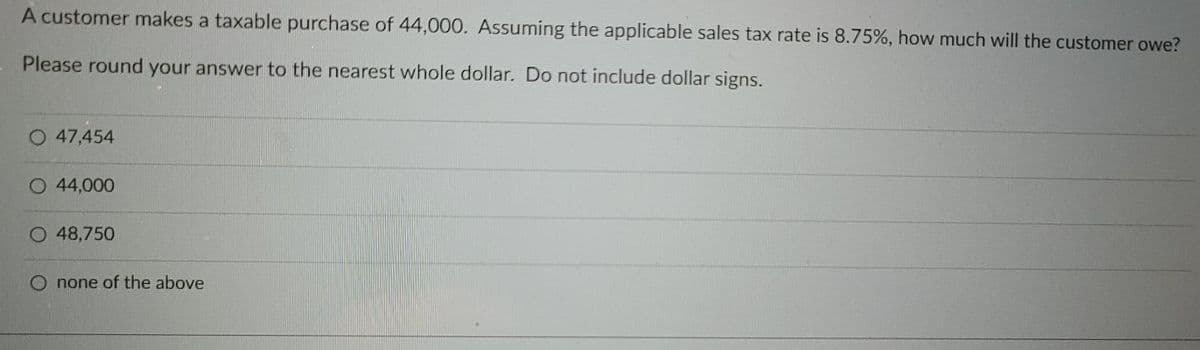

A customer makes a taxable purchase of 44,000. Assuming the applicable sales tax rate is 8.75%, how much will the customer owe? Please round your answer to the nearest whole dollar. Do not include dollar signs. O 47,454 O 44,000 O 48,750 O none of the above

Q: Required information The Foundational 15 (Static) [LO11-1, LO11-2] [The following information…

A: Return on investment is calculated by dividing net operating income by average operating assets.…

Q: Required information Exercise 11-23 (Algo) Change in estimate; useful life and residual value of…

A: DEPRECIATION EXPENSEDepreciation means gradual decrease in value of assets due to normal wear and…

Q: What is the amount of depreciation expense SLR would record for the year 20x6 on this machine?

A: Depreciation helps to allocate the cost of a fixed asset over its useful life. Fixed assets…

Q: Spectrum Ltd owns the following properties at 1 April 2012: Property A: An office building used by…

A: The objective of the question is to prepare extracts from Spectrum Ltd.’s entity statement of profit…

Q: Wildhorse Appliance Company has 5100 shares of 6%, $50 par value, cumulative preferred stock and…

A: The preference shareholders received the dividend before dividend is paid to common shareholders.…

Q: M/s Pankaj Arora bought machinery for ₹ 22,280 and spent 5,720 for its erection The estimated life…

A: The fixed assets tend to lose their value with the constant usage and the reduction in the value of…

Q: Swifty has not logged since 2016. If Swifty logged and sold 927,000 board feet of timber in 2027,…

A: Cost of timber = ((Purchase cost per acre - land value per acre)*Total acres) - Cost of timber +…

Q: On Jan 1st, Disney share price was $100 per share. On the morning of Jan 2nd, Disney announced they…

A: Let's break down the options for better clarity:a. Strong Form Market Efficiency:In a market with…

Q: (b) If Sunland Company's required rate of return is 11%, which projects are acceptable?

A: Project 22A annual cash flows = 17320+(243500/6)=57903PV factor for Internal rate of return =…

Q: Current liabilities Long-term liabilities Stockholders' equity Common stock, $5 par 5% Preferred…

A: a). Total liabilities to equity ratio : Total liabilities to equity ratio = (Current liabilities +…

Q: 1g. The firm carries a safety stock of 30 wheels. What is the annual holding costs to carry the…

A: Safety stock represents extra inventory held to mitigate the risk of stockouts due to uncertainties…

Q: After an unseasonably hot summer, Willow received a call from her tenant that the AC was no longer…

A: The objective of the question is to determine the date on which the HVAC unit would be considered…

Q: An investor purchased 509 shares of common stock, $25 par, for $19,851. Subsequently, 108 shares…

A: When the sale value of shares is greater than the cost of shares, it results in gain on sale of…

Q: A company using the composite approach to depreciation sells equipment for $10,000. The equipment…

A: Book value of equipment = Cost of equipment - Accumulated depreciationGain (Loss) on sale of…

Q: are dată for five companies. These data are for the companies' 2019 fiscal years. The market price…

A: Formulas:a. EPS = Net earnings / Shares outstandingb. P/E Ratio = Market price per share…

Q: At the end of 2022, GM did not have any PP&E. On Jan 1, 2023, GM purchased the following assets.…

A: Depreciation is the reduction in the value of asset due tonormal wear and tearEffluxion of…

Q: 1. Prepare entries to record construction costs and billings for each year

A: It is method used of computing the revenue to be recognize in the current year and the revenue to be…

Q: BMX Company has one employee. FICA Social Security taxes are withheld in the amount of $322.40. FICA…

A: The taxes that are paid by both the employer and the employee to support the country's employee…

Q: In its year end financial statements, Big Bank Corporation reports marketable debt securities of…

A: Marketable debt securities reporting involves disclosing the financial details of securities held by…

Q: A friend of yours borrows $19,500 from the bank at 8% annually to be repaid in 10 equal annual…

A: Calculation of installment amount: Installment amount = Amount / Present value annuity factor (PVAF)…

Q: Debt to assets ratio= Total liabilities/Total assets ABC Company reported the following debt to…

A: Debt to total assets ratio is one of the ratio being used in business. This is calculated by…

Q: Larkspur Corporation is authorized to issue 1,030,000 shares of $1 par value common stock. During…

A: 1.DateAccounts Debit Credit Jan. 15Cash (721,000 shares x $7 per share)$5,047,000 Common stock…

Q: Data related to the inventories of Costco Medical Supply are presented below: Surgical Equipment $…

A: Lower of cost or NRV can be done using either in individual or on group basis. In individual basis,…

Q: If it is material, which of the following does not require all prior reported financial statements…

A: IAS 8 prescribes the criteria for change in accounting estimates, accounting policies and errors. It…

Q: Following are some transactions and events of Business Solutions. February 26 The company paid cash…

A: "Since you have posted a question with multiple sub-parts, we will solve the first three sub-parts…

Q: Patterson Co.'s Wages Expense for the period was $120,000. It started the period with $10,000 in…

A: Cash Paid to Wages is a ledger used to record wages paid during the financial year. This is…

Q: Office Chair Corporation manufactures two types of office chairs, a Standard model and a Deluxe…

A: Under the ABC Costing overheads are allocated on the basis of cost driver. Cost drivers are the…

Q: In the REA data modeling technique, the identifiable objects that have economic value to the…

A: In the REA (Resources, Events, Agents) data modeling technique, resources are the identifiable…

Q: LCOME: Joe's salary Jessie's craft sales Interest from certificate of deposit Interest from Treasury…

A: Taxable income is the amount of the person's income that is taxed after all the deductions and…

Q: Case A: Compute cash interest received Interest revenue. Interest receivable, beginning of year…

A: Statement of cash flow includes the inflows and outflows of cash that took place during the…

Q: Bickel Corporation uses customers served as its measure of activity. The following report compares…

A: A budget is a forecast of revenue and expenses for a certain future period of time that is generally…

Q: Sales Variable expenses Contribution margin Fixed expenses Operating income Segmented Income…

A: “Since you have posted multiple questions, we will provide the solution only to the first question…

Q: balance on December 31, 20 X 8, in pounds, follows: Required: Prepare a schedule providing a proof…

A:

Q: Under what circumstances is it advantageous for a taxpayer to make a nondeductible contribution to a…

A: Tax year not given assuming tax year 2022For Roth IRAs, there are income limits that determine…

Q: The operating Income at December 2018 was: Equal or below 9,000 Between 9,000 and 18,001 Between…

A: Operating income is the profit generated by the business day to day operations and non operating…

Q: Edge Company produces two models of its product with the same machine. The machine has a capacity of…

A: Machine hours means total hours available for the manufacturing of goods. When machine hours is in…

Q: Elizabeth's regular hourly wage rate is $22, and she receives an hourly rate of $33 for work in…

A: Payroll Tax Expense: It refers to an expense that is borne by the employer of the company. It…

Q: Assume the following information: Milling Department Materials Beginning work in process Units…

A: Lets understand the basics.Equivalent units can be calculated using,(1) FIFO basis (2) Weighted…

Q: 46. The allocation of owner's private expenses to his/her business violates which of the following?…

A: Accounting principles means the fundamental upon which the whole accounting is based. Every entity…

Q: The January 28 (fiscal year-end) financial statements of Collette Inc. reported the following…

A: INVENTORY VALUATIONInventory Valuation is a Method of Calculation of Value of Inventory at the End…

Q: The year end financial statements for Pratt Inc., report the follow December 31, (In millions) Year…

A: Percent used up is the one which is evaluated as accumulated depreciation divided by the depreciable…

Q: Which of the following fringe benefits provided by an employer would result in taxable income to an…

A: The objective of the question is to identify which of the given fringe benefits provided by an…

Q: Orange Company owns 20% of Blue Company, and accounts for its investment using the equity method. On…

A: The provided scenario revolves around the accounting treatment of an equity investment using the…

Q: The Thompson Corporation, a manufacturer of steel products, began operations on October 1, 2022. The…

A: The process of debiting the cost of an asset and crediting a depreciation account is known as…

Q: Discuss factor(s) that should be considered besides total cost.

A: Economic order quantity is the optimal quantity of units that can be purchased with minimum…

Q: 7 A company owns an asset with an original cost of $300,000 and a current book value of $160,000.…

A: Impairment: It is often defined as a permanent decrease or fall in the value of the assets being…

Q: Elizabeth has three children ages 10, 17, and 19. All the children Ilive with her, are full-time…

A: The Child Tax Credit is a benefit granted to taxpayers for each qualifying child under the age of 17…

Q: 4 +Book Exercise 9-11 (Algo) Computing payroll taxes LO P2, P3 Mest Company has nine employees. FICA…

A: Any company with employees is subject to a payroll tax under the Federal Unemployment Tax Act, and…

Q: Local Furniture Ltd (LFL)incurred the following production costs during the financial year 2021:…

A: Cost of goods sold is basically the cost of goods that has been actually sold during the year.…

Q: Bertram Company failed to record depreciation expense in 2024. The journal entry to correct the…

A: Depreciation is recorded in order to record reduction in value of asset over the useful life period.…

Step by step

Solved in 3 steps

- For taxable income of $0-$50,000, the rate is 15 percent. For incomes of 450,001-$75,000 the base tax amount is $7,500 and the rate over the base is 25 percent. What is the tax amount due on an income of $68,000? I need step-by-step help with this question, as I'm confused by the breadown in the business finanace book!A seller of goods had the following details of sales and collection during the month: Receivables, beginning P 200,000.00 Gross sales 400,000.00 Less: Collection 500,000.00 Receivables, end P 100,000.00 1. What is the amount subject to business tax? a. P500,000 b. P400,000 c. P300,000 d. P200,000 2. In the immediately preceding problem, determine the amount subject to business tax if the taxpayer is a seller of services. a. P500,000 b. P400,000 c. P300,000 d. P200,000A VAT taxpayer had the following data on its operations for he month of January 2018:Sales, total invoice price P 592,480Purchases of goods, VAT not included:From VAT registered persons 100,000From nonVAT registered persons 8,000From persons subject to percentage taxes 10,000Salaries of employees 60,000Other operating expenses 12,000This is the first month of being liable to value added tax. Data in inventories at the beginning of the period bought from VAT registeredpersons follow:Inventory at cost P 44,800Inventory at realizable value 49,000Value added tax paid on beginning inventory 4,80016. How much is the input tax?17. How much is the value added tax payable?

- On December 28, 2018, Tristar Communications sold 10 units of its new satellite uplink system to various customers for $25,000 each. The terms of each sale were 1/10, n/30. Tristar uses the gross method to account forsales discounts. In what year will income before tax be affected by discounts, assuming that all customers paidthe net-of-discount amount on January 6, 2019? By how much?Calculate the tax rate if the tax amount is $ 64.50 on a purchase of $780?for Schedule C in individual income tax, how do I calculate the expense for transportation of 5725 total miles traveled, entertainment in total of $4200 and gifts of $450? I know only up to $400 can be deducted in gifts but do I just put 0 can be deducted. Thanks in advance for your help.

- On December 28, 2021, Tristar Communications sold 10 units of its new satellite uplink system to various customers for $25,000 each. The terms of each sale were 1/10, n/30. Tristar uses the gross method to account for sales discounts. In what year will income before tax be affected by discounts, assuming that all customers paid the net-of-discount amount on January 6, 2022? By how much?Company N will receive $55,000 of taxable revenue from a client. Use Appendix A and Appendix B. Required: Compute the NPV of the $55,000 assuming that Company N will receive $27,500 now (year 0) and $27,500 in year 1. The company’s marginal tax rate is 30 percent, and it uses a 6 percent discount rate. Compute the NPV of the $55,000 assuming that Company N will receive $27,500 in year 1 and $27,500 in year 2. The company’s marginal tax rate is 40 percent, and it uses a 4 percent discount rate. Compute the NPV of the $55,000 assuming that Company N will receive $11,000 now (year 0) and $11,000 in years 1, 2, 3, and 4. The company’s marginal tax rate is 10 percent, and it uses a 9 percent discount rate.From the data: May 2 - On sale to the public Purchase price, VAT not included P400,000 Selling price, VAT not includedP900,000 May 9 - On sale to the Government Purchase price, VAT not includedP200,000 Selling priceqP600,000 How much was the vat payable at the end of May? How much was the final value-added tax of May?

- Which of the following is true? A. The total tax due arising from each quarterly income tax return is only applicable to the taxable income for that quarter. B. The taxable compensation income of mixed-income earners are reported in each quarterly return. C. When an eligible taxpayer chooses the 8% optional tax, the P250,000 is deducted from the gross sales/receipts from business and other non-operating income in arriving at the tax base for the 8% rate. D. When a taxpayer who originally opted to be taxed at 8% breaches the VAT threshold at the middle of the year, he shall be liable to the graduated tax from the time it breaches the threshold. E. None of the other choices is true.There is a sales tax of 24 on an item that costs 276 before tax. A second item costs $218.50 before tax. What is the sales tax on the second item?if you have a percentage tax due of 70,000, is this monthly or quartelry paid to BIR