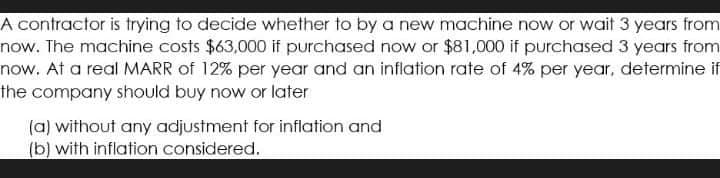

A contractor is trying to decide whether to by a new machine now or wait 3 years from now. The machine costs $63,000 if purchased now or $81,000 if purchased 3 years from now. At a real MARR of 12% per year and an inflation rate of 4% per year, determine i he company should buy now or later (a) without any adjustment for inflation and (b) with inflation considered.

A contractor is trying to decide whether to by a new machine now or wait 3 years from now. The machine costs $63,000 if purchased now or $81,000 if purchased 3 years from now. At a real MARR of 12% per year and an inflation rate of 4% per year, determine i he company should buy now or later (a) without any adjustment for inflation and (b) with inflation considered.

Fundamentals Of Construction Estimating

4th Edition

ISBN:9781337399395

Author:Pratt, David J.

Publisher:Pratt, David J.

Chapter18: Life-cycle Costing

Section: Chapter Questions

Problem 14RQ

Related questions

Question

Transcribed Image Text:A contractor is trying to decide whether to by a new machine now or wait 3 years from

now. The machine costs $63,000 if purchased now or $81,000 if purchased 3 years from

now. At a real MARR of 12% per year and an inflation rate of 4% per year, determine if

the company should buy now or later

(a) without any adjustment for inflation and

(b) with inflation considered.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, civil-engineering and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals Of Construction Estimating

Civil Engineering

ISBN:

9781337399395

Author:

Pratt, David J.

Publisher:

Cengage,

Fundamentals Of Construction Estimating

Civil Engineering

ISBN:

9781337399395

Author:

Pratt, David J.

Publisher:

Cengage,