Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 16, Problem 5P

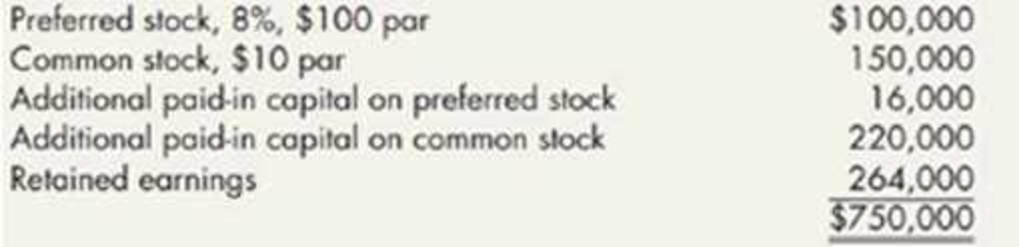

Alert Company’s shareholders’ equity prior to any of the following events is as follows:

The company is considering the following alternative items:

- 1. An 8% stock dividend on the common stock when it is selling for $30 per share.

- 2. A 30% stock dividend on the common stock when it is selling for $32 per share.

- 3. A special stock dividend to common shareholders consisting of 1 share of

preferred stock for every 100 shares of common stock. The preferred stock and common stock are selling for $123 and $31 per share, respectively. - 4. A 2-for-1 stock split on the common stock, reducing the par value to $5 per share (assume the same date for declaration and issuance). The market price is $30 per share on the common stock.

- 5. A property dividend to common shareholders consisting of 100 bonds issued by West Company. These bonds are carried on the Alert Company books as an available-for sale investment at a fair value of $48,000 (which is also its cost); it has a current value of $54,000.

- 6. A cash dividend, consisting of a normal dividend and a liquidating dividend, on both the preferred and the common stock. The 10% preferred dividend includes a 2% liquidating dividend, and the $2.30 per share common dividend includes a $0.30 per share liquidating dividend (separate liquidating dividend contra accounts should be used).

Required:

For each of the preceding alternative items:

- 1. Record (a) the

journal entry at the date of declaration and (b) the journal entry at the date of issuance. - 2. Compute the balances in the shareholders’ equity accounts immediately after the issuance (any gains or losses are to be reflected in the

retained earnings balance; ignore income taxes).

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Chapter 16 Solutions

Intermediate Accounting: Reporting And Analysis

Ch. 16 - What are the four important dates in regard to a...Ch. 16 - How does the ex-dividend date differ from the date...Ch. 16 - Prob. 3GICh. 16 - Prob. 4GICh. 16 - Prob. 5GICh. 16 - Prob. 6GICh. 16 - How does the accounting for a liquidating dividend...Ch. 16 - Prob. 8GICh. 16 - Prob. 9GICh. 16 - Prob. 10GI

Ch. 16 - What items might a corporation include in the...Ch. 16 - Prob. 12GICh. 16 - Prob. 13GICh. 16 - Prob. 14GICh. 16 - Prob. 15GICh. 16 - On what date are stock dividends and splits...Ch. 16 - Prob. 17GICh. 16 - What two earnings per share figures generally are...Ch. 16 - Prob. 19GICh. 16 - Prob. 20GICh. 16 - Prob. 21GICh. 16 - A company with potentially dilutive share options...Ch. 16 - Prob. 23GICh. 16 - Cash dividends on the 10 par value common stock of...Ch. 16 - A prior period adjustment should be reflected, net...Ch. 16 - Prince Corporations accounts provided the...Ch. 16 - Effective May 1, the shareholders of Baltimore...Ch. 16 - Kent Corporation was organized on January 1, 2014....Ch. 16 - For purposes of computing the weighted average...Ch. 16 - In determining basic earnings per share, dividends...Ch. 16 - Hyde Corporations capital structure at December...Ch. 16 - Iredell Company has 2,500,000 shares of common...Ch. 16 - Prob. 10MCCh. 16 - Prob. 1RECh. 16 - Prob. 2RECh. 16 - Prob. 3RECh. 16 - Use the same facts as in RE 16-3, but instead...Ch. 16 - Given the following current year information,...Ch. 16 - In Year 2, Adams Corporation discovered that it...Ch. 16 - Howard Corporal ion had 10,000 shares of common...Ch. 16 - Given the following year-end information for...Ch. 16 - Aiken Corporation has compensatory share options...Ch. 16 - Marlboro Corporation has 9% convertible preferred...Ch. 16 - Sarasota Corporation has 9% convertible bonds...Ch. 16 - Given the following year-end information, compute...Ch. 16 - Various Dividends Carlyon Company listed the...Ch. 16 - Dividends Andrews Company has 80,000 available to...Ch. 16 - Prob. 3ECh. 16 - Prob. 4ECh. 16 - Stock Dividend Comparison Although Oriole Company...Ch. 16 - Prior Period Adjustments Scobie Company began 2019...Ch. 16 - Prob. 7ECh. 16 - Prob. 8ECh. 16 - Prob. 9ECh. 16 - Shareholders Equity Herrera Manufacturing...Ch. 16 - Prob. 11ECh. 16 - Weighted Average Shares At the beginning of 2019,...Ch. 16 - Weighted Average Shares At the beginning of the...Ch. 16 - Earnings per Share The 2018 balance sheet for...Ch. 16 - Prob. 15ECh. 16 - Jumbo Corporation reported the following...Ch. 16 - Lucas Company reports net income of 5,125 for the...Ch. 16 - Monona Company reported net income of 29,975 for...Ch. 16 - Lyon Company shows the following condensed income...Ch. 16 - Extreme Company reported the following information...Ch. 16 - Mills Company had five convertible securities...Ch. 16 - Prob. 22ECh. 16 - Prob. 23ECh. 16 - Prob. 24ECh. 16 - Prob. 25ECh. 16 - Tama Companys capital structure consists of common...Ch. 16 - Percy Company has 15,000 shares of common stock...Ch. 16 - Prob. 28ECh. 16 - Keener Company has had 1,000 shares of 7%, 100 par...Ch. 16 - Otter Tail, Inc., began operations in January 2015...Ch. 16 - On January 1, 2019, Kittson Company had a retained...Ch. 16 - Prob. 4PCh. 16 - Alert Companys shareholders equity prior to any of...Ch. 16 - Prob. 6PCh. 16 - Oakwood Inc. is a public enterprise whose shares...Ch. 16 - Prob. 8PCh. 16 - Prob. 9PCh. 16 - Prob. 10PCh. 16 - Raun Company had the following equity items as of...Ch. 16 - Prob. 12PCh. 16 - Prob. 13PCh. 16 - Gray Company lists the following shareholders...Ch. 16 - Included in the December 31, 2018, Jacobi Company...Ch. 16 - Prob. 16PCh. 16 - Graham Railways Inc. is evaluating its operations...Ch. 16 - Prob. 18PCh. 16 - Anoka Company reported the following selected...Ch. 16 - Winona Company began 2019 with 10,000 shares of 10...Ch. 16 - Waseca Company had 5 convertible securities...Ch. 16 - Roseau Company is preparing its annual earnings...Ch. 16 - Prob. 23PCh. 16 - Frost Company has accumulated the following...Ch. 16 - The controller of Red Lake Corporation has...Ch. 16 - Prob. 26PCh. 16 - Problems may be encountered in accounting for...Ch. 16 - Stock splits and stock dividends may be used by a...Ch. 16 - Earnings per share (EPS) is the most featured...Ch. 16 - The earnings per share data required of a company...Ch. 16 - Prob. 5CCh. 16 - Public enterprises are required to present...Ch. 16 - Prob. 7CCh. 16 - Ryan Company has as a goal that its earnings per...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A corporation issued 100 shares of $100 par value preferred stock for $150 per share. The resulting journal entry would include which of the following? A. a credit to common stock B. a credit to cash C. a debit to paid-in capital in excess of preferred stock D. a debit to casharrow_forwardStockholders' Equity Terminology A list of terms and a list of definitions or examples are presented below. Make a list of the numbers 1 through 12 and match the letter of the most directly related definition or example with each number Definitions and Examples Capitalizes retained earnings. Shares issued minus treasury shares. Emerson Electric will pay a dividend to all persons holding shares of its common stock on December 15, 2019, even if they just bought the shares and sell them a few days later. The accumulated earnings over the entire life of the corporation that have not been paid out in dividends. Common Stock account balance divided by the number of shares issued. The state of Louisiana set an upper limit of 1,000,000 on the number of shares that Gumps Catch Inc. can issue. Shares that never earn dividends. Any changes to stockholders equity from transactions with no owners. A right to purchase stock at a specified future time and specified price. j. A stock issue that requires no journal entry. k. Shares that may earn guaranteed dividends. 1. On October 15, 2019, General Electric announced its intention to pay a dividend on common stock.arrow_forwardOutstanding Stock Lars Corporation shows the following information in the stockholders equity section of its balance sheet: The par value of common stock is S5, and the total balance in the Common Stock account is $225,000. There are 13,000 shares of treasury stock. Required: What is the number of shares outstanding? Use the following information for Exercises 10-58 and 10-59: Stahl Company was incorporated as a new business on January 1, 2019. The company is authorized to issue 600,000 shares of $2 par value common stock and 80,000 shares of 6%, S20 par value, cumulative preferred stock. On January 1, 2019, the company issued 75,000 shares of common stock for $15 per share and 5,000 shares of preferred stock for $25 per share. Net income for the year ended December 31, 2019, was $500,000.arrow_forward

- Use the same facts as in RE 16-3, but instead assume that Pickens declares and issues a 50% stock dividend when the stock is selling for 30 per share. Prepare the journal entry on the date of declaration to record Pickenss stock dividend.arrow_forwardNutritious Pet Food Companys board of directors declares a large stock dividend (50%) on June 30 when the stocks market value per share is $30. At that time, there are 10,000 shares of $1 par value common stock outstanding (none held in treasury). What is the journal entry to record the stock dividend distribution on July 31?arrow_forwardNutritious Pet Food Companys board of directors declares a 2-for-1 stock split on June 30 when the stocks market value per share is $30. At that time, there are 10,000 shares of $1 par value common stock outstanding (none held in treasury). What is the new par value of the shares and how many shares are outstanding after the split? What is the total amount of equity before and after the split?arrow_forward

- Chen Corporation began 2012 with the following stockholders equity balances: The following selected transactions and events occurred during the year: a. Issued 10,000 shares of common stock for 60,000. b. Purchased 1,200 shares of treasury stock for 4,800. c. Sold 2,000 shares of treasury stock for 11,000. d. Generated net income of 94,000. e. Declared and paid the full years dividend on preferred stock and a dividend of 1.00 per share on common stock outstanding at the end of the year. Chen Corporation maintains several paid-in capital accounts (Paid-in Capital in Excess of Par, Paid-in Capital from Treasury Stock, etc.) in its ledger, but combines them all as Additional paid-in capital when preparing financial statements. Open the file STOCKEQ from the website for this book at cengagebrain.com. Enter the formulas in the appropriate cells on the worksheet. Then fill in the columns to show the effect of each of the selected transactions and events listed earlier. Enter your name in cell A1. Save the completed worksheet as STOCKEQ2. Print the worksheet. Also print your formulas. Check figure: Total stockholders equity balance at 12/31/12 (cell G21). 398,800.arrow_forwardChen Corporation began 2012 with the following stockholders equity balances: The following selected transactions and events occurred during the year: a. Issued 10,000 shares of common stock for 60,000. b. Purchased 1,200 shares of treasury stock for 4,800. c. Sold 2,000 shares of treasury stock for 11,000. d. Generated net income of 94,000. e. Declared and paid the full years dividend on preferred stock and a dividend of 1.00 per share on common stock outstanding at the end of the year. Chen Corporation maintains several paid-in capital accounts (Paid-in Capital in Excess of Par, Paid-in Capital from Treasury Stock, etc.) in its ledger, but combines them all as Additional paid-in capital when preparing financial statements. In the space provided below, prepare the stockholders equity section of Chen Corporations balance sheet as of December 31, 2012. Use proper headings and provide full disclosure of all appropriate information. Chens corporate charter authorizes the issuance of 1,000 shares of preferred stock and 100,000 shares of common stock.arrow_forwardRaun Company had the following equity items as of December 31, 2019: Preferred stock, 9% cumulative, 100 par, convertible Paid-in capital in excess of par value on preferred stock Common stock, 1 stated value Paid-in capital in excess of stated value on common stock| Retained earnings The following additional information about Raun was available for the year ended December 31, 2019: 1. There were 2 million shares of preferred stock authorized, of which 1 million were outstanding. All 1 million shares outstanding were issued on January 2, 2016, for 120 a share. The preferred stock is convertible into common stock on a 1-for-1 basis until December 31, 2025; thereafter, the preferred stock ceases to be convertible and is callable at par value by the company. No preferred stock has been converted into common stock, and there were no dividends in arrears at December 31, 2019. 2. The common stock has been issued at amounts above stated value per share since incorporation in 2002. Of the 5 million shares authorized, 3,580,000 were outstanding at January 1, 2019. The market price of the outstanding common stock has increased slowly but consistently for the last 5 years. 3. Raun has an employee share option plan where certain key employees and officers may purchase shares of common stock at 100% of the marker price at the date of the option grant. All options are exercisable in installments of one-third each year, commencing 1 year after the date of the grant, and expire if not exercised within 4 years of the grant date. On January 1, 2019, options for 70,000 shares were outstanding at prices ranging from 47 to 83 a share. Options for 20,000 shares were exercised at 47 to 79 a share during 2019. During 2019, no options expired and additional options for 15,000 shares were granted at 86 a share. The 65,000 options outstanding at December 31, 2019, were exercisable at 54 to 86 a share; of these, 30,000 were exercisable at that date at prices ranging from 54 to 79 a share. 4. Raun also has an employee share purchase plan whereby the company pays one-half and the employee pays one-half of the market price of the stock at the date of the subscription. During 2019, employees subscribed to 60,000 shares at an average price of 87 a share. All 60,000 shares were paid for and issued late in September 2019. 5. On December 31, 2019, there was a total of 355,000 shares of common stock set aside for the granting of future share options and for future purchases under the employee share purchase plan. The only changes in the shareholders equity for 2019 were those described previously, the 2019 net income, and the cash dividends paid. Required: Prepare the shareholders equity section of Rauns balance sheet at December 31, 2019. Substitute, where appropriate, Xs for unknown dollar amounts. Use good form and provide full disclosure. Write appropriate notes as they should appear in the publisher financial statements.arrow_forward

- Assume that Lily Corporation has outstanding 1,500 shares of 150 par callable preferred stock that were issued at 175 per share, and that no dividends are in arrears. If the call price is 185 per share, what journal entry will Lily make to record the recall of these shares?arrow_forwardAnoka Company reported the following selected items in the shareholders equity section of its balance sheet on December 31, 2019, and 2020: In addition, it listed the following selected pretax items as a December 31, 2019 and 2020: The preferred shares were outstanding during all of 2019 and 2020; annual dividends were declared and paid in each year. During 2019, 2,000 common shares were sold for cash on October 4. During 2020, a 20% stock dividend was declared and issued in early May. At the end of 2019 and 2020, the common stock was selling for 25.75 and 32.20, respectively. The company is subject to a 30% income tax rate. Required: 1. Prepare the comparative 2019 and 2020 income statements (multiple-step), and the related note that would appear in Anokas 2020 annual report. 2. Next Level Compute the price/earnings ratio for 2020. How does this compare to 2019? Why is it different?arrow_forwardFollowing is the shareholders equity section of All-Wood Doors on a day a. Use the financial statement template below to show the financial statement effects of the following dividend events. (Assume that the events are independent.) (1) Cash dividend declaration and payment of 1 per share (3) Property dividend declaration and payment of shares representing a short-term investment in Screen Products, Ltd., with a fair value of 10,000 (3) 10% stock dividend (4) 100% stock dividend (5) 3-for-1 stock split (6) 1-for-2 reverse stock split b. Which events changed the book value of common equity? Under what conditions will these events lead to future increases and decreases in ROE?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

IAS 10 Events After the Reporting Period; Author: Silvia of CPDbox;https://www.youtube.com/watch?v=ijYZlb1_ZyQ;License: Standard Youtube License