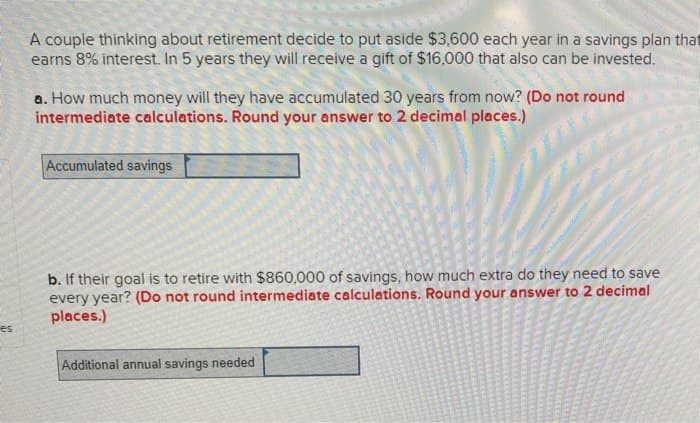

A couple thinking about retirement decide to put aside $3,600 each year in a savings plan that earns 8% interest. In 5 years they will receive a gift of $16,000 that also can be invested. a. How much money will they have accumulated 30 years from now? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Accumulated savings es b. If their goal is to retire with $860,000 of savings, how much extra do they need to save every year? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Additional annual savings needed

A couple thinking about retirement decide to put aside $3,600 each year in a savings plan that earns 8% interest. In 5 years they will receive a gift of $16,000 that also can be invested. a. How much money will they have accumulated 30 years from now? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Accumulated savings es b. If their goal is to retire with $860,000 of savings, how much extra do they need to save every year? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Additional annual savings needed

Chapter5: The Time Value Of Money

Section: Chapter Questions

Problem 23P

Related questions

Question

None

Transcribed Image Text:A couple thinking about retirement decide to put aside $3,600 each year in a savings plan that

earns 8% interest. In 5 years they will receive a gift of $16,000 that also can be invested.

a. How much money will they have accumulated 30 years from now? (Do not round

intermediate calculations. Round your answer to 2 decimal places.)

Accumulated savings

es

b. If their goal is to retire with $860,000 of savings, how much extra do they need to save

every year? (Do not round intermediate calculations. Round your answer to 2 decimal

places.)

Additional annual savings needed

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning