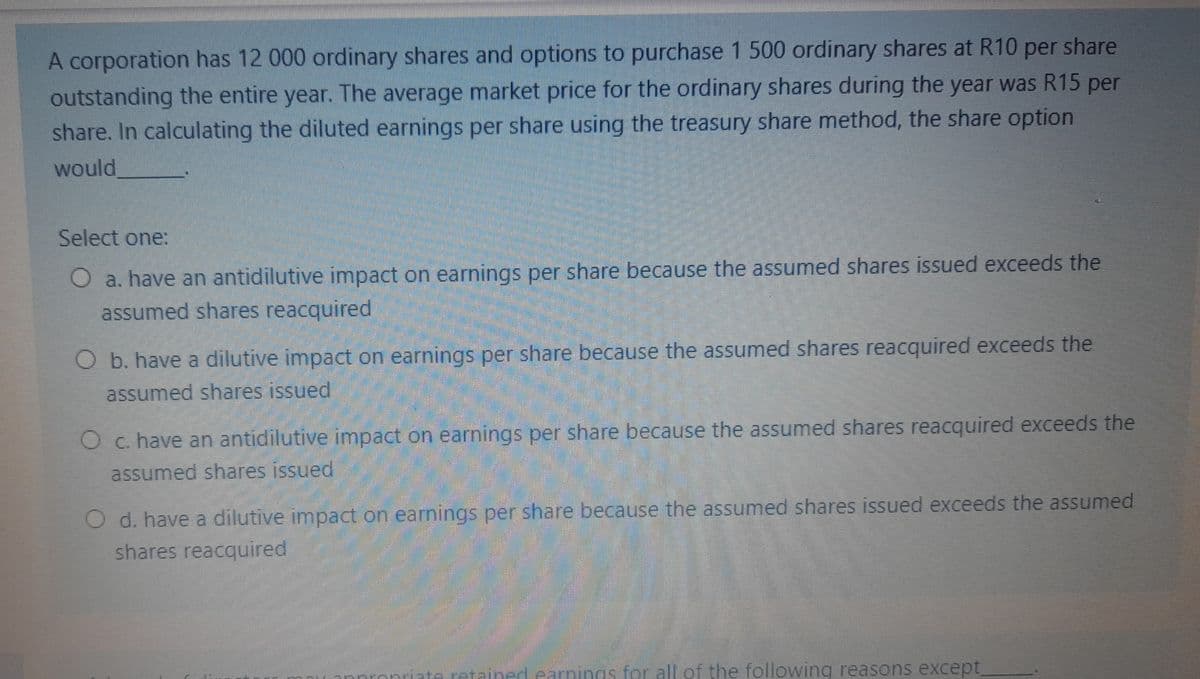

A corporation has 12 000 ordinary shares and options to purchase 1 500 ordinary shares at R10 per share outstanding the entire year. The average market price for the ordinary shares during the year was R15 per share. In calculating the diluted earnings per share using the treasury share method, the share option would Select one: O a. have an antidilutive impact on earnings per share because the assumed shares issued exceeds the assumed shares reacquired O b. have a dilutive impact on earnings per share because the assumed shares reacquired exceeds the assumed shares issued O c. have an antidilutive impact on earnings per share because the assumed shares reacquired exceeds the accumad shares issued

A corporation has 12 000 ordinary shares and options to purchase 1 500 ordinary shares at R10 per share outstanding the entire year. The average market price for the ordinary shares during the year was R15 per share. In calculating the diluted earnings per share using the treasury share method, the share option would Select one: O a. have an antidilutive impact on earnings per share because the assumed shares issued exceeds the assumed shares reacquired O b. have a dilutive impact on earnings per share because the assumed shares reacquired exceeds the assumed shares issued O c. have an antidilutive impact on earnings per share because the assumed shares reacquired exceeds the accumad shares issued

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter15: Shareholders’ Equity: Capital Contributions And Distributions

Section: Chapter Questions

Problem 15E

Related questions

Question

Transcribed Image Text:A corporation has 12 000 ordinary shares and options to purchase 1 500 ordinary shares at R10 per share

outstanding the entire year. The average market price for the ordinary shares during the year was R15 per

share. In calculating the diluted earnings per share using the treasury share method, the share option

would

Select one:

O a. have an antidilutive impact on earnings per share because the assumed shares issued exceeds the

assumed shares reacquired

O b. have a dilutive impact on earnings per share because the assumed shares reacquired exceeds the

assumed shares issued

4

O c. have an antidilutive impact on earnings per share because the assumed shares reacquired exceeds the

assumed shares issued

O d. have a dilutive impact on earnings per share because the assumed shares issued exceeds the assumed

shares reacquired

mnion.

retained earnings for all of the following reasons except

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning