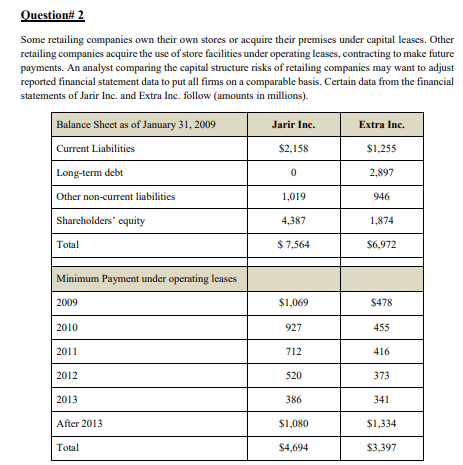

A) Compute the present value of operating lease obligations using an 8% discount rate for Jarir Inc. and Extra Inc. as of January 31, 2009. Assume that all cash flows occur at the end of each year. Also assume that the minimum lease payment each year after 2013 equals $360 million per year for three years for Jarir Inc. and $333.5 million for four years for Extra Inc.. (This payment scheduling assumption can be obtained by assuming that the payment amount for 2013 continues until the aggregate payments after 2013 have been made, rounding the number of years upward, and then assuming level payments for that number of years. For Jarir Inc.: $1,080/$386 = 2.8 years. Rounding up to three years creates a three-year annuity of $1,080/3 years = $360 million per year. B) Compute each of the following ratios for Jarir, Inc. and Extra Inc. as of January 31, 2009, using the amounts originally reported in their balance sheets for the year. (1) Liabilities to Assets Ratio = Total Liabilities/Total Assets (2) Long-Term Debt to Long-Term Capital Ratio = Long-Term Debt/(Long-Term Debt + Shareholders’ Equity) C) Repeat Requirement (b) but assume that these firms capitalize operating leases. D) Comment on the results from Requirements (b) and (c).

A) Compute the present value of operating lease obligations using an 8% discount rate for Jarir

Inc. and Extra Inc. as of January 31, 2009. Assume that all

year. Also assume that the minimum lease payment each year after 2013 equals $360 million

per year for three years for Jarir Inc. and $333.5 million for four years for Extra Inc.. (This

payment scheduling assumption can be obtained by assuming that the payment amount for

2013 continues until the aggregate payments after 2013 have been made, rounding the number

of years upward, and then assuming level payments for that number of years. For Jarir Inc.:

$1,080/$386 = 2.8 years. Rounding up to three years creates a three-year annuity of $1,080/3

years = $360 million per year.

B) Compute each of the following ratios for Jarir, Inc. and Extra Inc. as of January 31, 2009, using

the amounts originally reported in their balance sheets for the year.

(1) Liabilities to Assets Ratio = Total Liabilities/Total Assets

(2) Long-Term Debt to Long-Term Capital Ratio = Long-Term Debt/(Long-Term Debt +

Shareholders’ Equity)

C) Repeat Requirement (b) but assume that these firms capitalize operating leases.

D) Comment on the results from Requirements (b) and (c).

Step by step

Solved in 2 steps