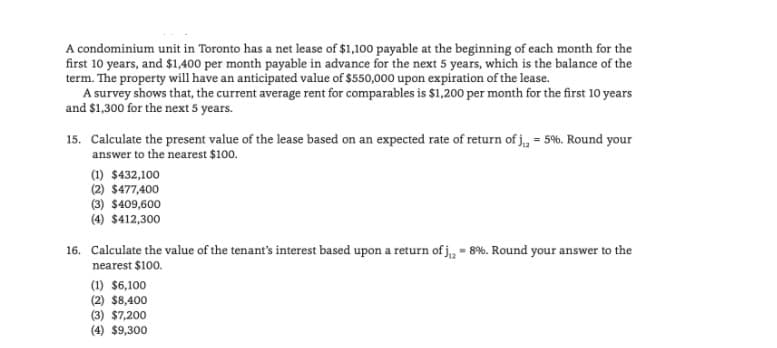

A condominium unit in Toronto has a net lease of $1,100 payable at the beginning of each month for the first 10 years, and $1,400 per month payable in advance for the next 5 years, which is the balance of the term. The property will have an anticipated value of $550,000 upon expiration of the lease. A survey shows that, the current average rent for comparables is $1,200 per month for the first 10 years and $1,300 for the next 5 years. 15. Calculate the present value of the lease based on an expected rate of return of j,, - 5%. Round your answer to the nearest $100. (1) $432,100 (2) $477,400 (3) $409,600 (4) $412,300 16. Calculate the value of the tenant's interest based upon a return of j,, - 8%. Round your answer to the nearest $100. (1) $6,100

A condominium unit in Toronto has a net lease of $1,100 payable at the beginning of each month for the first 10 years, and $1,400 per month payable in advance for the next 5 years, which is the balance of the term. The property will have an anticipated value of $550,000 upon expiration of the lease. A survey shows that, the current average rent for comparables is $1,200 per month for the first 10 years and $1,300 for the next 5 years. 15. Calculate the present value of the lease based on an expected rate of return of j,, - 5%. Round your answer to the nearest $100. (1) $432,100 (2) $477,400 (3) $409,600 (4) $412,300 16. Calculate the value of the tenant's interest based upon a return of j,, - 8%. Round your answer to the nearest $100. (1) $6,100

Chapter19: Lease And Intermediate-term Financing

Section: Chapter Questions

Problem 9P

Related questions

Question

100%

Transcribed Image Text:A condominium unit in Toronto has a net lease of $1,100 payable at the beginning of each month for the

first 10 years, and $1,400 per month payable in advance for the next 5 years, which is the balance of the

term. The property will have an anticipated value of $550,000 upon expiration of the lease.

A survey shows that, the current average rent for comparables is $1,200 per month for the first 10 years

and $1,300 for the next 5 years.

15. Calculate the present value of the lease based on an expected rate of return of j, = 5%. Round your

answer to the nearest $100.

(1) $432,100

(2) $477,400

(3) $409,600

(4) $412,300

16. Calculate the value of the tenant's interest based upon a return of j, = 8%. Round your answer to the

nearest $100.

(1) $6,100

(2) $8,400

(3) $7,200

(4) $9,300

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

how to do part two of the question? Calculate the value of the tenant's interest based upon a return of j, = 8%. Round your answer to the nearest $100. (1) $6,100 (2) $8,400 (3) $7,200 (4) $9,300

Solution

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub