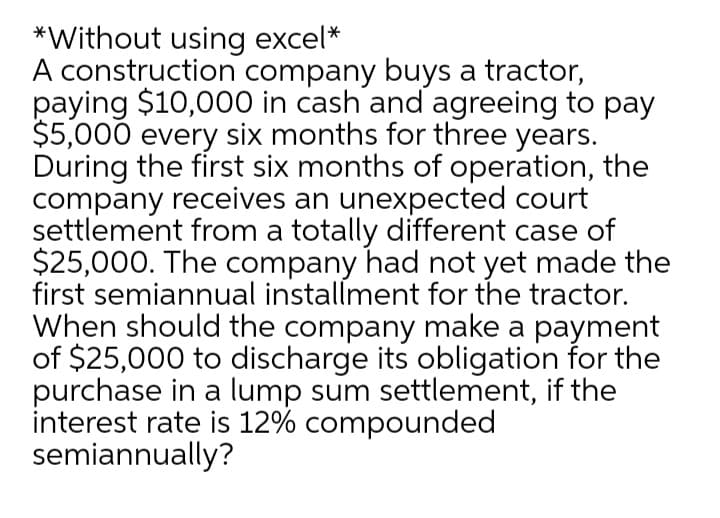

A construction company buys a tractor, paying $10,000 in cash and agreeing to pay $5,000 every six months for three years. During the first six months of operation, the company receives an unexpected court settlement from a totally different case of $25,000. The company had not yet made the first semiannual installment for the tractor. When should the company make a payment of $25,000 to discharge its obligation for the purchase in a lump sum settlement, if the interest rate is 12% compounded semiannually?

A construction company buys a tractor, paying $10,000 in cash and agreeing to pay $5,000 every six months for three years. During the first six months of operation, the company receives an unexpected court settlement from a totally different case of $25,000. The company had not yet made the first semiannual installment for the tractor. When should the company make a payment of $25,000 to discharge its obligation for the purchase in a lump sum settlement, if the interest rate is 12% compounded semiannually?

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter5: Business And Economic Forecasting

Section: Chapter Questions

Problem 2E

Related questions

Question

3

Transcribed Image Text:*Without using excel*

A construction company buys a tractor,

paying $10,000 in cash and agreeing to pay

$5,000 every six months for three years.

During the first six months of operation, the

company receives an unexpected court

settlement from a totally different case of

$25,000. The company had not yet made the

first semiannual installment for the tractor.

When should the company make a payment

of $25,000 to discharge its obligation for the

purchase in a lump sum settlement, if the

interest rate is 12% compounded

semiannually?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning