing from the boat dealership. b) Calculate the after-tax…

A: Interest rates are the rates at which borrowers can obtain funds from lenders. Different types of…

Q: Your company has the following expected dividends over the next 6 years: $2.00, $2.40, $3.20, $3.60,…

A: Present value is the estimation of the current value of future return which is likely to be received…

Q: A demand loan of $8000.00 is repaid by payments of $4000.00 after two years, $4000.00 after four…

A: A loan is a contract between two parties where money is transferred with the promise of repayment…

Q: Three $25,000, 11% bonds with semi-annual coupons redeemable at par were bought eight years before…

A: Price of the bond is the PV of future coupons and par value discounted using the Yield to maturity.…

Q: How do you justify using a “constant dollar” cash flow analysis when inflation over the period…

A: A "constant dollar" cash flow analysis is a method of evaluating the cash flows associated with an…

Q: Mikas Hospital Ltd. is considering investing in a new production line for its pain-reliever…

A:

Q: Peyton received a 10 year subsidized student loan of $33,000 I didn’t and your interest rate of…

A: Subsidized student loan- In case of subsidized student loan, the federal government pays the…

Q: Firm A has a value of $100 million and Firm B has a value of $70 million. Merging the two would…

A: value of Firm B = $70 million Present value = $20 million Purchase cost = $75 million

Q: You have been offered a contract to work as a consultant. The company will pay you $6215 per month.…

A: The worth of the contract today is the present value of all the given amounts. The amounts are…

Q: 6 Under the third party evaluation process, which is the first step to be followed? O Initiate CBC…

A: The Third Party Evaluation Process is a systematic and structured approach used to evaluate…

Q: Suppose that the yield on a two-year Treasury security is 5.84%, and the yield on a five-year…

A: Under expectation theory, we can determine the future rates using the spot rates as the term…

Q: You have just arranged for a $1,800,000 mortgage to finance the purchase of a large tract of land.…

A:

Q: Write the constraint below as a linear inequality. A canoe requires 6 hours of fabrication and a…

A: Here, X is the number of canoes Y is he number of rowboat. Total number of hours should not exceed…

Q: Assume that a 5-year bond pays interest of $90 once a year (1 payment / year) and will mature for…

A: Duration of a bond refers to a process used to measure the change in the price of bond according…

Q: An 11% coupon callable bond with $100 par and maturing in 5 years is yielding 11.60%. The yield to…

A: The difference between the call price of the bond and its face value is call premium of the bond.…

Q: Why should you be concerned with retirement and estate

A: The retirement planning of the most important decisions because it involved part of the decisions…

Q: Both Bond Bill and Bond Ted have 12.4 percent coupons, make semiannual payments, and are priced at…

A: Bond valuation is the process of determining the fair value of a bond, which is a debt instrument…

Q: Following are the probability distribution of returns of portfolio of Stock A and Stock B in equal…

A: Expected Return: It represents the return anticipated by the investor for investing in the issuer's…

Q: "Company B, is a private company that designs, manufactures and distributes certain consumer…

A: Data given: Earnings=$40 million Av. Price /Earnings Ratio=10 No. of shares to be issued=10 million

Q: Nancy Cardoza (hypothetical person) invested $4,300 in ExxonMobil stock because her research…

A: Here, Investment Amount is $4,300 Interest Rate is 9% Time Period is 5 years Note: In this question…

Q: To complete her college education, Judy received education loans of $23,256 including interest. Find…

A: Here, Loan Amount including interest is $23,256 Time Period is 72 months

Q: To insure you, Assurances Nochance Ltd offers the following plan: you will pay 20 annual…

A: Present value is the estimation of the current value of future cash value which is likely to be…

Q: If you knew that you can invest in a passive index fund, at a low cost, and capture all the returns…

A: Passive Index fund A passive fund is a financial tool that bases its investment decisions on the…

Q: Equity holders’ investment in the firm is K100 million, and the beta of the equity is 0.6. if the…

A: Annual profit is the profit earned on an investment made throughout the period of 12 months.

Q: XZYY, Inc. currently has an issue of bonds outstanding that will mature in 24 years. The bonds have…

A: The face value of the bond is $1,000. The annual coupon rate is 13%. The current price of the bond…

Q: Kessen Inc.'s bonds mature in 7 years, have a par value of $1,000, and make an annual coupon payment…

A: In the given case, we have provided the par value of bond . It is a maturity value of bond. Since,…

Q: Discuss the contribution of holbrook working (1895 - 1985) to capital market efficiency

A: Holbrook Working (1895 - 1985) was an American economist who made significant contributions to the…

Q: 4: Your daughter just turned 5 years old. You plan to send her to college beginning on her 18th…

A: First, we need to determine the PV of the college expenses at age 18 using the PV of annuity due…

