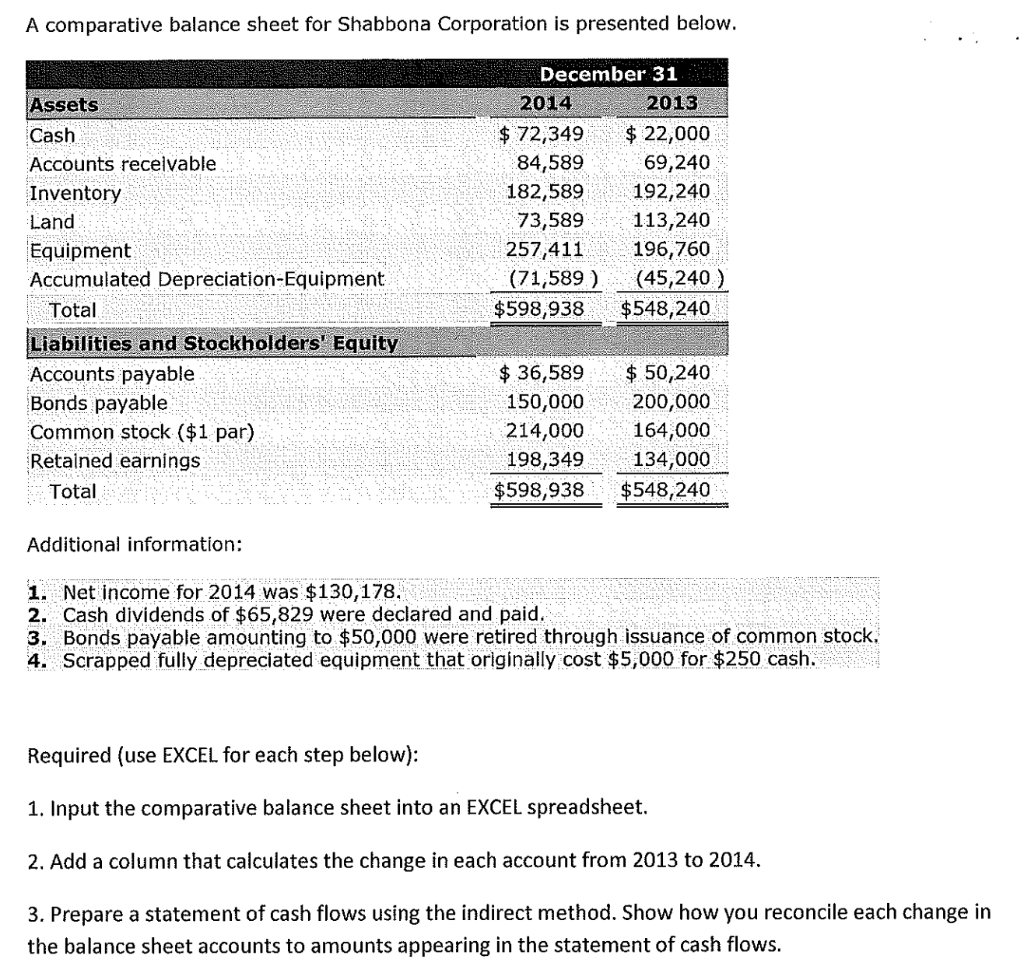

A comparative balance sheet for Shabbona Corporation is presented below.

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter17: Financial Statement Analysis

Section17.4: Analyzing Financial Statements Using Financial Ratios

Problem 1WT

Related questions

Question

please help me

Transcribed Image Text:A comparative balance sheet for Shabbona Corporation is presented below.

Assets

Cash

Accounts receivable

Inventory

Land

Equipment

Accumulated Depreciation-Equipment

Total

Liabilities and Stockholders' Equity

Accounts payable

Bonds payable

Common stock ($1 par)

Retained earnings:

Total

December 31

2014

$ 72,349

84,589

182,589

73,589

257,411

(71,589)

$598,938

$36,589

150,000

214,000

198,349

$598,938.

2013

$ 22,000

69,240

192,240

113,240

196,760

(45,240)

$548,240

$ 50,240

200,000

164,000

134,000

$548,240

Additional information:

1. Net income for 2014 was $130,178.

2. Cash dividends of $65,829 were declared and paid.

3. Bonds payable amounting to $50,000 were retired through issuance of common stock.

4. Scrapped fully depreciated equipment that originally cost $5,000 for $250 cash.

Required (use EXCEL for each step below):

1. Input the comparative balance sheet into an EXCEL spreadsheet.

2. Add a column that calculates the change in each account from 2013 to 2014.

3. Prepare a statement of cash flows using the indirect method. Show how you reconcile each change in

the balance sheet accounts to amounts appearing in the statement of cash flows.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning