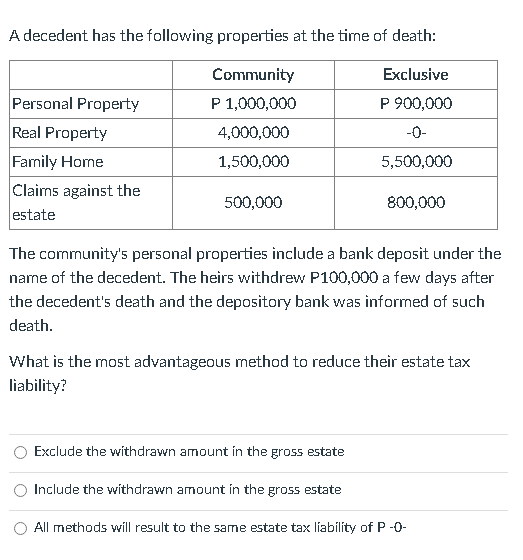

A decedent has the following properties at the time of death: Community Exclusive Personal Property Real Property P 1,000,000 P 900,000 4,000,000 -0- Family Home 1,500,000 5,500,000 Claims against the 500,000 800,000 estate

A decedent has the following properties at the time of death: Community Exclusive Personal Property Real Property P 1,000,000 P 900,000 4,000,000 -0- Family Home 1,500,000 5,500,000 Claims against the 500,000 800,000 estate

Chapter27: The Federal Gift And Estate Taxes

Section: Chapter Questions

Problem 41P

Related questions

Question

timed task, need help thanks.

Transcribed Image Text:A decedent has the following properties at the time of death:

Community

Exclusive

Personal Property

P 1,000,000

P 900,000

Real Property

4,000,000

-0-

Family Home

1,500,000

5,500,000

Claims against the

estate

500,000

800,000

The community's personal properties include a bank deposit under the

narme of the decedent. The heirs withdrew P100,000 a few days after

the decedent's death and the depository bank was informed of such

death.

What is the most advantageous method to reduce their estate tax

liability?

Exclude the withdrawn amount in the gross estate

Include the withdrawn amount in the gross estate

All methods will result to the same estate tax liability of P -0-

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you