Ef 322.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- Part I. Explain why an American call options on futures could be optimally exercised early while call options on the spot can not be optimally exercised. Assume that there is no dividend. Explain how to use call options and put options to create a synthetic short position in stock. Part II. Indicate whether each of the following two statements below is true, false or uncertain and justify your response. It is theoretically impossible for an out-of-money European call and an in-the-money European put to be trading at the same price. Both options are written on the same non-dividend paying stock. A 3-month European put option on a non-dividend-paying stock is currently selling for $3.80. The stock price is $48.0, the strike price is $51, and the risk-free interest rate is 6% per annum (continuous compounding). There is no arbitrage opportunity in this scenario.Under the assumptions of the Black-Scholes model, which value does not affect the price of a European call option: Select one: a. the interest rate r b. the spot price S c. the strike price K d. the return of the stock µ e. the volatility of the stock σMy question is for a synthetic call option why do we need to borrow the present value of the strike price and what does it mean in a simple language explanation. Similarly why do we need to lend the present value of the stock at risk-free rate and what does it mean in simple language explanation? Please also clarify the significance of risk free rate? Why is it used in put call parity. Synthetic Call Option: If an investor believes that a call option is over-priced, then he/she can sell the call on the market and replicate a synthetic call. Borrow the present value of the strike price at the risk free rate and purchase the underlying stock and a put. Synthetic Put Option: Similar to the synthetic call option. A synthetic put can be created by re-arranging the put-call parity relationship, if the trader believes the put is overvalued. Synthetic Stock: A synthetic stock can also be created by rearranging the put-call parity identity. In this case, the investor will buy the…

- Explain why an American call options on futures could be optimally exercised early while call options on the spot can not be optimally exercised. Assume that there is no dividend. Explain how to use call options and put options to create a synthetic short position in stock.Below is a chart with profit/loss on the vertical axis, and the $/£ exchange rate on the horizontal axis. The solid line shows the profit/loss schedule for a: Question 8 options: put option in isolation (e.g. used for speculating that the pound will depreciate) None of the above covered call option (a call option is used as a hedge) covered put option (a put option is used as a hedge)Which of the following statements about European option contracts is TRUE? a. Typically American options are cheaper than otherwise similar European options due to the uncertainty regarding the date of exercise. b. One can synthesise a long forward position in the underlying by being long a call and short a put c. A long call position and a short put position both involve buying the underlying and so are equivalent d. The price of an option can be obtained by computing the true probabilities of each state of nature, working out the expected option payoff across those states and then discounting back to the present.

- State whether the following statements are true or false. In each case, provide a brief explanation. a. In a risk averse world, the binomial model states that, other things being equal, the greater the probability of an up movement in the stock price, the lower the value of a European put option. b. By observing the prices of call and put options on a stock, one can recover an estimate of the expected stock return. c. An investor would like to purchase a European call option on an underlying stock index with a strike price of 210 and a time to maturity of 3 months, but this option is not actively traded. However, two otherwise identical call options are traded with strike prices of 200 and 220 respectively, hence the investor can replicate a call with a strike price of 210 by holding a static position in the two traded calls. d. In a binomial world,if a stock is more likely to go up in price than to go down, an increase in volatility would increase the price of a call option and reduce…Suppose that C is the price of a European call option to purchase a security whose present price is S. Show that if C>S then there is an opportunity for arbitrage (i.e. risk-less profit). You may assume the interest rate is r=0 so that the present value calculations are unnecessary.Suppose your client says, “I am invested in Japanese stocks but want to eliminate my exposure to this market for a period of time. Can I accomplish this without the cost and inconvenience of selling out and buying back in again if my expectations change?”a. Briefly describe a strategy to hedge both the local market risk and the currency risk of investing in Japanese stocks.b. Briefly explain why the hedge strategy you described in part (a) might not be fully effective.

- Select all of the following statements that accurately compare or contrast forwards and options: Group of answer choices Taking naked long positions in either a call or forward will lead to an overall long position in the underlying security. Options and forwards always have identical payoffs if the spot price remains the same. Both options and forwards can be used to reduce exposure to foreign exchange risk. Going long a naked put option and going short a naked forward both cause unlimited liability. Both options and forwards require the payment of a premium at the initiation of the contract. Forward contracts impose obligations on both parties in the transaction. Options contracts only impose an obligation on one party.Could you help giving me explanations on this quant finance problem? Which of the following statement about the one-step binomial tree-model are correct ? Select all correct options. A. The stock's expected return does not play any role for the arbitrage-free pricing of an option written on the stock. B. Arbitrage-free prices of European stock options can be computed as expected values of the discounted payoff of the option of maturity by using the risk-neutral probability. C. The seller of a European stock option can perfectly hedge herself against the risk of paying the payoff to the holder of the option at maturity by implementing a hedging strategy which perfectly replicates the payoff at maturity by trading the underlying stock.I asked the question below earlier today, and got a response, but I didn't understand it. I'm sure the response was well written and clear, but I have a very limited background in this area and probably need more of a layman's terms explanation! Thanks. Suppose that C is the price of a European call option to purchase a security whose present price is S. Show that if C>S then there is an opportunity for arbitrage (ie. riskless profit). Assume the interest rate r=0 so present value calculations are unnecessary.